Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

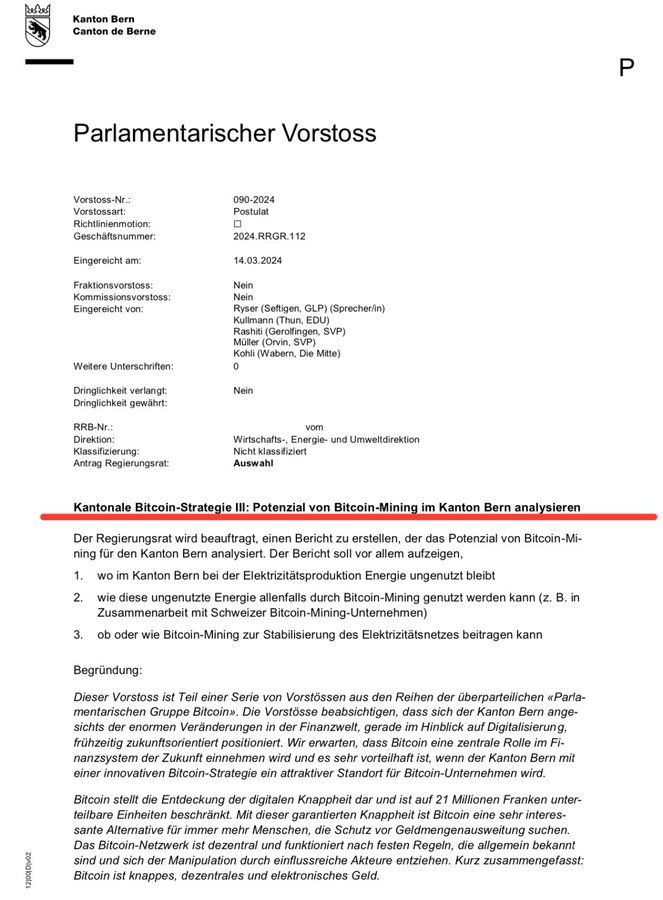

BREAKING: Switzerland passes legislation to study how Bitcoin mining can balance the grid and use wasted energy

[Dennis Porter] - Bitcoin Archive

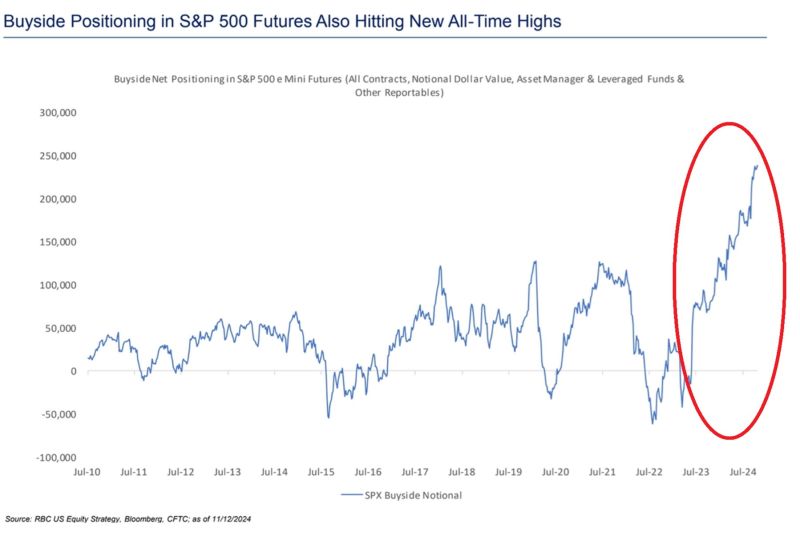

🚨INSTITUTIONAL INVESTORS HAVE NEVER BEEN MORE BULLISH🚨

Asset managers, leveraged funds and other investors net LONG positioning in the S&P 500 exceeded 240,000 contracts, the most on record. This is DOUBLE the amount seen in 2021 before the bear market started. Euphoria is an understatement. Source: Global Markets Investor

OUCH! French stocks are set for their worst under-performance against European peers since 2010 as a budget standoff threatens to topple the govt.

Source: BBG, HolgerZ

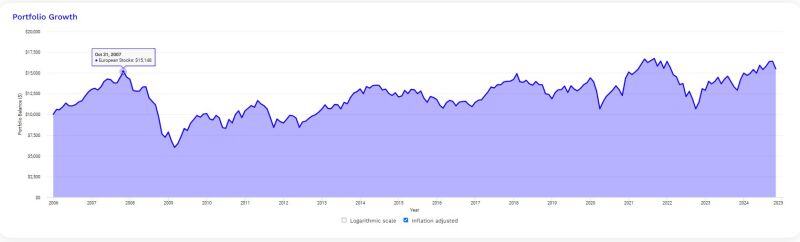

On an inflation-adjusted basis, including dividends, European stocks are up 2% in the last 17 years.

Source: Mike Zaccardi, CFA, CMT, MBA

French bond premium hits 12-year high as German yields drop amid political uncertainty

Source: PiQ @PiQSuite

Investing with intelligence

Our latest research, commentary and market outlooks