Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Best ad ever... or why in communication less is more...

Source: Creapills 💊

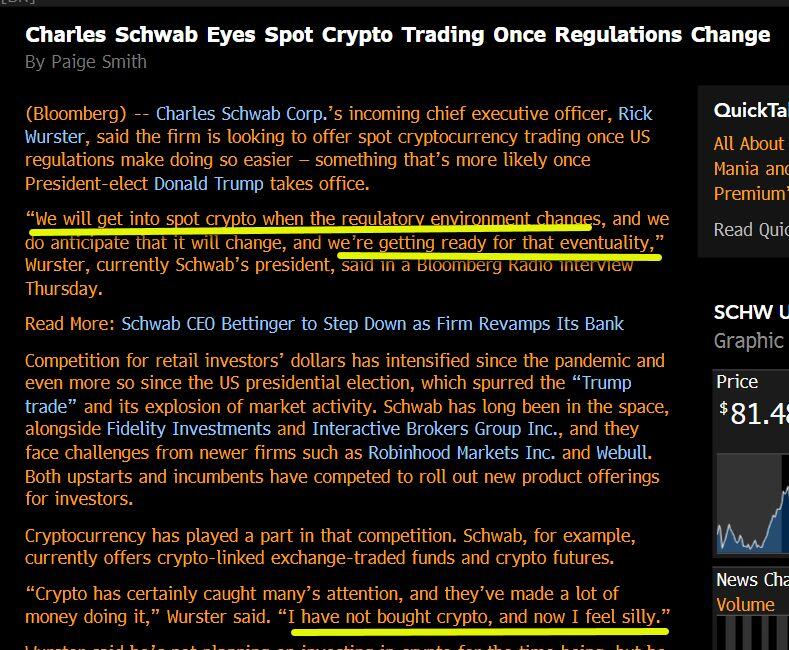

Breaking news:

Officially, Gary Gensler’s five-year term on the commission does not run out until 2026, but it has become customary for SEC chairs to move on when the US presidency changes hands. https://on.ft.com/4fzNwtJ Source: FT

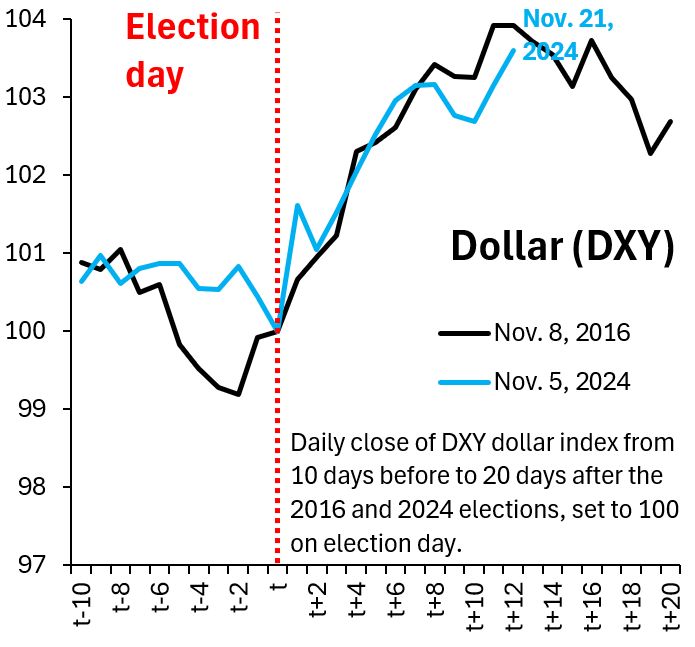

The similarity between the Dollar rise since the election and what happened in 2016 is uncanny.

In both cases, the Dollar was by this point closing in on a 4% rise, with an ultimate rise of around 6% by the end of the year. So - if 2016 is a guide - there's another 2% to go now. Source: Robin Brooks

⚠️NVIDIA MOMENTUM IS FADING⚠️

Nvidia announced it expects revenue of $37.5 billion in Q4 which is $400 million above average expectations. $400 million was the SMALLEST beat in at least 2 years. By comparison, the Fiscal 2Q 2024 sales expectations were beat by $3.8 BILLION. Source: Global Markets Investor

15% of Micro Strategy $MSTR float is still short...

Source: www.zerohedge.com

Investing with intelligence

Our latest research, commentary and market outlooks