Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

BREAKING >>> Trump has appointed David Sacks as the White House "AI & Crypto Czar."

Sacks will create a legal framework for the U.S. crypto industry to provide clarity and foster growth. Sacks is a known Solana ($SOL) bag holder Source: Truth Social, Bloomberg @DavidSacks

French President Emmanuel Macron came out fighting against opposition parties who he said “chose chaos”

by bringing down his premier in a historic no-confidence vote, vowing not to step aside before the end of his term. “The mandate that you have entrusted to me democratically is a five-year mandate, and I will exercise it fully until its end,” Macron said on Thursday. Macron’s term runs until 2027, but he is facing rising pressure from opposition groups to step down early. The president said he would name a new prime minister “in the coming days”, as he hit out at the far-right Rassemblement National and the leftist Nouveau Front Populaire alliance. Source: FT >>> https://on.ft.com/4ikxkhz

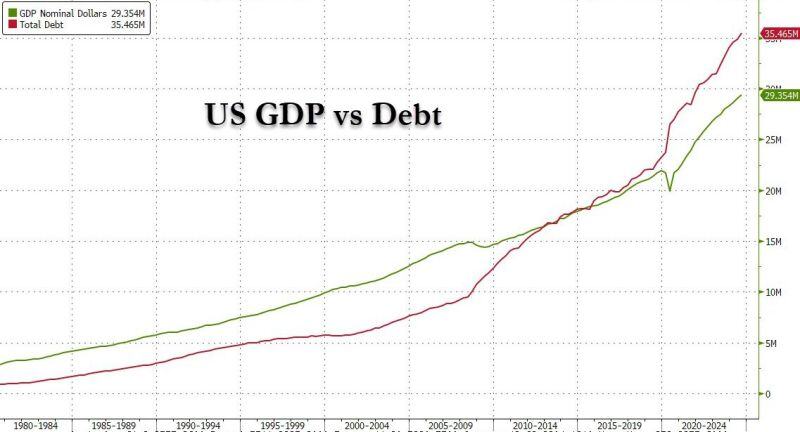

The problem in one chart

More $debt is needed to generate $1 of GDP Source: zerohedge

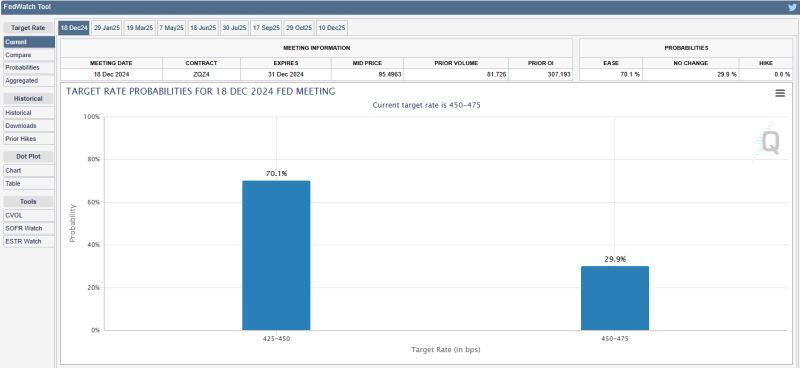

There is now a 70% chance of a 25 bps interest rate cut at this month's FOMC meeting 🚨

Source: Barchart

Investing with intelligence

Our latest research, commentary and market outlooks