Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Nvidia Entering Major Support Zone

After a 34% consolidation since January, Nvidia is now back on the major swing support zone between 90.69-103.41. Keep an eye on the price action for potential opportunities. Source: Bloomberg

ASML Approaching Major Support Zone

ASML has consolidated 44% since July 2024! For the moment, the trend remains bearish, but the stock is approaching a major support zone between 534-566. Keep an eye on the price action in the next few days for any potential opportunities. Source: Bloomberg

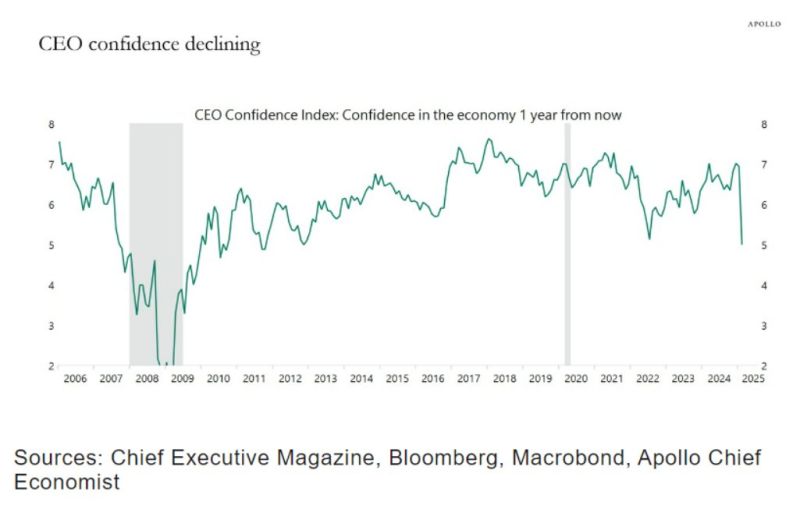

CEO confidence one year out has fallen to the lowest since 2010:

Apollo's Torsten Slok

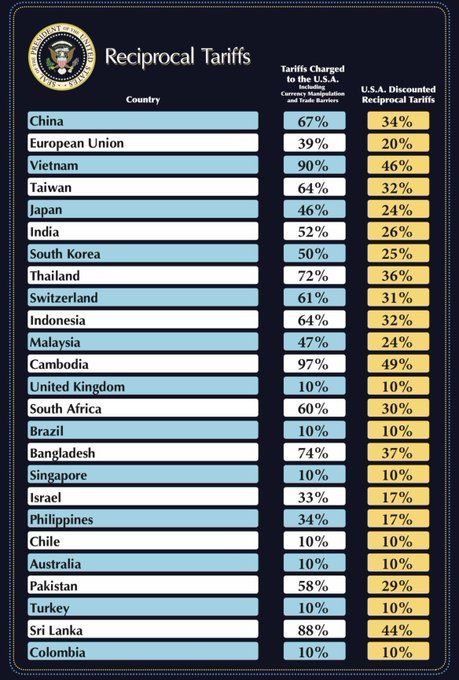

The list is out...

34% RECIPROCAL TARIFFS ON CHINA 20% RECIPROCAL TARIFFS ON THE EUROPEAN UNION

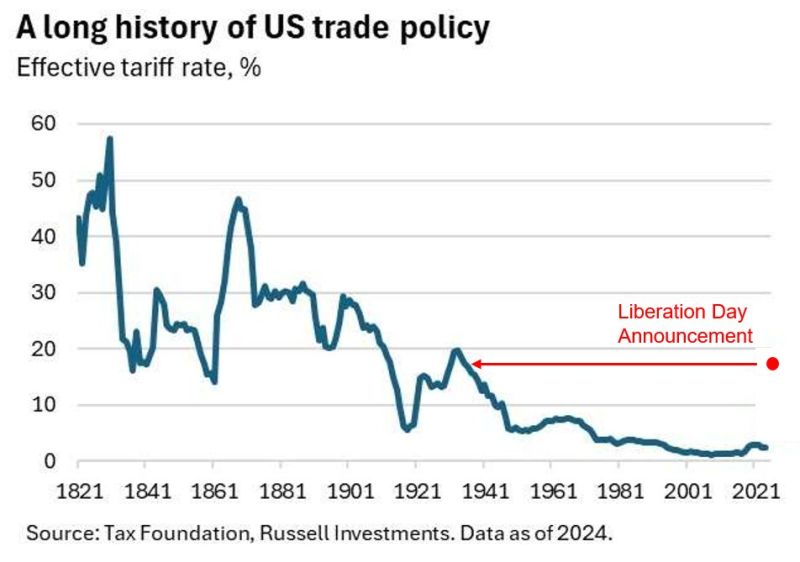

➡️ Liberation Day announcement brings US tariffs to levels not seen since the Smoot-Hawley.

➡️ Rough estimate of ~1.2% drag to US growth if they persist, before any retaliatory tariffs. ➡️ ~300bln/year revenue raise. ➡️ Canada & Mexico outcome is better than expected. ➡️ Europe & Japan is worse. Source: Bob Elliott

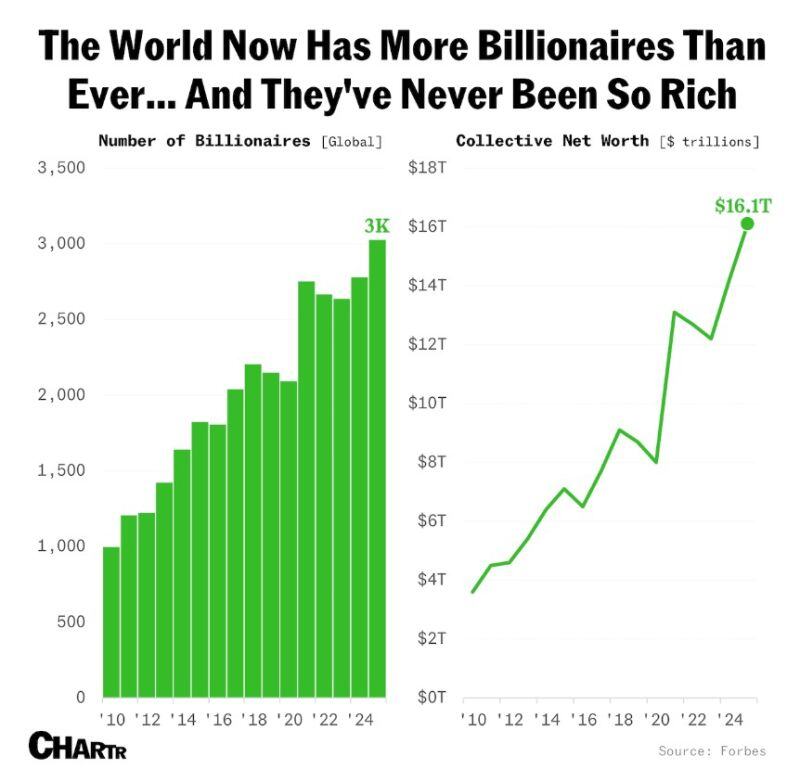

In 2010, Forbes’ annual snapshot of the world’s billionaire population showed just 1,001 members, with Mexican business magnate Carlos Slim Helú topping the rankings with $53.5 billion

a sum that would put him in 30th position in 2025. Since then, the count has more than tripled, total collective wealth has more than quadrupled from $3.6 trillion, and the average list member’s net worth has risen from about $3.6 billion to $5.32 billion. Source: Chartr

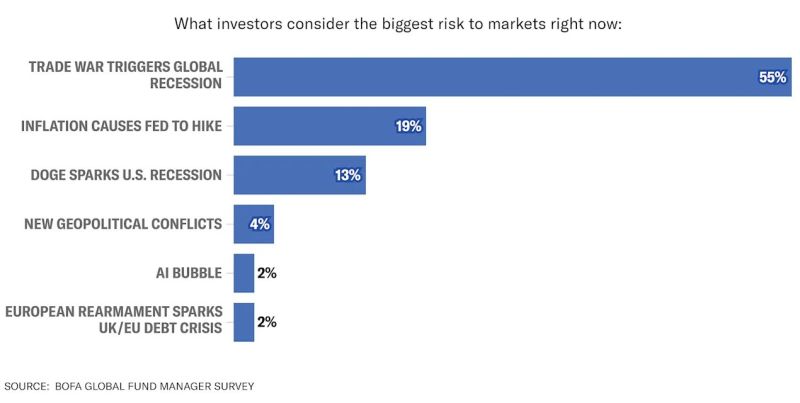

Here’s what investors consider to be the biggest risk to markets right now 👇

Source: Cheddar Flow @CheddarFlow

CHINA URGES US TO IMMEDIATELY CANCEL RECIPROCAL TARIFFS, VOWS COUNTER-MEASURES

Source: Geiger Capital @Geiger_Capital

Investing with intelligence

Our latest research, commentary and market outlooks