Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

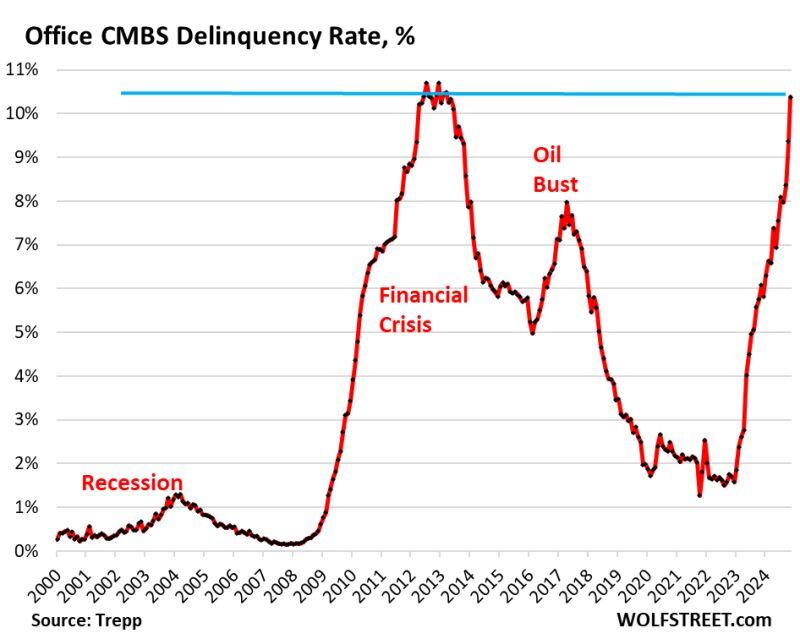

Office CMBS Delinquency Rate Spikes to 10.4%, Just Below Worst of Financial Crisis Meltdown. Fastest 2-Year Spike Ever.

Office-to-residential conversions are growing, but are minuscule because not many towers are suitable for conversion. Source: www,wolfstreet.com, Wolf Richter

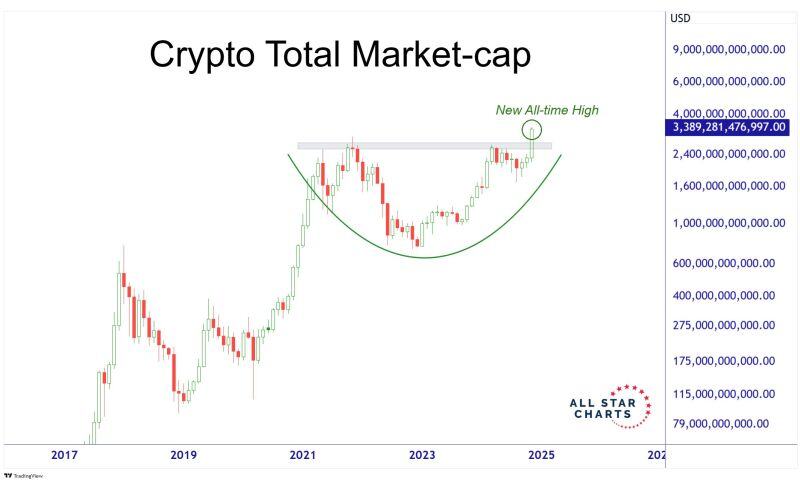

Ripple $XRP forms a God Candle as it becomes the world's 3rd largest cryptocurrency, valued at almost $140 Billion

Source: Barchart

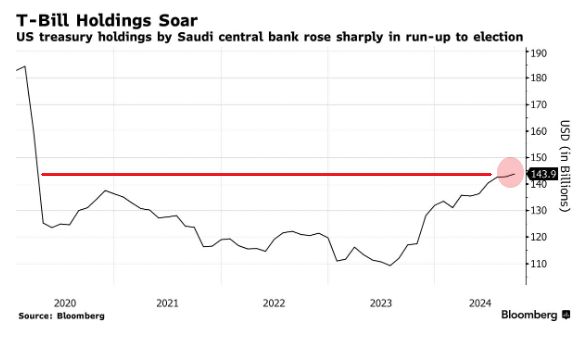

🚨 Saudi Arabia's U.S. Treasury Holdings are now the largest in more than 4.5 years

Source: Barchart, Bloomberg

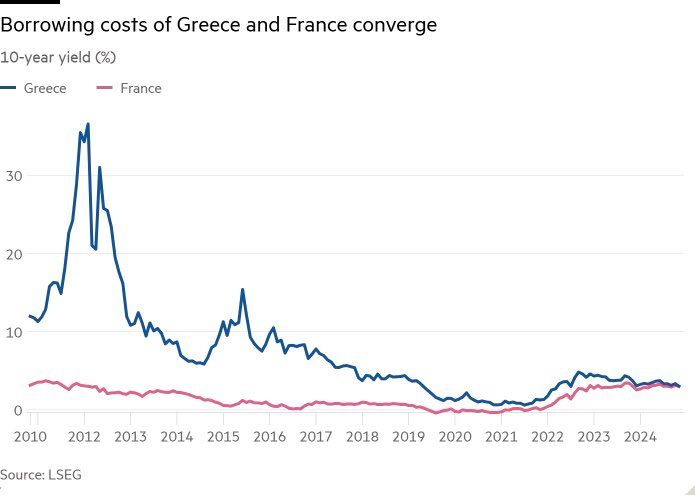

The chart of the day:

France’s benchmark bond yield matched Greece’s for the first time on record, the latest milestone in a week marked by mounting anxiety over the fate of Prime Minister Michel Barnier’s government. The rate on 10-year French notes, traditionally considered among the safest in the euro area, briefly rose to 3.03% before paring the move. That was the same as comparable Greek bonds, a country once at the heart of the European sovereign debt crisis. Investors are concerned that France may struggle to pass a budget for next year, with the far-right National Rally party threatening a no-confidence vote to bring the government down if its demands aren’t met. While French bonds rallied after Finance Minister Antoine Armand said he is prepared to make concessions on the 2025 budget, that did little to dent months of underperformance. “France is not Greece,” said finance minister Antoine Armand. "France has . . . far superior economic and demographic power which means it is not Greece.” Humility at its best... Source: FT, LSEG

Crypto Stablecoin market value reaches $190 Billion, an all-time high 🚨

"Cash on the Sidelines" Source: Bloomberg

ALL DAY TRADING IS COMING??

This start-up stock exchange just won approval from the US SEC to allow nonstop trading 23 hours a day, 5 days a week. Trading technology pioneer Dmitri Galinov's 24 Exchange has secured regulatory approval to launch what could become America's first near round-the-clock equities trading venue, marking a potential watershed moment for US market structure. The extended hour trading is subject to Equity Data Plans making changes that would facilitate overnight trading hours and 24X National Exchange making an additional rule filing with the SEC confirming the changes and the Exchange’s ability to comply with the Securities Exchange Act. The Securities and Exchange Commission (SEC) has greenlit 24X National Exchange, the latest venture from Galinov, who previously founded FastMatch - now Euronext FX - and held senior roles at Direct Edge. The approval represents a significant milestone for the firm, which has been steadily expanding its trading offerings since its 2019 launch. The exchange will roll out in two phases, with initial trading hours from 4:00 AM ET to 7:00 PM ET on weekdays, starting in the second half of 2025. The second phase would extend trading from 8:00 PM ET Sunday through 7:00 PM ET Friday, subject to approval from Equity Data Plans and additional SEC requirements. A one-hour operational pause will occur during each trading day to accommodate routine software upgrades and functionality testing. (Source: www.liquidityfinder.com)

Investing with intelligence

Our latest research, commentary and market outlooks