Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Unusual VIX Call Surge at High Strikes

Shortly after 10:15 a.m. ET, there was an explosion of trading activity in far out-of-the-money options tied to the Cboe Volatility Index (commonly known as the VIX), which tracks the 30-day implied volatility of the S&P 500 based on options prices. The volumes were centered in VIX call options that expire in May, for the 55, 65, and 75 strikes. The VIX, also known as Wall Street’s “fear gauge,” has rarely eclipsed these levels.

% Off 52-Week High

Gold: -3% S&P: -5% Apple: -9% Amazon: -14% Microsoft: -16% Google: -19% Nvidia: -22% Bitcoin: -24% Palantir: -33% Coinbase: -41% Tesla: -43% Ethereum: -46% MicroStrategy: -56% Dogecoin: -59% Trump Media: -70% Trump Coin: -83% Fartcoin: -89% Melania Coin: -94%

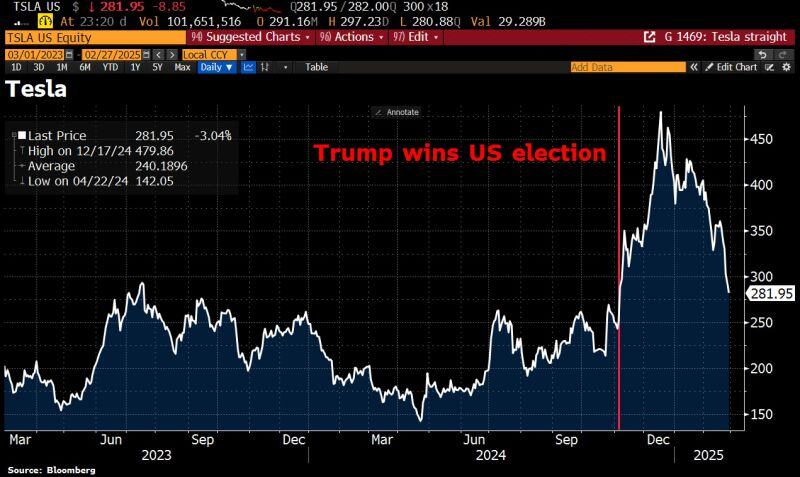

The End of the Trump Trade?

When Donald Trump won the election on November 5, the so-called "Trump trades" surged—Tesla, crypto, tech, oil, and banks all rallied. But since Trump officially took office on January 20—and especially over the past week—these trades have started to unwind. Source: HolgerZ, Bloomberg

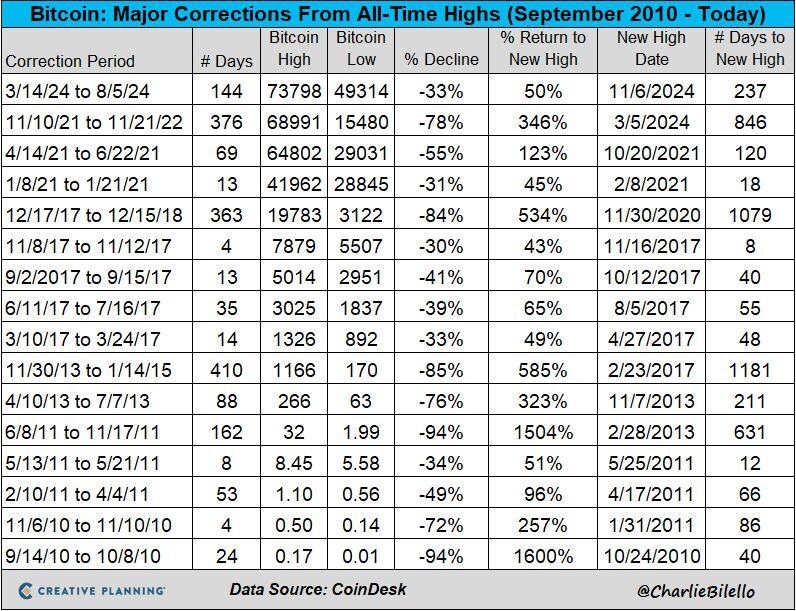

At $80,000, Bitcoin is now down around 27% from its all-time high of $109,000.

Is that a big drawdown for Bitcoin? No... Source: Charlie Bilello

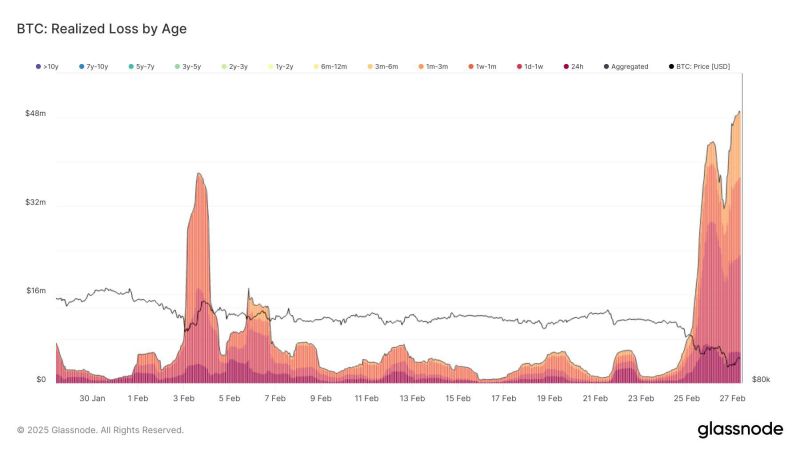

🚨74% of bitcoin losses came from holders who bought in the last month

🚨Newcomers are getting shaken out. Source: Quinten | 048.eth @QuintenFrancois on X, Glassnode

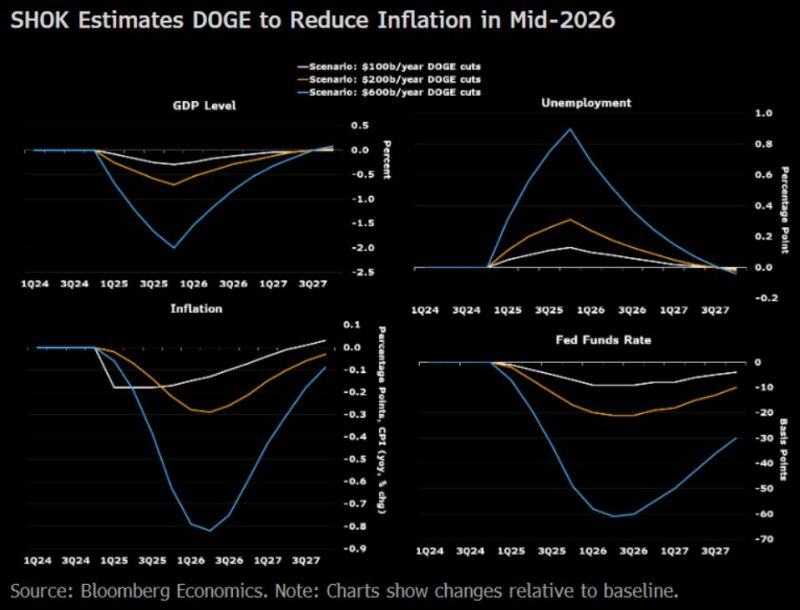

DOGE DEFLATIONARY EFFECTS?

Bloomberg Economics estimates that if hashtag#DOGE attempts to go for savings of $600B/year, GDP could take a -2% hit by the end of this year, the unemployment rate could rise by nearly a percentage point, and CPI y/y could fall by nearly 0.9 percentage points. Source: Kevin Gordon @KevRGordon on X

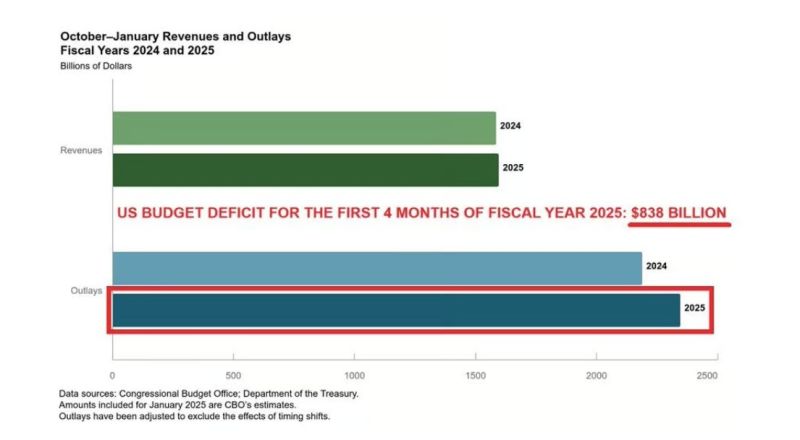

🚨US budget deficit is SKYROCKETING: The US borrowed $838 billion in the first 4 months of Fiscal Year 2025, or $7 BILLION A DAY.

This is $306bn HIGHER than the corresponding period last year, according to CBO👇 Source: Global Markets Investor @GlobalMktObserv

If you had invested $10,000 into Nvidia $NVDA stock when it went public in 1999 and held to today you'd currently have $52.6 Million

source : evan

Investing with intelligence

Our latest research, commentary and market outlooks