Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

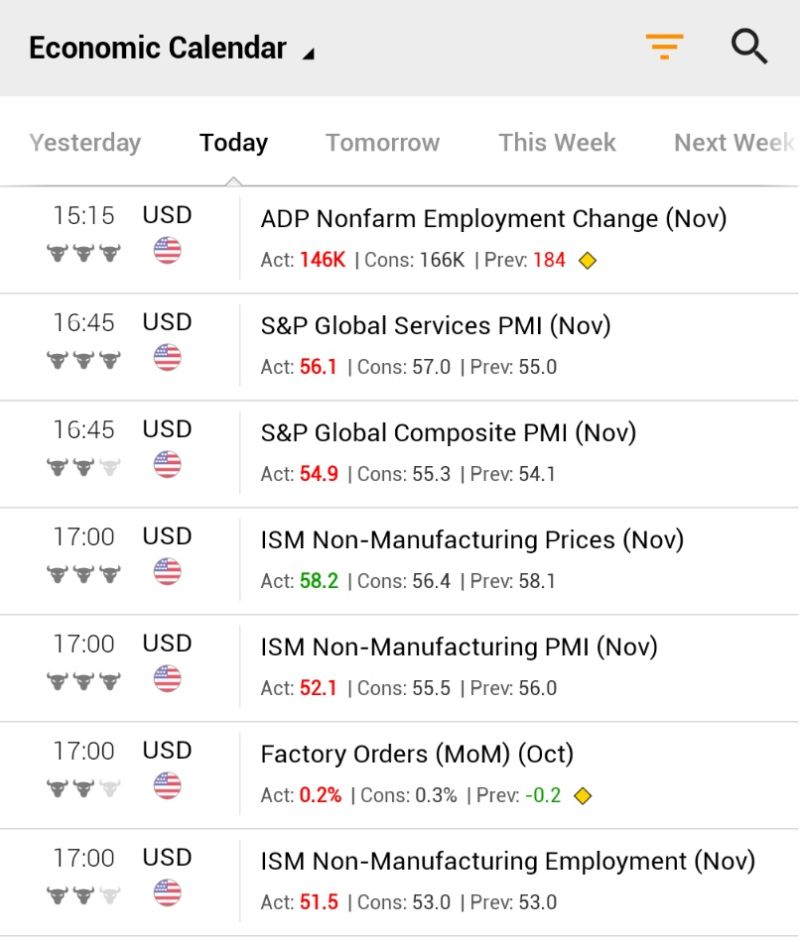

US Economic Surprises are starting to roll out.

See below yesterday macro numbers - majority of them missed estimates (hard & soft data) *ADP Payrolls: Miss 🔴 *S&P Services PMI: Miss 🔴 *ISM Services PMI: Miss 🔴 *ISM Services Employment: Miss 🔴 *Factory Orders: Miss 🔴 Source: Jessie Cohen

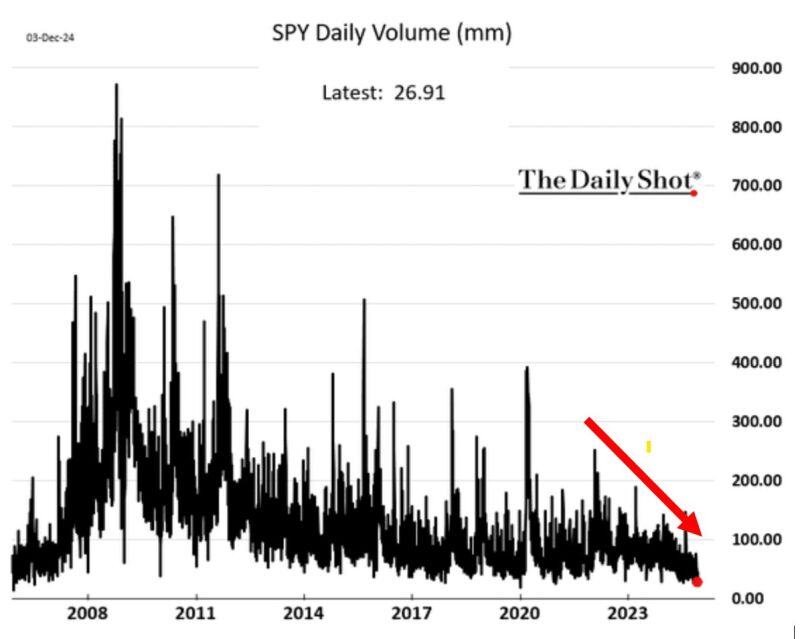

US STOCK MARKET LIQUIDITY IS FALLING

S&P 500 ETF daily trading volume PLUNGED to 26.9 million on Tuesday, near the lowest since 2007. At the same time, S&P 500 futures trading volume FELL to the lowest in 3 YEARS. This increases the risk of some wild moves going forward. Source: Global Markets Investor, The Daily Shot

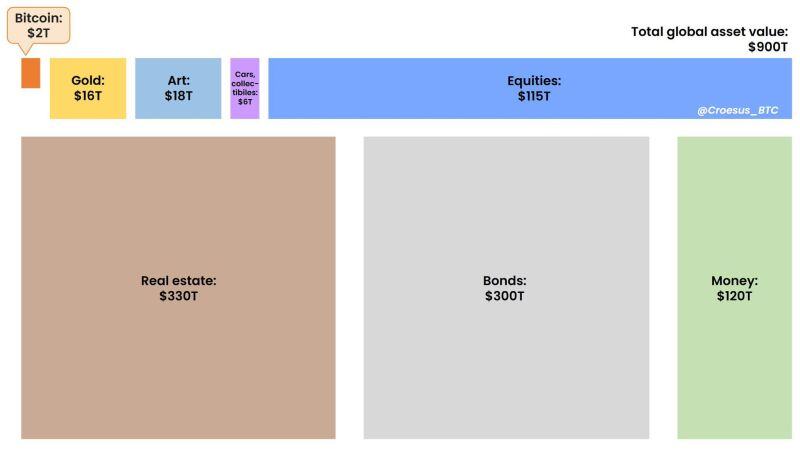

Bitcoin is still just 0.2% of global asset value.

Here is the latest update of this chart, which you may have seen in Microstrategy CEO Michael Saylor's presentations. With Bitcoin's price over $90k and ~$2T in market value, it may feel like you're late to Bitcoin... but it is still a tiny bucket in the global asset ocean. Source: Jesse Myers (Croesus 🔴) @Croesus_BTC

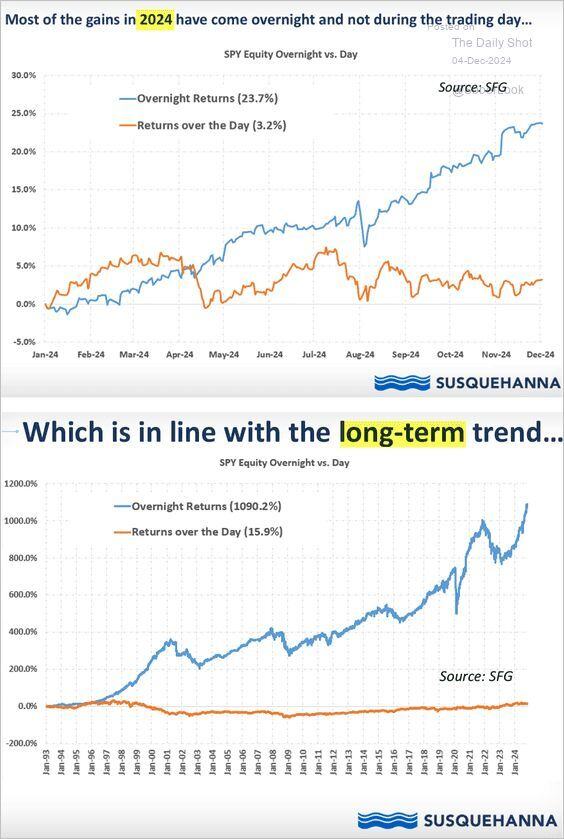

Overnight gains in US equities have massively outpaced intraday gains.

Source: Chris Murphy, Susquehanna International Group, The Daily Shot

As the old adage says... "Concentration makes you rich. Diversification keeps you rich".

#BTC

Investing with intelligence

Our latest research, commentary and market outlooks