Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Physical gold craziness...

The big 3 vaults (Brinks, JPM, HSBC), are running out of space where to store the physical; the 3 alone hold more than 35 million oz of physical.

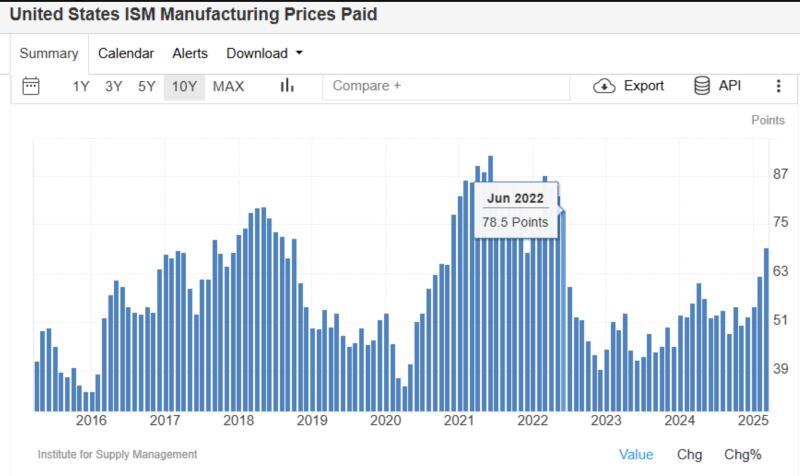

ISM Manufacturing Priced Paid at 69.4 - Highest since inflation's peak in June 2022

Source: Mike Zaccardi, CFA, CMT, MBA

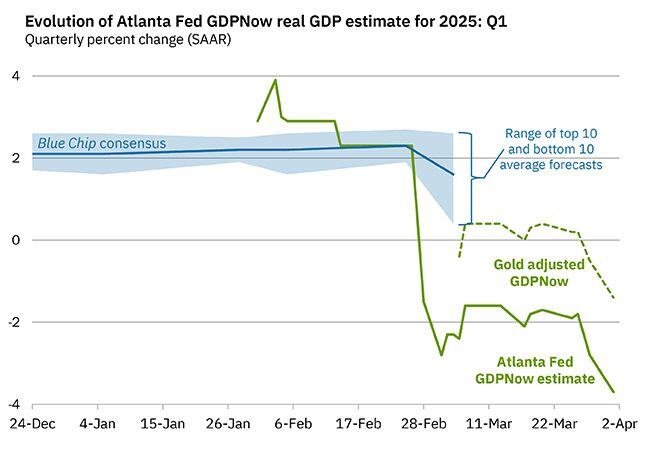

On April 1, the GDPNow model nowcast of real GDP growth in Q1 2025 is -3.7%.

Adjusting for gold imports, the model now sees -1.4% GDP contraction in Q1 2025. Just 2 months ago, they saw GDO growing by +3.8% in the same period...

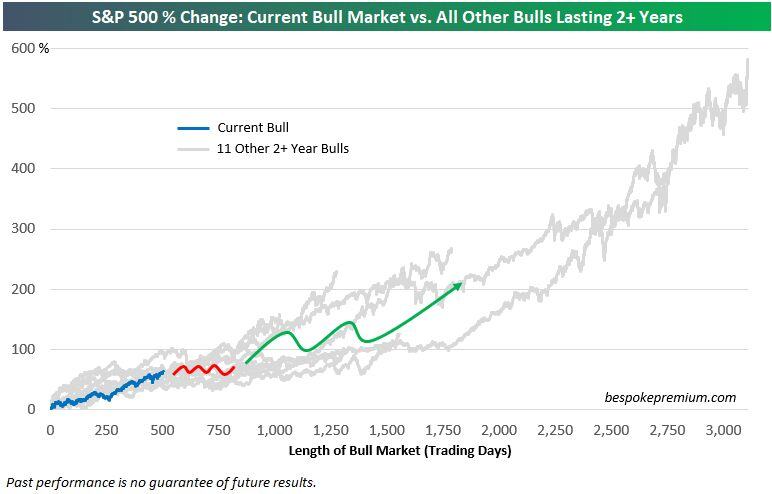

Bull markets that make it past the two-year mark have typically consolidated in year three before heading higher again.

Source: Bespoke

The Truflation US YoY inflation rate dropped from 1.76% to 1.38% — a considerable decline driven by key categories.

Which categories and sub-categories are driving the drop? 👉 Housing – all 3 subcategories are cooling: • Rented dwellings • Owned dwellings • Other lodging 👉 Transport – vehicle prices and other vehicle expenses are falling, even as gasoline edges up. Truflation continues to capture shifts in inflation dynamics in real time — well ahead of official data. Reminder: Over the past 3 months, the Truflation index has dropped from 3.11% to 1.38%. Is the Fed paying attention?

Germany is the european country the most sensitive to global trade according to Goldman - see chart below

According to Goldman Sachs, the Dax and MDax have a beta of 1.9 to world trade growth — meaning they tend to move almost twice as strongly w/changes in global trade. That’s much higher than the US market, which has a beta of 1.4. In contrast, the UK’s FTSE 100 is less exposed to global trade, thanks to its defensive sector mix and the UK’s services-driven economy. The Swiss SMI is similarly more insulated. It’s also a defensive index, and Swiss exports are generally less sensitive to global demand, as they often consist of high-tech, specialized products. Source: HolgerZ, Goldman Sachs

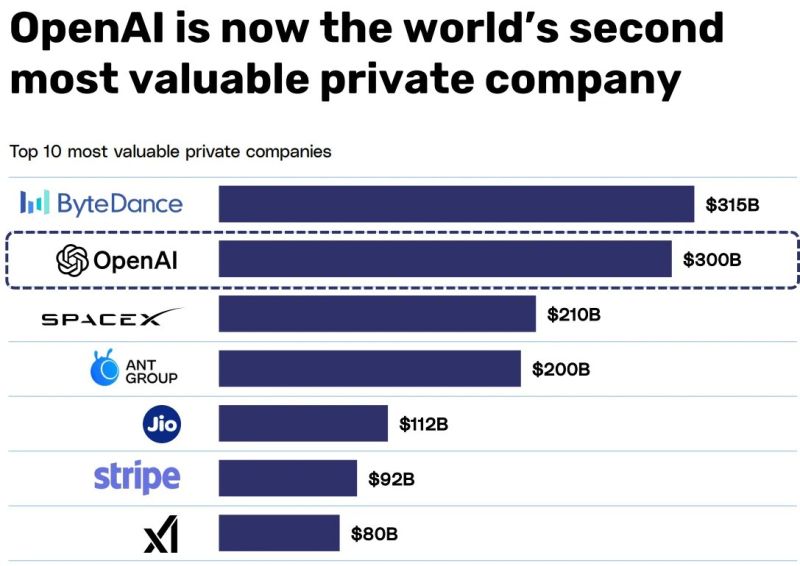

OpenAI is now the world's second most valuable private company

Source: Markets & Mayhem @Mayhem4Markets

Investing with intelligence

Our latest research, commentary and market outlooks