Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Wow! JPMorgan's S&P 500 target for the end of 2024 was 4,200. For 2025, it's now 6,500

Source: Trend Spider

Citi U.S. Economic Surprise Index is starting to roll over again

Source: Bloomberg

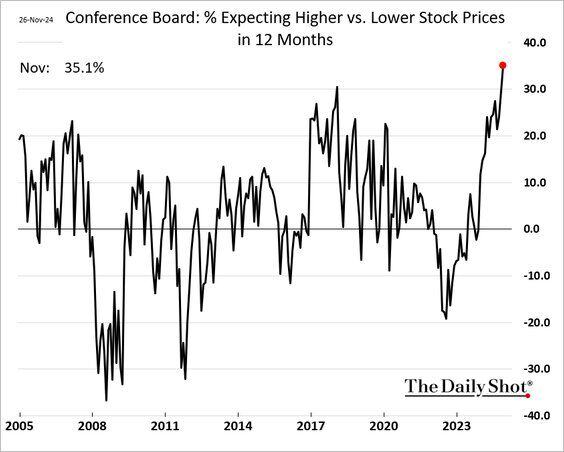

US households have not been this giddy on stocks in decades.

Source: The Daily Shot

Semiconductor Stocks $SMH testing the 200D moving average for only the 4th time since January 2023 🚨

Source: Barchart

So brutal but so true from @psarofagis

Source: @Eric Balchunas

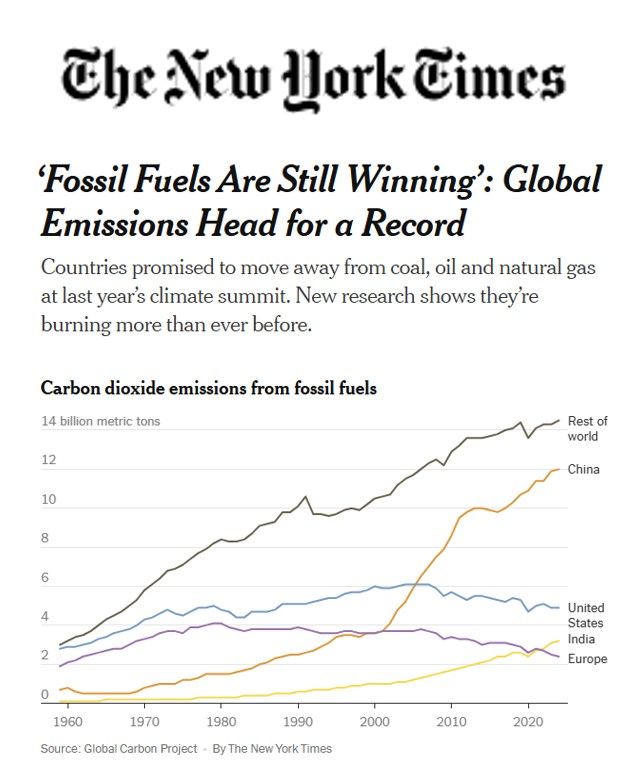

Countries promised to move away from coal, oil and natural gas at last year’s climate summit. New research shows they’re burning more than ever before.

One year after world leaders made a splashy promise to shift away from fossil fuels, countries are burning more oil, natural gas and coal than ever before, researchers said this week. Global carbon dioxide emissions from fossil fuels are on track to reach a record 37.4 billion metric tons in 2024, a 0.8 percent increase over 2023 levels, according to new data from the Global Carbon Project. It’s a trend that puts countries farther from their goal of stopping global warming. The increase was not uniform across the globe. Emissions will most likely decline this year in the United States and Europe, and fossil fuel use in China slowed. Yet that was offset by a surge in carbon dioxide from India and the rest of the world. Source: NYT

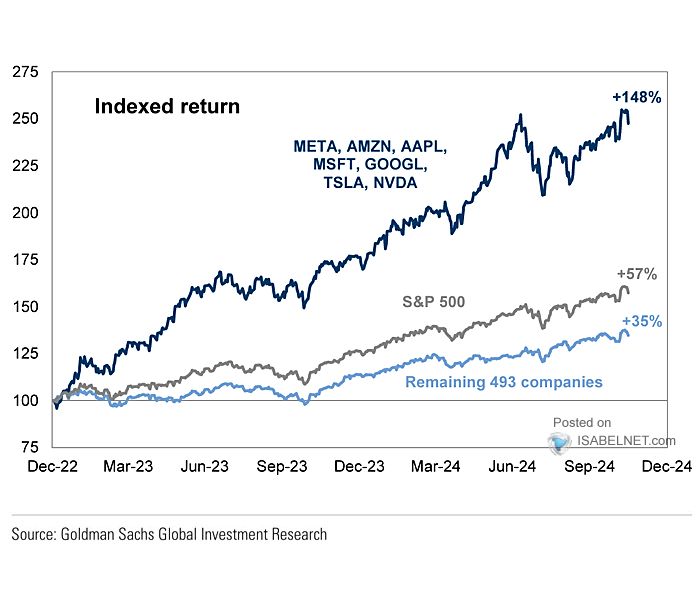

With their massive market caps and impressive price appreciation, the Magnificent7 stocks have played a crucial role in driving the S&P 500 index’s performance.

Without them, S&P 500 returns since December 2022 would be much closer to average, still good, mind you, but more average. 🤣 @ISABELNET_SA thru Lance Roberts on X

Investing with intelligence

Our latest research, commentary and market outlooks