Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Should pension funds invest in Crypto?

The Times @CoinCornerDanny makes the case for YES!! The "Times" are changing... Source: Bitcoin Magazine

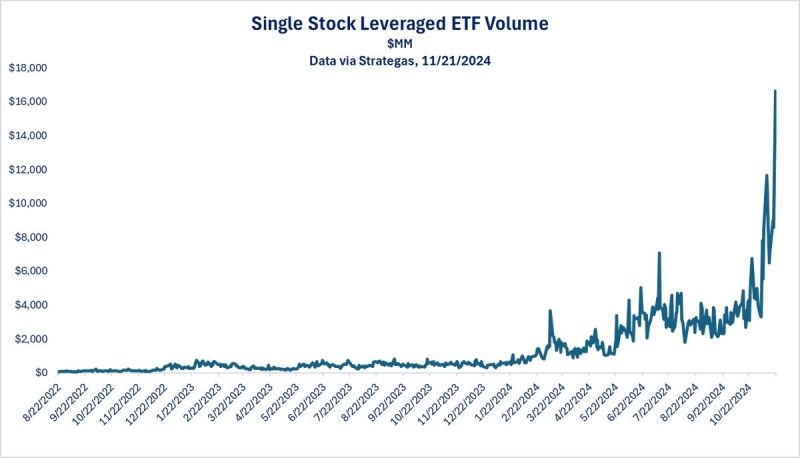

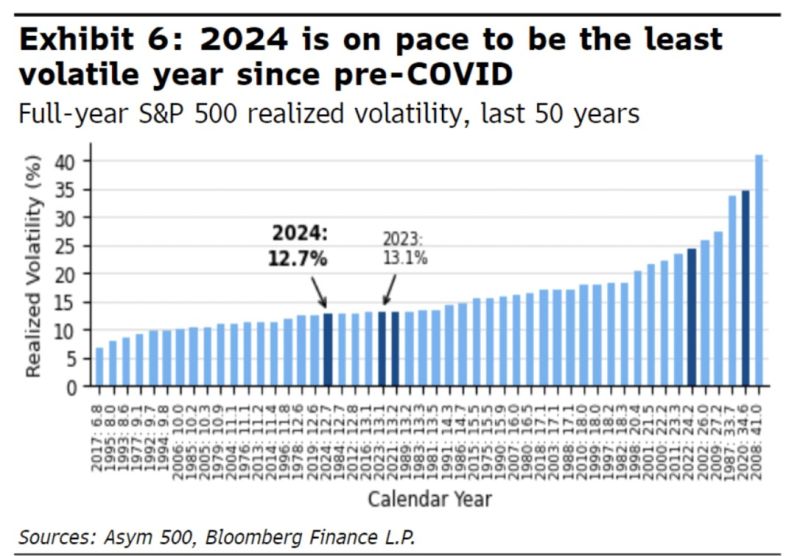

It has been a very quiet year... Can we expect the same in 2025??? (Clone)

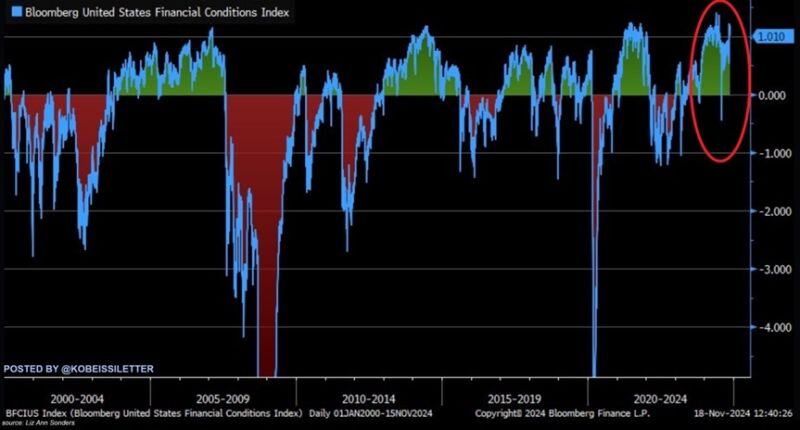

Financial conditions are now even easier than previous records seen in late 2020 and 2021. In fact, this makes financial conditions easier than when the Fed cut rates to near 0% overnight in 2020. Meanwhile, the market is pricing in a 59% chance of another 25 bps Fed rate cut in December. Source: The Kobeissi Letter, Bloomberg

Deere breakout ???

Deere & Company (DE US) has been attempting to surpass the $450 level for over two years. Recently, significant trading volumes have been observed, indicating a potential breakout. It's advisable to monitor this development closely. Source: Bloomberg

Jeff Bezos built Amazon with one simple rule: “If two pizzas can’t feed the team, it’s too big.”

The Two-Pizza Rule is rooted in Bezos’ belief that small, autonomous teams are more productive than large, bureaucratic ones. - Decision-making is faster. - Communication is clearer. - Accountability is higher. By limiting the size of teams, Bezos ensured that every member contributed meaningfully and avoided the pitfalls of “groupthink” and overcomplexity. Teams are given the freedom to innovate and make decisions without relying on higher-ups for approval. Each team has full responsibility for their product or project, from development to execution. This approach encourages entrepreneurial thinking within the company, treating each team as a mini-startup. The Two-Pizza Rule has directly contributed to Amazon’s success by fostering an innovation-first culture. - Alexa: Developed by a dedicated small team that was given the freedom to experiment. - Amazon Prime: Launched by a focused team tasked with creating a subscription model that would lock in customer loyalty. - AWS (Amazon Web Services): What started as a small internal project turned into Amazon’s most profitable division. The Two-Pizza Rule isn’t just about productivity—it also improves employee satisfaction and engagement. - Smaller groups mean deeper connections and more effective teamwork. - Team members feel more responsible for their outcomes, leading to higher motivation. - Less time is wasted on unnecessary meetings and approvals, leaving more time for innovation. Bezos’ Two-Pizza Rule offers a simple but powerful lesson: less is more. Keep teams small and focused, and give them autonomy to innovate. This approach can help any business, regardless of size, to move faster, think creatively, and achieve more with less. Source: Business Nerd

It has been a very quiet year... Can we expect the same in 2025???

Source: Asym 50, RBC

💥 BREAKING: Bernstein says MicroStrategy's treasury model is "unprecedented" and will attract BILLIONS in capital looking for Bitcoin exposure. They are raising $MSTR price target to $600

Meanwhile, MicroStrategy announced this morning they just bought another 55,000 Bitcoin for $5.4billion! The company now holds 386,700 Bitcoin which were acquired for $21.9 billion at an average of $56,761 per bitcoin. Source: Radar, Bitcoin Archive

L'Oréal Rebounding off Major Support

L'Oréal (OR FP) showed strong signs of a rebound last week with a Hammer candlestick pattern. The stock tested the major swing support zone between 300-328 and has seen a 31% consolidation since June! Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks