Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

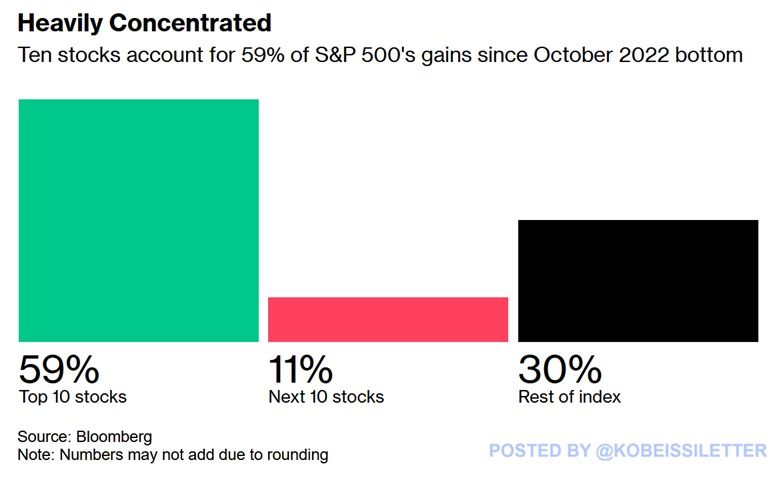

This has never been seen before: The top 10 US stocks have accounted for 59% of the S&P 500’s gains since the October 2022 bottom.

By comparison, the next 10 stocks have contributed just 11% while the remaining 480 stocks have contributed 30%. Over this period, the top 10 stocks' share of the S&P 500’s is up 13 percentage points, now reflecting a record 40% of the index. The top 3 stocks alone reflect a record 21% of the index's market cap. A few stocks are driving the entire market. Source: Bloomberg

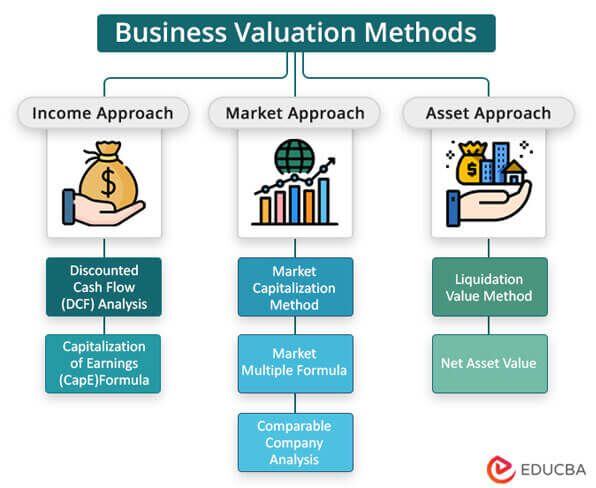

Great visualization of valuation methods:

Source: h/t EDUCBA, The Investing for Beginners Podcast @IFB_podcast

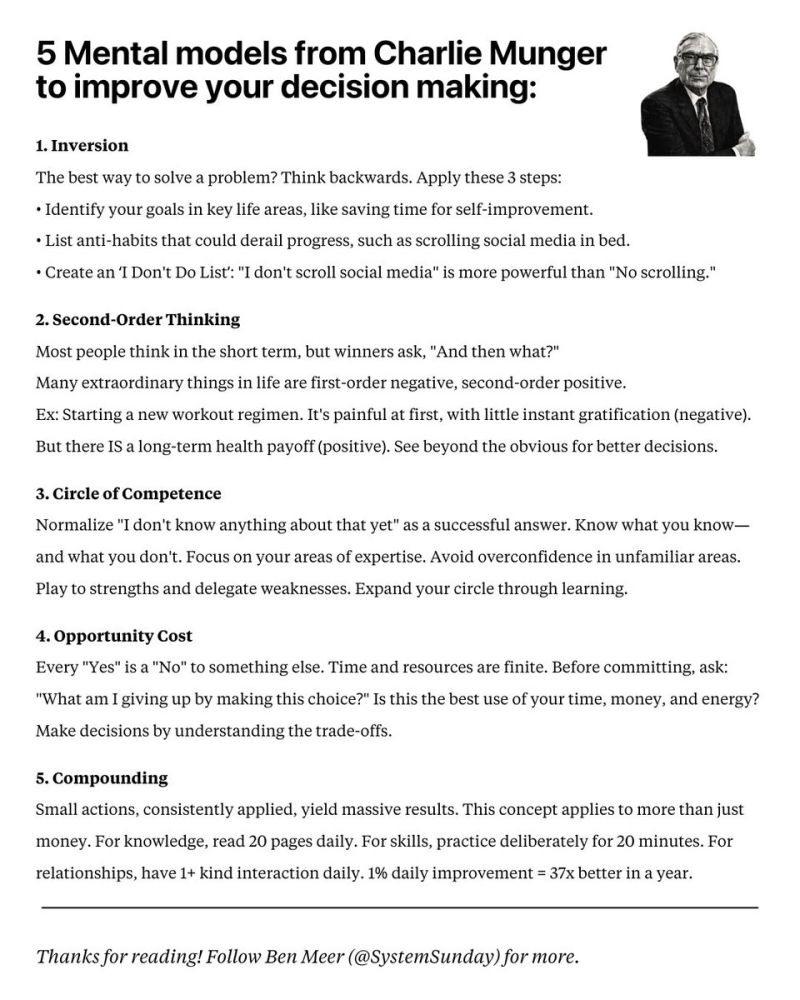

5 mental models from Munger to sharpen your thinking

Source: InvestmentBook1 (@Investment Books (Dhaval))

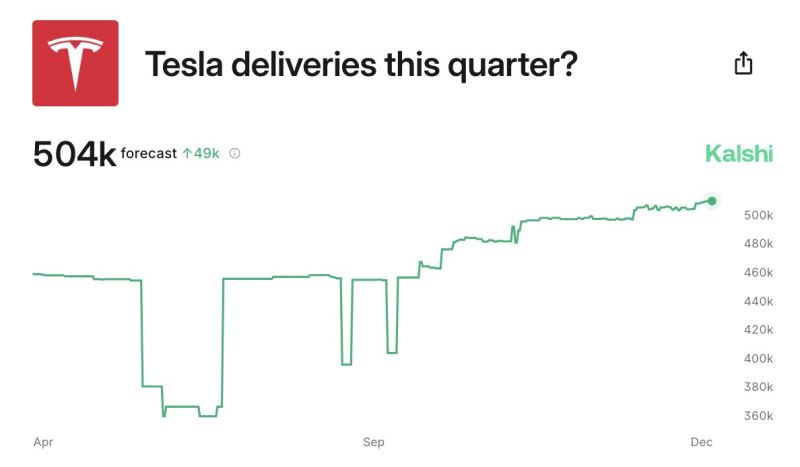

All eyes are on Tesla, $TSLA, this week: Tesla is expected to report Q4 2024 deliveries of 504,000 this week, according to Kalshi.

This would mark an ~8.9% increase from the 462,890 vehicles delivered in Q3 2024. If Tesla does in fact report over 500,000 deliveries, it would mark a new quarterly record for the company. Tesla is now the 8th largest company in the world by market cap and worth ~$1.4 trillion. Can Tesla extend its historic run this week? Source: The Kobeissi Letter

BREAKING: Tether has burned over $1 billion overnight—their largest single burn in history. This marks the 4th major burn in 10 days.

Source: Jacob King

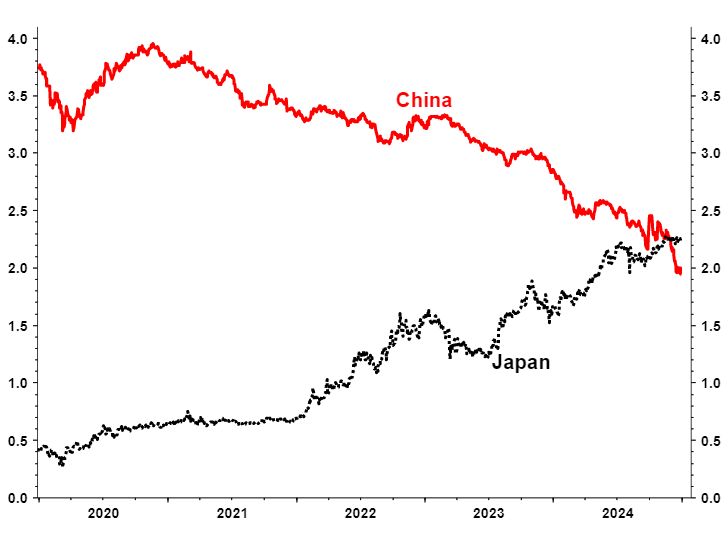

The Japanification of China: This has to be a contender for the chart of 2024 (30y bond yields).

Source: Albert Edwards

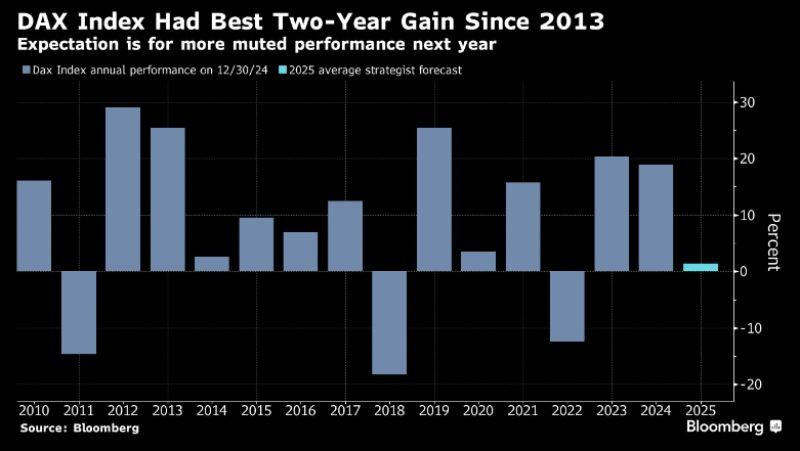

Germany’s Dax index ended the year 2024 with a 18.85% gain after 20.3% rally in 2023

meaning the German benchmark index concluded its biggest 2-year run in more than a decade, even though Germany's GDP shrank in 2023 and probably also in 2024. 👉 SAP, Siemens Energy and Rheinmetall are among top performers. 👉 Chinese competition and lagging demand weigh on automakers. Source: Bloomberg, HolgerZ

Investing with intelligence

Our latest research, commentary and market outlooks