Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

🚨Cash is TRASH, according to US equity funds:

Cash allocation of US equity funds has declined to just ~1.5%, the lowest on RECORD. The Fear of Missing Out (FOMO) has never been greater. This creates downside risk Source: Global Markets Investor, Goldman Sachs

🚨BREAKING: UKRAINE AGREES TO U.S. MINERALS DEAL AFTER TRUMP ADMINISTRATION DROPS $500B DEMAND

Kyiv has finalized a minerals deal with Washington, securing joint development of Ukraine’s oil, gas, and mineral resources—but only after the Trump administration dropped its toughest demands, including a $500 billion revenue claim. The deal establishes a fund where Ukraine will contribute 50% of proceeds from future mineral monetization, but it does not include the security guarantees Kyiv originally sought. With Zelenskyy expected to visit the White House for a signing ceremony, this deal marks a major shift in U.S.-Ukraine relations under Trump. Source: Financial Times thru Mario Nawfal on X

2025 rate cut odds:

from just ONE 2 weeks ago to MORE THAN TWO now... Source: zerohedge

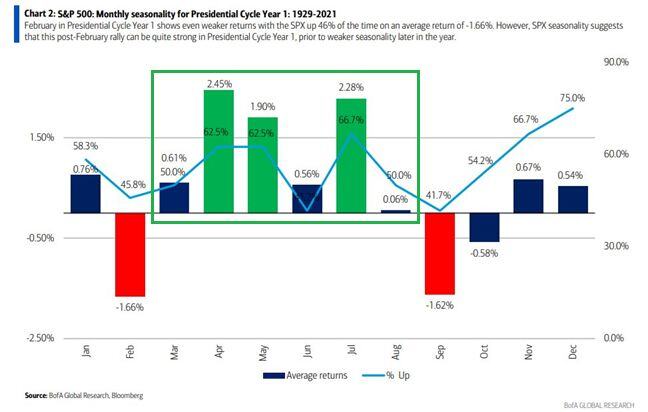

More Year 1 seasonality...

March-August pretty solid, on average. SPX 1929-2021 Suttmeier BofA. Source: Mike Zaccardi, CFA, CMT 🍖 @MikeZaccardi

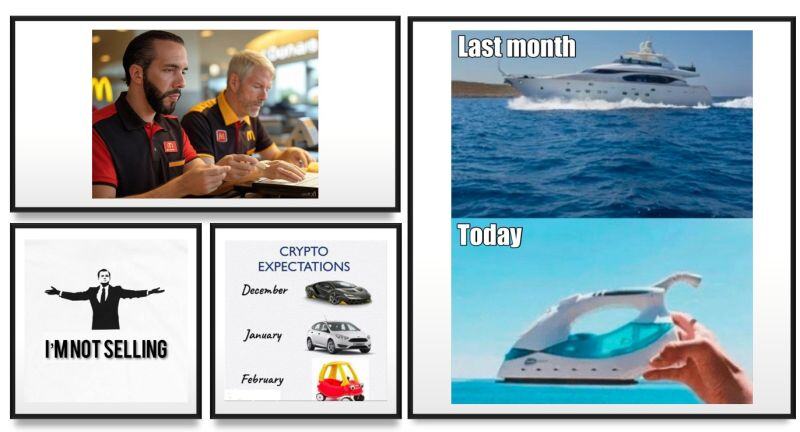

Bitcoin under $90k...

here's a compilation of the best crypto liquidation memes on X

It's the liquidity stupid...

Bitcoin $BTC is finally catching up with the drop of liquidity (with a 10 weeks lag). The good news is that Global M2 is accelerating again (but due to the lag risk assets should resume uptrend later on - all other things being equal of course...) Source: Bloomberg, Joe Consorti

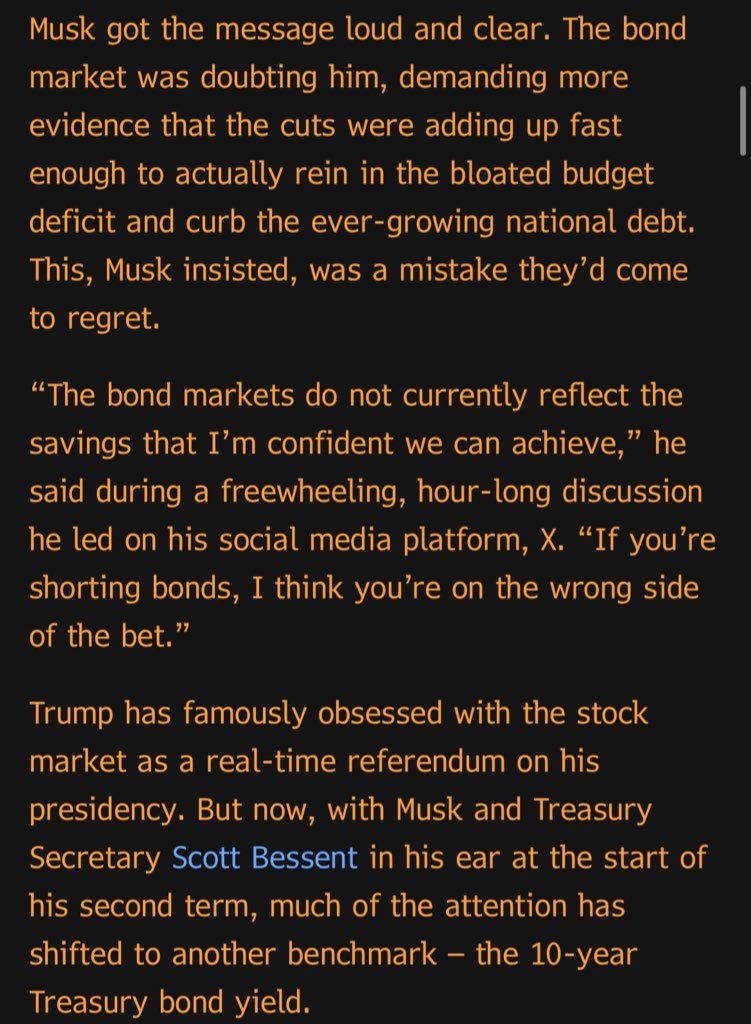

The Trump 1.0 put was on equities $SPY

Will the Trump 2.0 put be on us treasuries $TLT ??? Source: Geiger Capital @Geiger_Capital on X, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks