Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

This is the largest daily gold selloff in four years (-3.5%)

Primarily due to profit-taking transitioning into long liquidation after last week's strong rally, Israel's Netanyahu "in principle" approval of a Lebanon ceasefire deal and the announcement of Scott Bessent as President-elect Donald Trump's nominee for US Treasury Secretary. Bessent is seen as another advocate of a smaller government and budget deficits. Source chart: Bloomberg, Tavi Costa

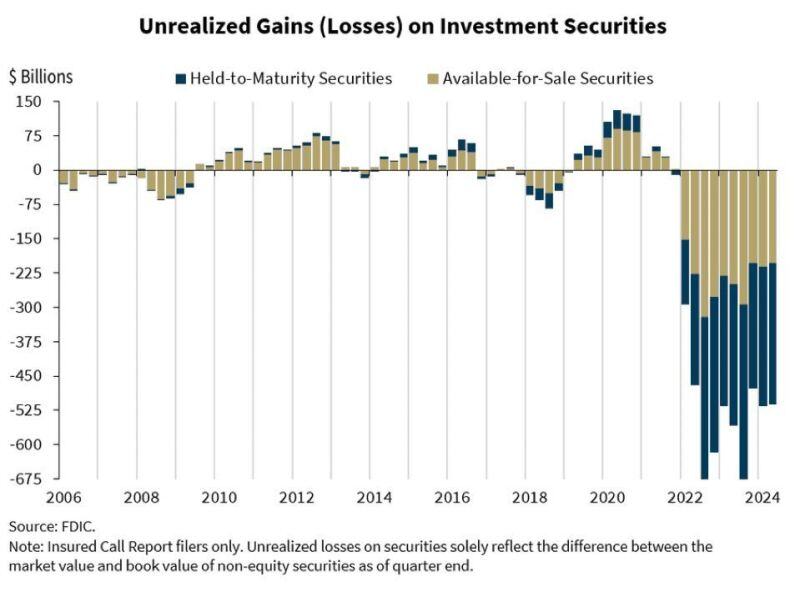

BREAKING 🚨: U.S. banks are now grappling with a whopping $515 billion in unrealized losses.

To put it into perspective, that's over 8x higher than during the 2008 financial crisis. Source: BofA, Jacob King

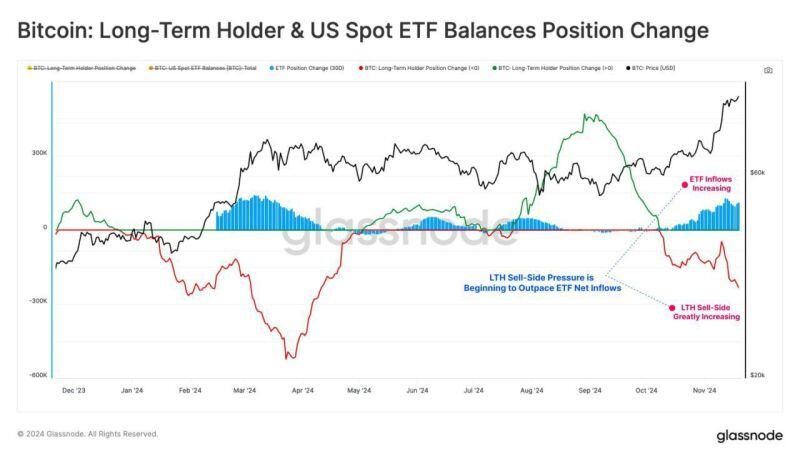

Data from glassnode show that some long-term BTC holders are offloading some of their bitcoins.

Long-term Bitcoin holders sold 128K $BTC, but U.S. spot ETFs absorbed 90% of the selling pressure. 🔥 Strong institutional demand is fuelling BTC’s rally, bringing it closer to the $100K milestone. 🚀💎 Source: Kyledoops

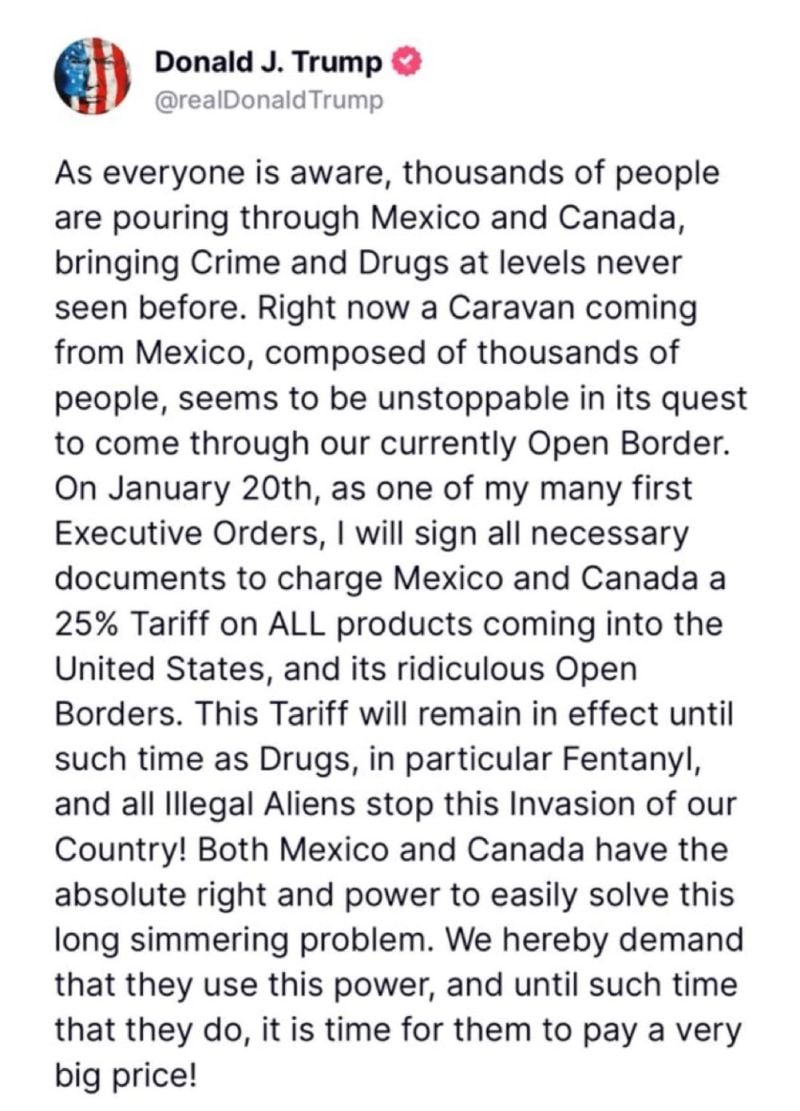

Donald Trump has said he would impose tariffs of 25 per cent on all US imports from Canada and Mexico on his first day in office (and an extra 10 per cent tariff on Chinese goods).

In social media posts, Trump accused the countries of permitting illegal immigration and drug trafficking. Trump said the new China tariffs would come on top of existing levies. He had also threatened on the campaign trial to impose “whatever tariffs are required” to stop Chinese cars from crossing into the US from Mexico. FT >>> The tariffs on the US’s three largest trading partners would increase costs and disrupt business, one expert said, adding that “even the threat of tariffs can have a chilling effect”. A former US trade official agreed the disruption would be significant, especially given the degree of integration in North American manufacturing across sectors such as the automotive industry. He added that “tariffs are inflationary and will drive up prices”.

The Russell 2000 $IWM hit new ALL TIME HIGHS today for the first time in 3 years

Source: Evan

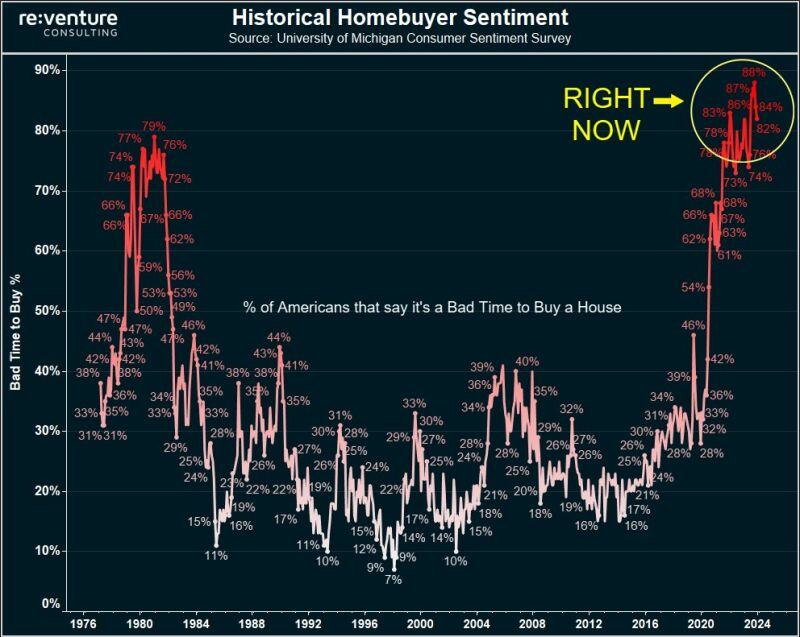

82% of Americans say it's a bad time to buy a house in late 2024.

That's the most pessimistic homebuyers have ever been about the housing market. Helps explain why homebuyer demand is so low. Source: Nick Gerli, re:venture

Investing with intelligence

Our latest research, commentary and market outlooks