Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

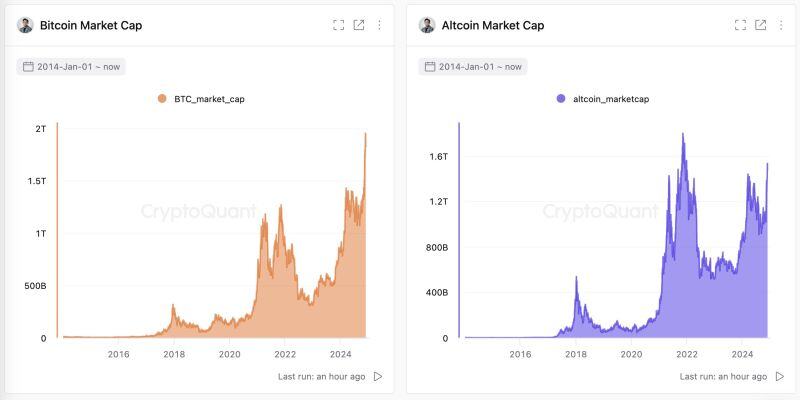

Why is altcoin season delayed?

Here's the view by Ki Young Ju on X: "Compared to the last cycle, the nature of capital flowing into Bitcoin has shifted. The current Bitcoin rally is primarily driven by demand from institutional investors and spot ETFs. Unlike crypto exchange users, institutional investors and ETF buyers have no intention of rotating their assets from Bitcoin to altcoins. Moreover, as they operate outside of crypto exchanges, asset rotation becomes inherently less feasible. While institutional investors might allocate funds to major altcoins via ETFs or investment vehicles, minor altcoins still rely on crypto exchange users to buy them. For altcoins to reach a new all-time high market capitalization, they will require a significant influx of fresh capital to crypto exchanges. The altcoin market cap below its previous ATH indicates reduced fresh liquidity from new exchange users. If Bitcoin retail FOMO reignites, exchange user activity might increase, potentially setting the stage for an altcoin season. However, Bitcoin's future growth is expected to come from ETFs, institutions, and maybe govts, rather than retail traders on crypto exchanges".

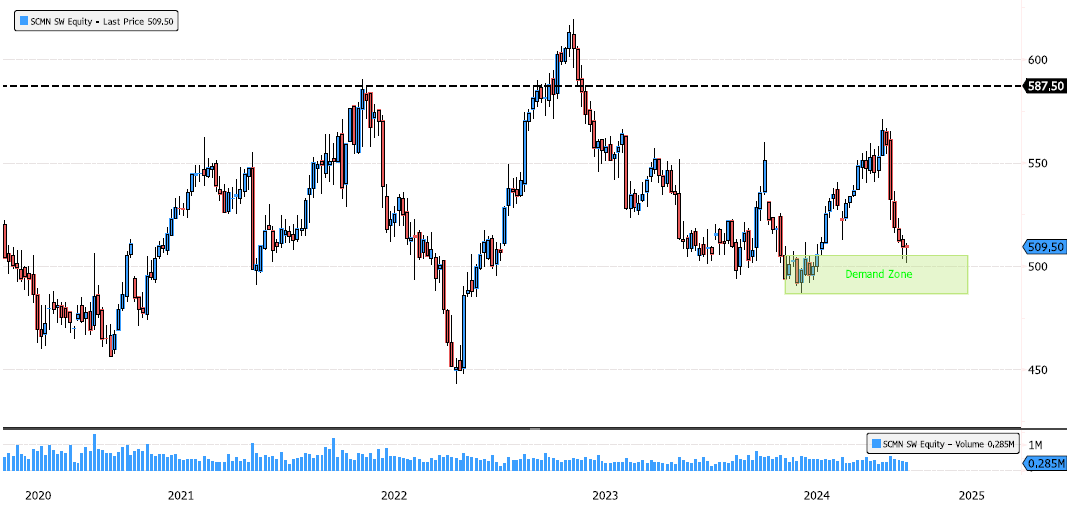

Swisscom Back on Demand Zone

Swisscom (SCMN SW) recently posted a strong swing, suggesting that the May consolidation could be over. Keep an eye on the demand zone between 486.80-505 for potential price action. Source: Bloomberg

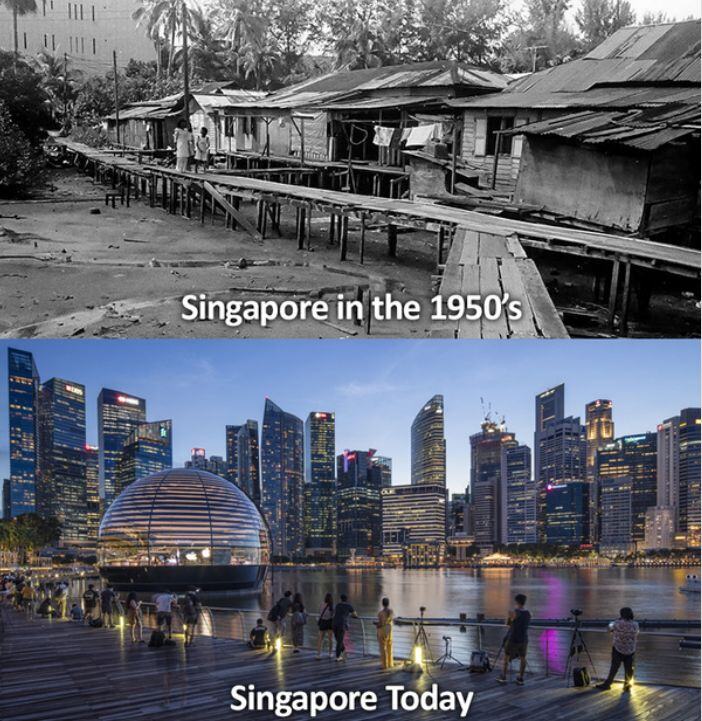

Vision is everything...

In 1965, Singapore was forced a tiny island of 2M people forced out of Malaysia. No army. No resources. No fresh water. Then ONE man's ruthless vision built modern Asia's greatest success... Source: Great post by Oscar Hoole on X

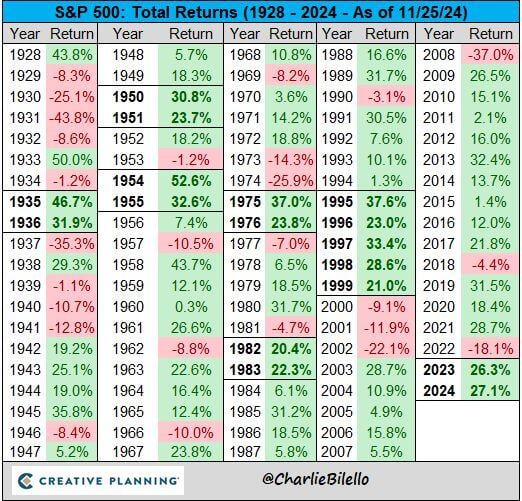

The S&P 500 is currently on pace for back-to-back years with a total return above 20%.

The last time that happened: 1998-1999. $SPX Source: Charlie Bilello

US Fed officials see interest rate cuts ahead, but only ‘gradually,’ meeting minutes show - CNBC

Federal Reserve officials expressed confidence that inflation is easing and the labor market is strong, allowing for further interest rate cuts albeit at a gradual pace, according to minutes from the November meeting released Tuesday. The meeting summary contained multiple statements indicating that officials are comfortable with the pace of inflation, even though by most measures it remains above the Fed’s 2% goal. With that in mind, and with conviction that the jobs picture is still fairly solid, Federal Open Market Committee members indicated that further rate cuts likely will happen, though they did not specify when and to what degree.

What happened to the Titanic now seems very clear...

Source: @AutismCapital on X

The S&P 500 has gained over $10 trillion in value this year.

Source: Brew Markets

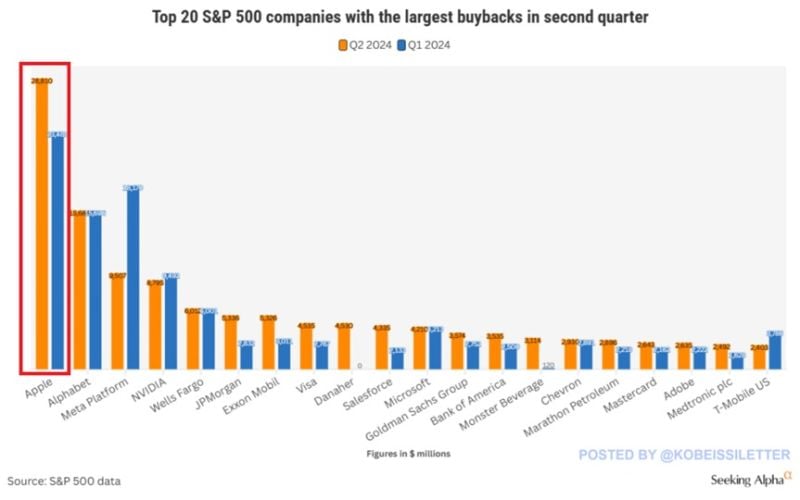

BREAKING: S&P 500 buybacks jumped 35% in Q2 2024 to $236 billion, near the all-time record.

Furthermore, a massive 52% of stock repurchases were conducted by the index's top 20 firms. This compares to a long-term average of 48% and pre-pandemic average of 45%. Apple, $AAPL, Alphabet, $GOOGL, Meta, $META, and Nvidia, $NVDA ALONE back $63 billion of stock. The Information Technology sector saw $68 billion of repurchases while Financials and Communication Services saw $45 billion and $35 billion, respectively. Buybacks are fueling the stock market rally. Source: The Kobeissi Letter

Investing with intelligence

Our latest research, commentary and market outlooks