Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

The US is being hard on Europe.

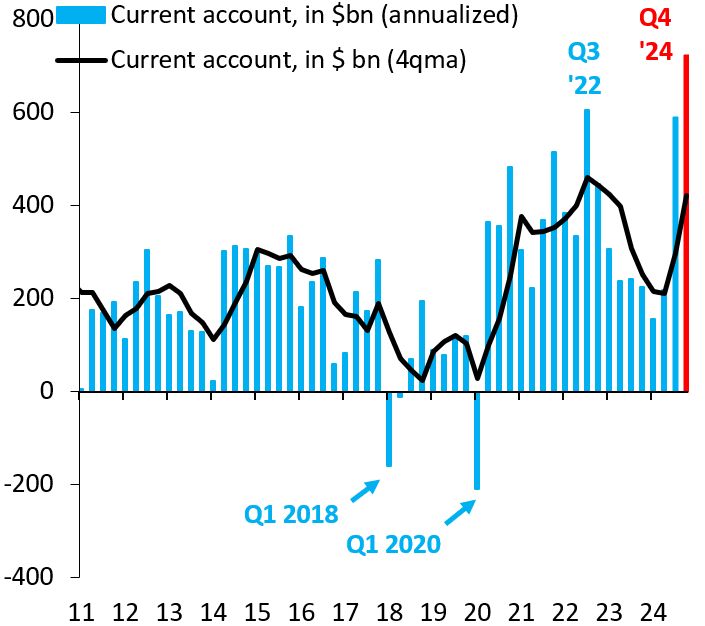

However, the true (economic) enemy for the US is not Europe but China. As shown on the chart below by Robin Brooks, China's current account surplus in Q4 '24 is the largest ever.

The 2nd largest pension fund in the US now owns nearly $100 million bitcoin via MSTR

Source: The Bitcoin Historian on X

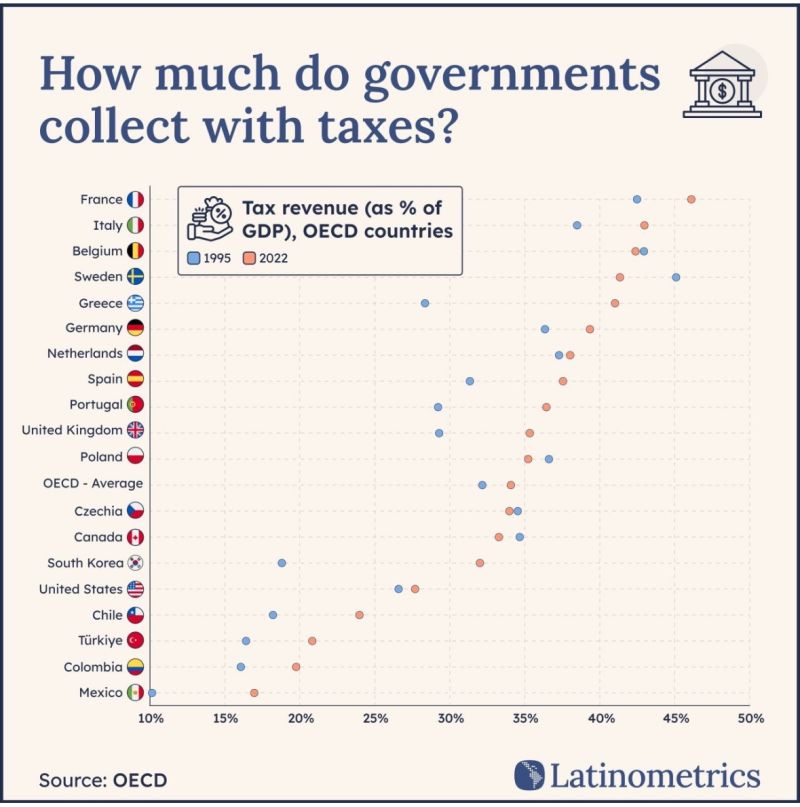

In France and Italy, governments impose taxes to the tune of almost 50% (!) of GDP.

In the US, that’s barely 30%. Not a fun experience for productive individuals and companies in Europe... Source: Alf Macro on X

European Stocks see largest weekly inflow in more than 2 years 🚨

Source: Barchart

"Biggest macro imbalance in the world is the chronic undervaluation of China's Yuan. "

"China's trade surplus - once you look at goods net of commodities (blue) - was the largest ever in 2024. This is why tariffs on China will keep going higher after an already large 10% tariff..." Source: Robin Brooks

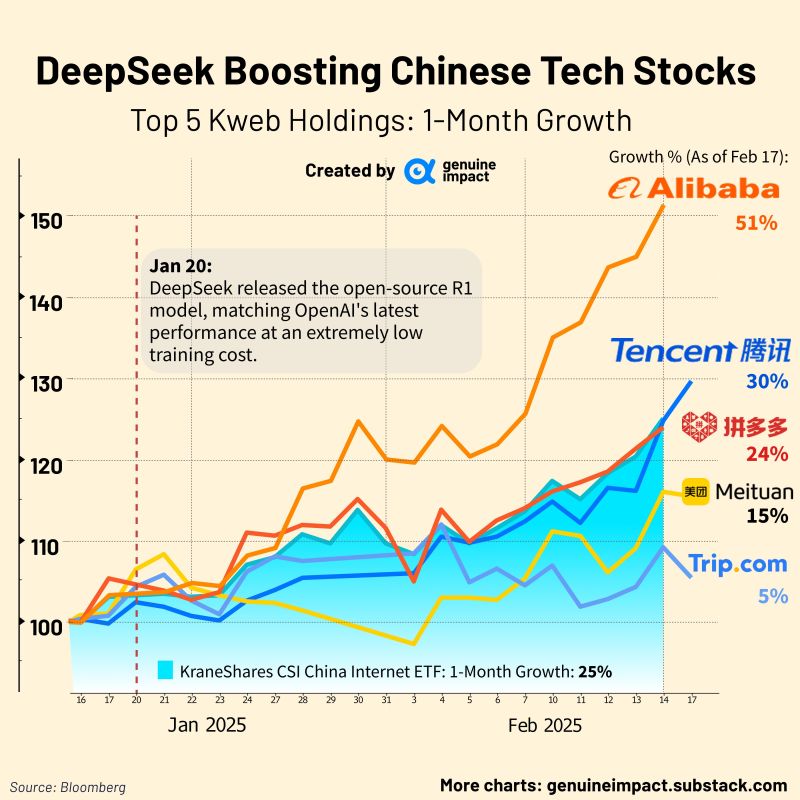

🤖After DeepSeek's release, Chinese tech stocks have surged, with Alibaba leading the way, up over 50% in just one month🚀!

The AI boom sparked by DeepSeek is prompting global investors to reassess investment opportunities in China's tech and AI sectors, particularly the AI capabilities of previously undervalued Chinese internet companies. With Alibaba collaborating with Apple to integrate AI features into the Chinese version of the iPhone and 🔵Tencent's WeChat adopting DeepSeek, the demand for AI cloud computing services in China could soon mirror the supply shortages seen in the US. It's clear that China's AI progress is catching up to the US at an accelerated pace—and costs are dropping even faster. Source: Genuine Impact

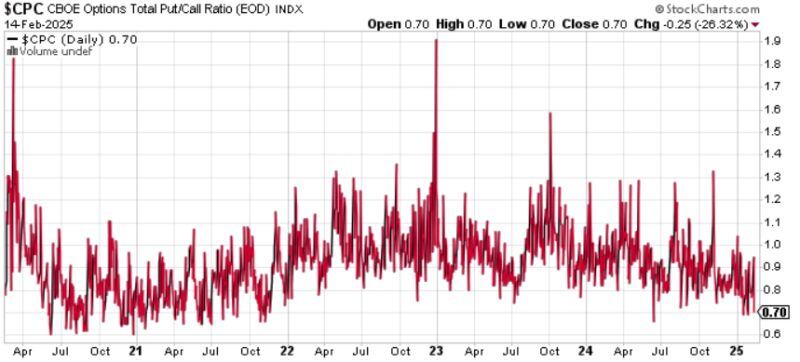

IS THE MARKET TOO COMPLACENT ?

The Put-to-call ratio 30-day moving average FELL to the LOWEST since November 2021, one month before the 2022 bear market started. This aligns with the Feb 2020 levels, before the 2020 CRASH. Hedging barely exists in this market.👇 Source: Global Markets

Investing with intelligence

Our latest research, commentary and market outlooks