Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

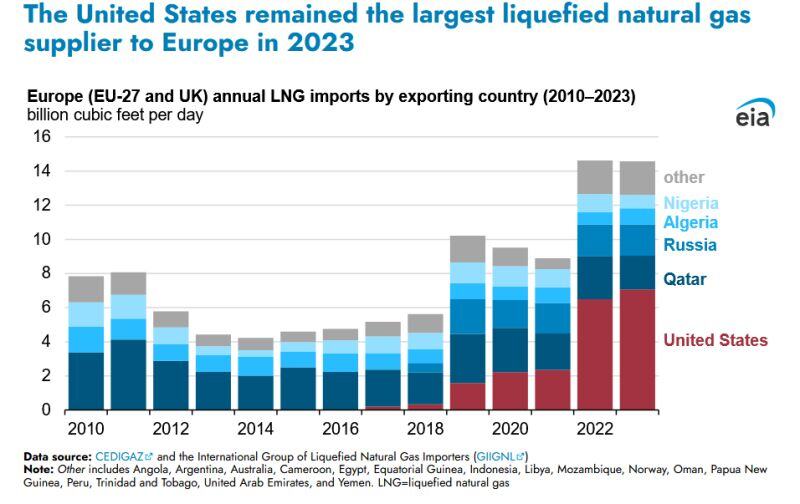

Europe has gone from relying entirely on cheap Russian gas to relying entirely on expensive US LNG

Source: zerohedge

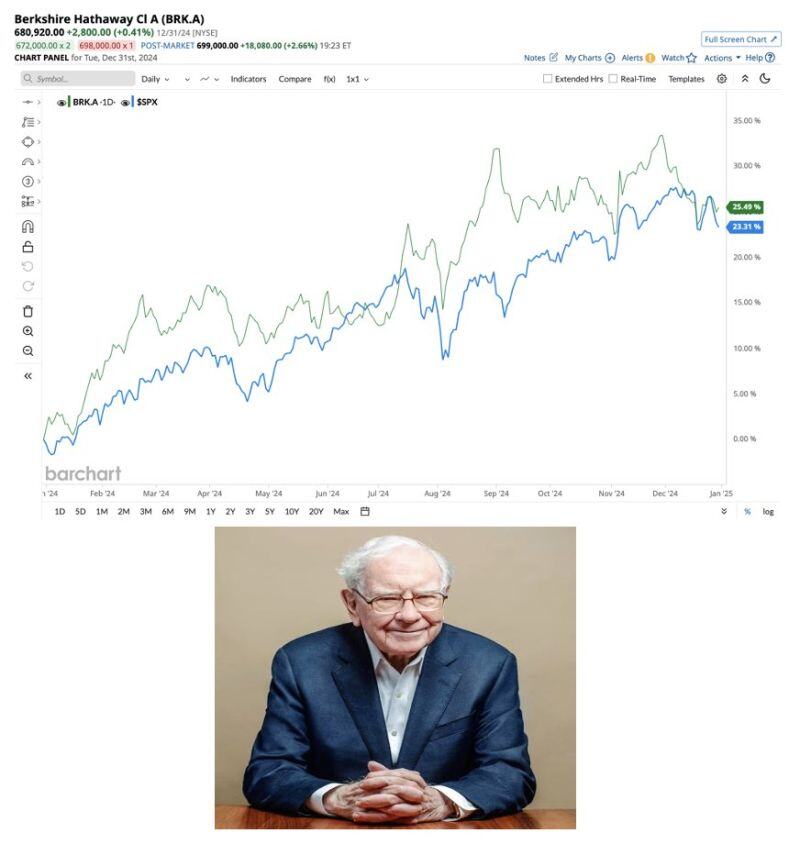

Warren Buffett did it again! Berkshire Hathaway outperformed the S&P 500 in 2024.

Source: Barchart

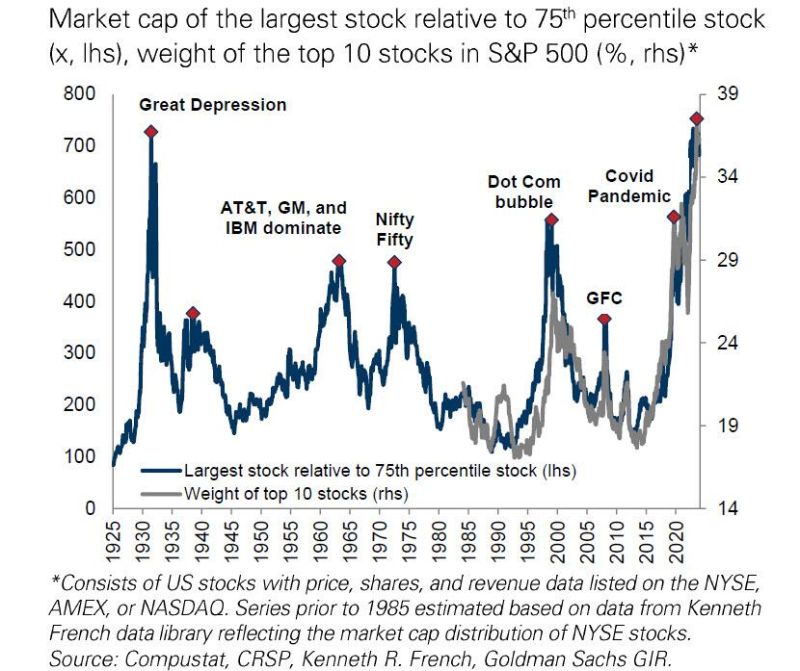

The last time just 10 stocks accounted for 38% of total market cap was just before the Great Depression

Source: Goldman, zerohedge

MicroStrategy $MSTR now down 47% since hitting an all-time high 6 weeks ago

Source: Barchart

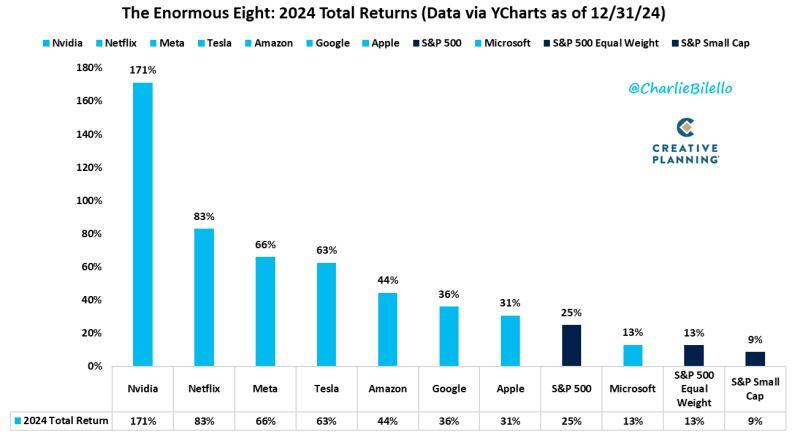

The Enormous Eight: 2024 Returns

Nvidia $NVDA: +171% Netflix $NFLX: +83% $META: +66% Tesla $TSLA: +63% Amazon $AMZN: +44% Google $GOOGL: +36% Apple $AAPL: +31% -S&P 500 $SPY: +25% Microsoft $MSFT: +13% -S&P Equal Weight $RSP: +13% -S&P SmallCap $IJR: +9% Source: Charlie Bilello

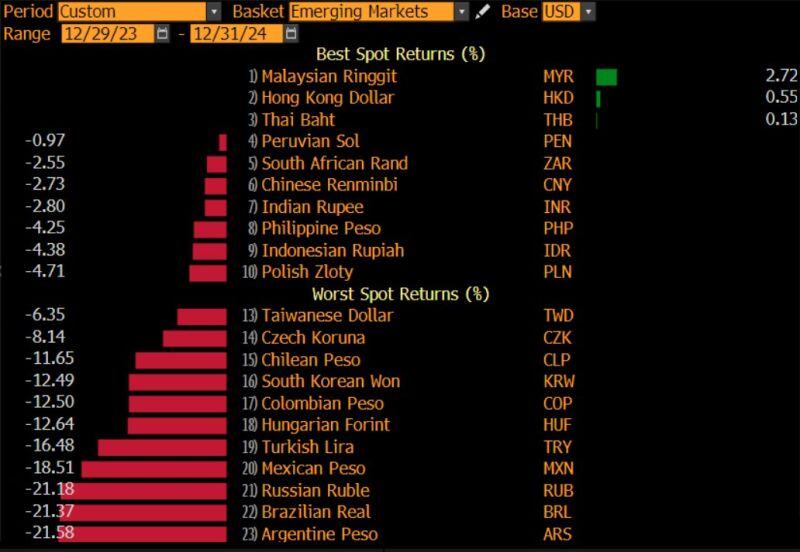

This is EM currency performance versus the Dollar in 2024. The 3 worst performers are: (i) Argentina's Peso; (ii) Brazil's Real; (iii) Russia's Ruble.

Source: Bloomberg, Robin Brooks

Swiss central bank faces call to hold bitcoin in reserves

Swiss citizens are advancing a new initiative to integrate Bitcoin into the financial reserves of the Swiss National Bank (SNB). This proposal has entered the official signature collection phase, aiming to secure 100,000 signatures within 18 months. If successful, the initiative will proceed to a national referendum to amend the Swiss federal constitution. The Swiss citizens initiative is an attempt to include Bitcoin in Article 99 (Clause 3) of the Swiss constitution which presently requires some amount of the country to be stored in gold. Bitcoin enthusiasts have suggested that Bitcoin should be considered as an instrument similar to gold. However, the initiative encounters numerous challenges even though the interest has been escalating. Switzerland being a neutral country does not often make changes to its constitution and the process is quite long and complicated. The proposal has to be supported and getting 100,000 verified signatures within the time limit is rather a challenging feat. source : coingape

Investing with intelligence

Our latest research, commentary and market outlooks