Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

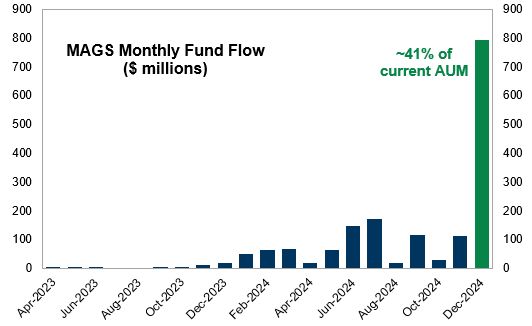

An ETF that tracks the Mag7, $MAGS, registered its largest inflow since inception last Friday,

gathering +$157mm (~8% of current AUM), pushing December inflows to +$800mm (~41% of current AUM) Source: GS, zerohedge

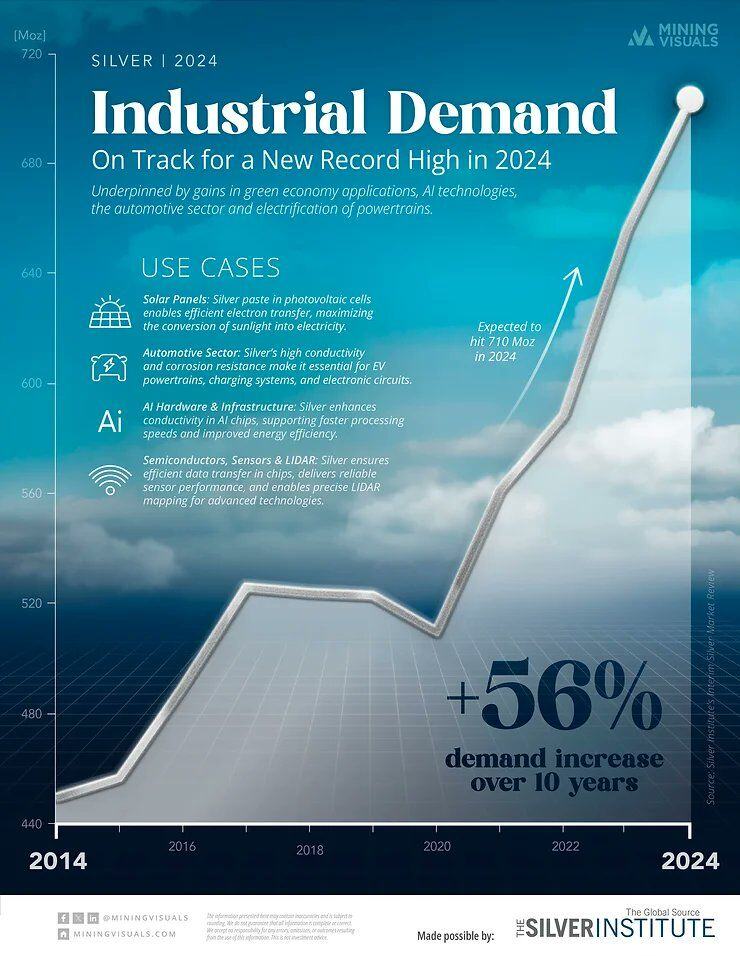

SILVER industrial demand to hit record high in 2024, up 56% in last 10 years

Source: Mining Visuals

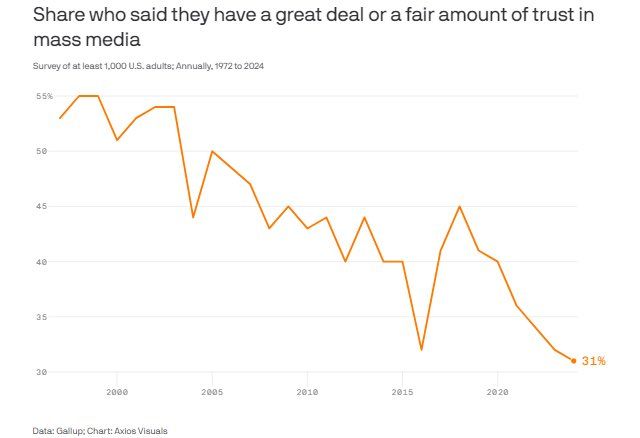

In the US, only 31% of adults trust mass media.

Fewer and fewer people are trusting the news media these days. In many countries, X is the #1 news app. There is a reason for that. People want real info on what is happening. The legacy news media has failed in that task. Source: Wall Street Mav @WallStreetMav on X

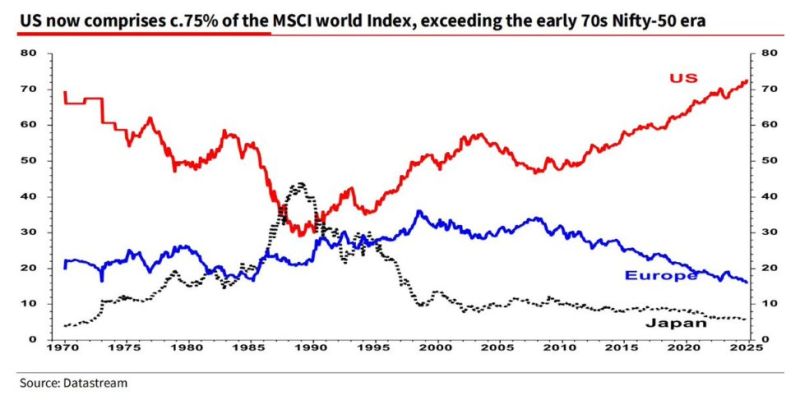

US is now 75% of MSCI World Index, a 55 Year High

Source: Datastream, Special Situations Research Newsletter on X

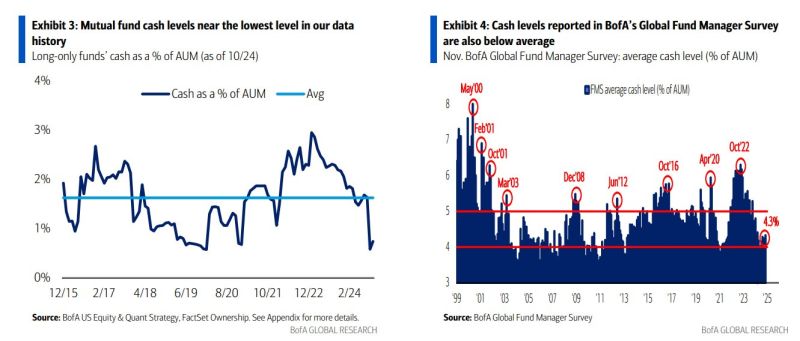

2025 is going to start and mutual funds and hedge funds managers cash levels are near record lows

Source: BofA

The Triangle of Faith

Source: Investment Books (Dhaval) @InvestmentBook1

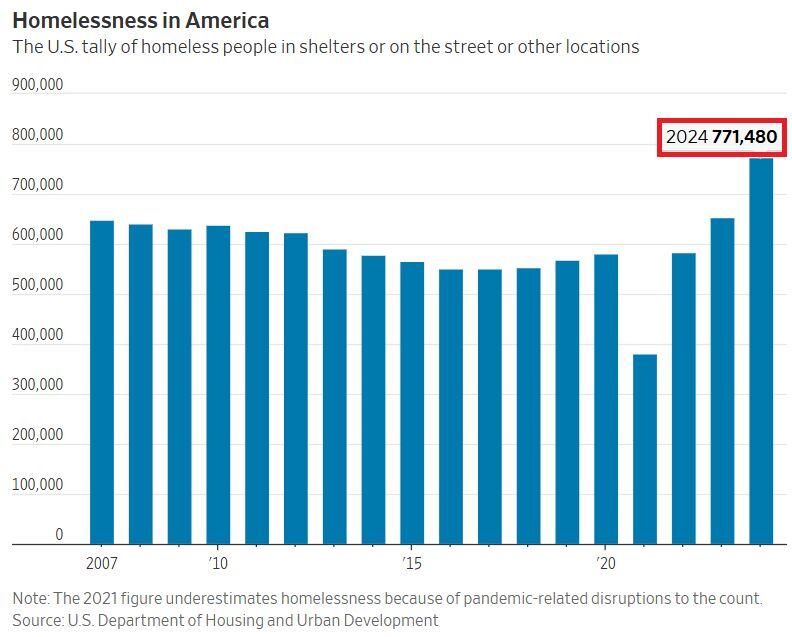

🚨THIS IS A CONCERNING NEWS🚨The number of homeless people in the US jumped 18% from 2023 to a RECORD 771,480 in 2024.

Over the last 4 years, homelessness has rapidly accelerated. On the other hand, the top 10 billionaires gained $730 BILLION in wealth. This is sad. And this is NOT a US-only phenomena. Source: Global Markets Investor

Investing with intelligence

Our latest research, commentary and market outlooks