Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

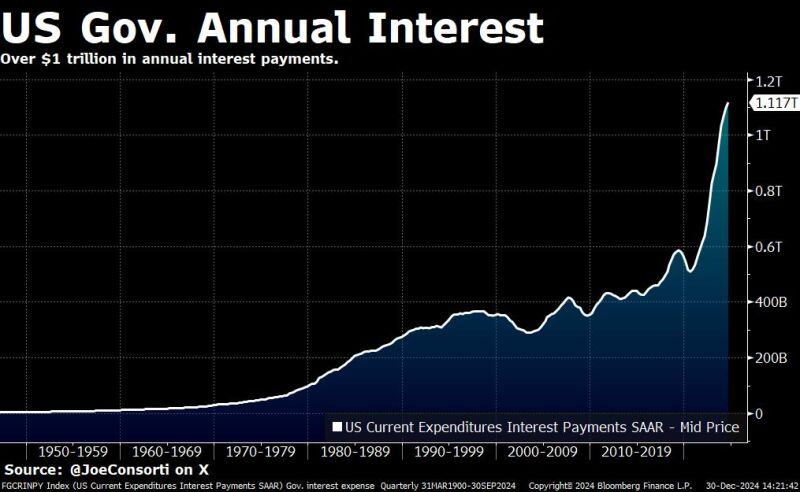

The US Treasury's annual interest expense surpassed $1.117 trillion this year — making it the second-largest government expense.

At the current issuance schedule & interest rates, it will surpass Social Security at $1.46 trillion in 2025 to become the largest government expense. Source: Bloomberg, Joe Consorti

Next year, $3.08 trillion in US Treasury notes and bonds—about 12% of the total—will mature.

At current rates of ~4.46%, rolling this debt would raise the interest expense 54% over the current average coupon of 2.88%. That is an extra $48.7 billion in annual interest expense. Source: Bloomberg, Joe Consorti

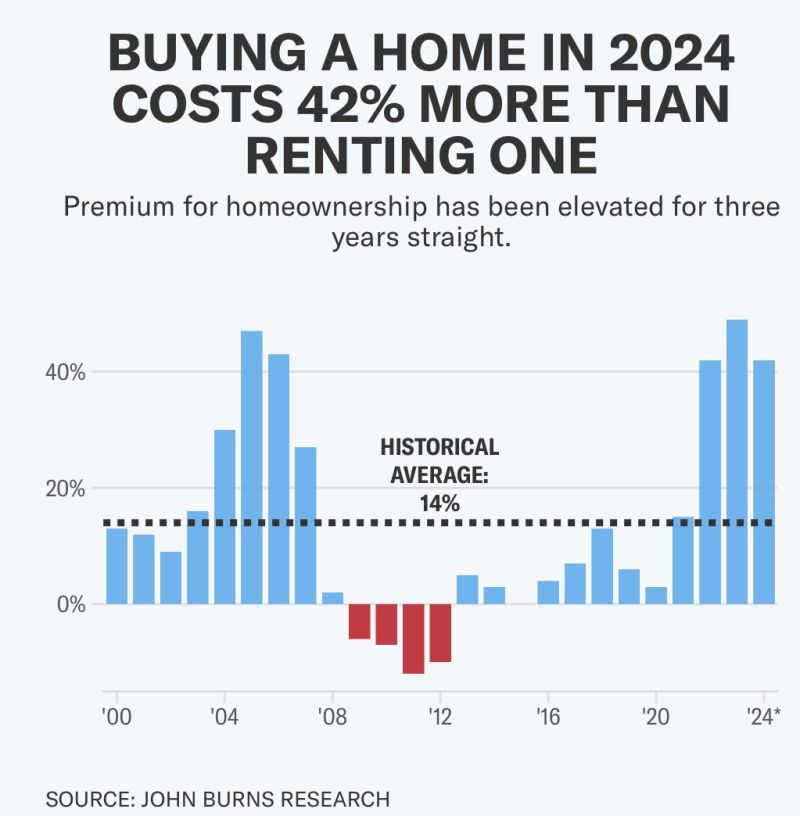

In the US, buying a home in 2024 costs 42% more than renting one

Source: John Burns Research

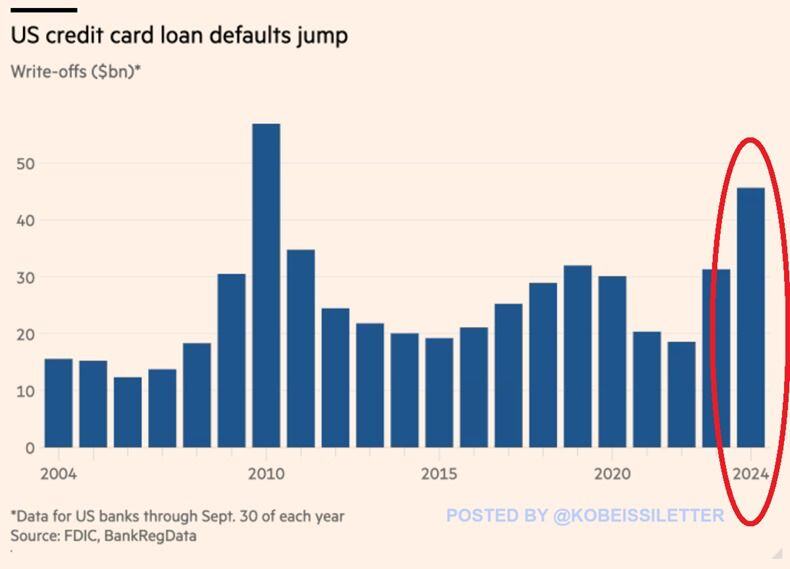

BREAKING: US credit card defaults jumped to $46 billion in the first 9 months of 2024, the highest since 2010.

Credit card defaults are now up over 50% year-over-year. Defaults of seriously delinquent credit card loan balances have more than doubled over the last 2 years. Bottom-income consumers were hit the hardest due to years of elevated inflation and interest rates. Additionally, the savings rate of the bottom third is now 0%, according to Moody’s. Source: FT, The Kobeissi Letter

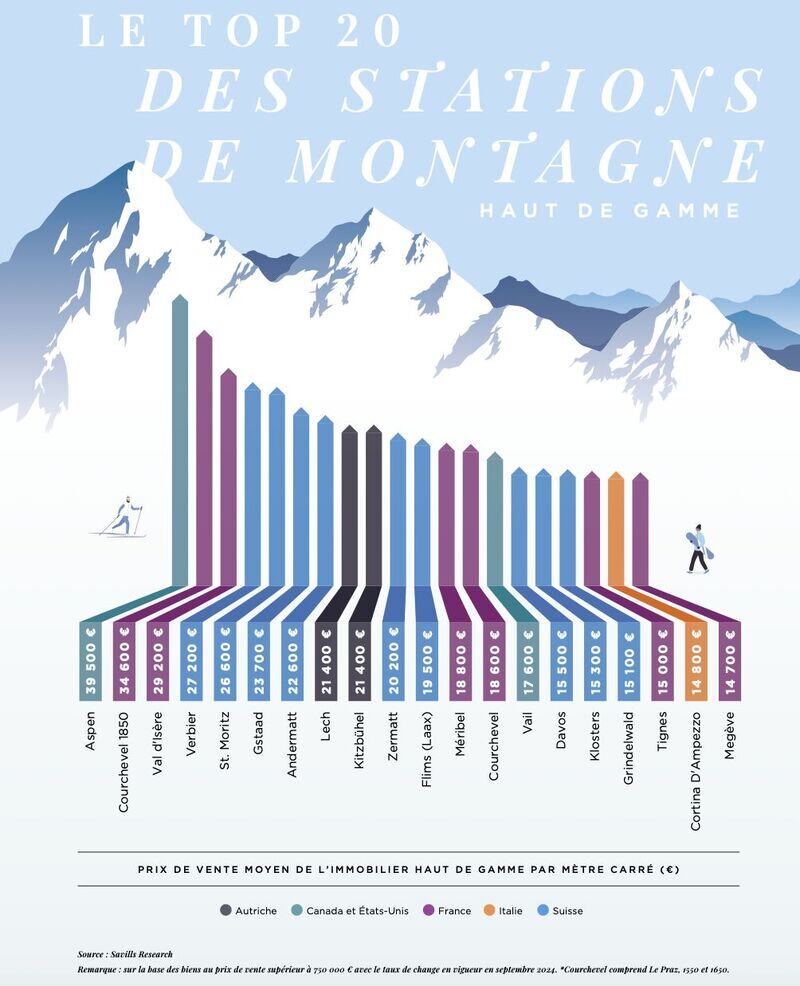

Top 20 ski resorts as ranked by Property residential price per m2 (sqm)

Source: Savills Research thru Bogdan KOWAL on linkedin

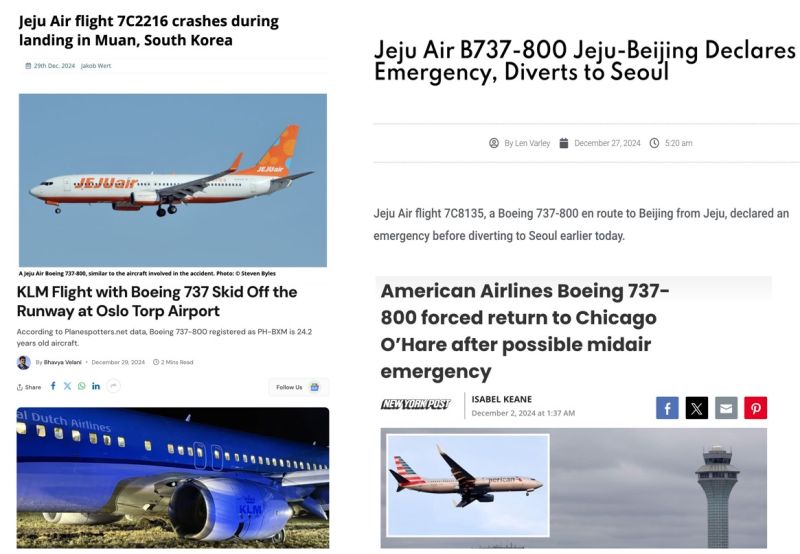

Flying with a 737-800 is becoming stressful... what a month... (or maybe just a coincidence)

Source: Lee Seng Foo🇲🇾李成富 @sengfoo88 on X

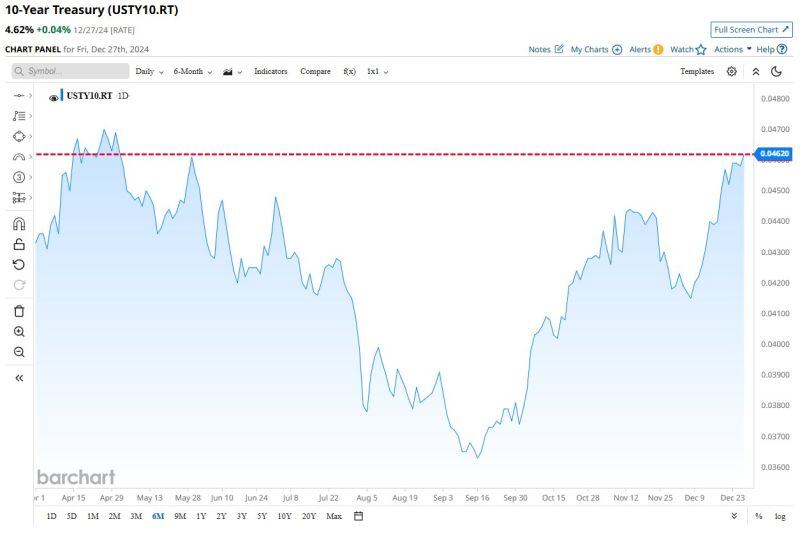

10-Year Treasury Yield closes at highest level in almost 8 months 🚨

Source. Barchart

Investing with intelligence

Our latest research, commentary and market outlooks