Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

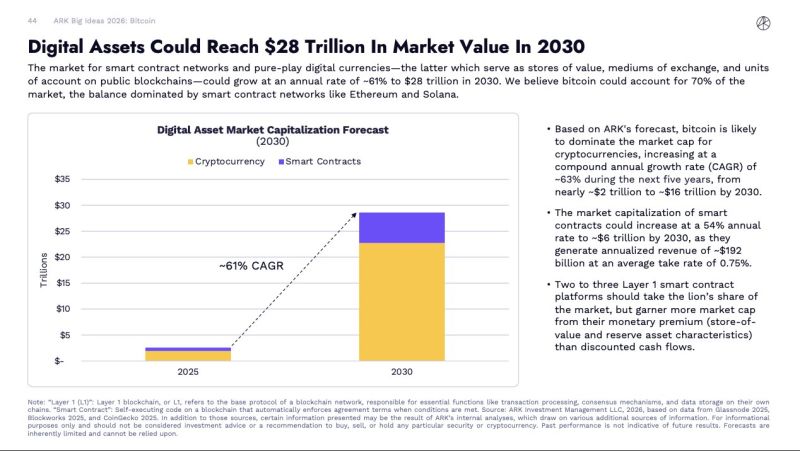

Cathie Wood's Ark invest predicts digitalassets could reach $28 trillion by 2030, with Bitcoin dominating at $16 trillion by 2030.

Source: Cointelegraph

Emerging Market stocks now outperforming U.S. equities by the largest margin since 2023

Source: Barchart

The BofA’s Bull & Bear Indicator is still flashing a sell signal (i.e too much bullishness = contrarian sell signal)

Indicators covered: 1) Hedge fund positioning: Bullish 2) Equity inflow: Very Bullish 3) Bond inflows: Bullish 4) Credit market technicals: Bullish 5) Global stock index breadth: Very Bullish 6) FMS global fund manager positioning: Very Bullish Source: BofA, Global Markets Investor

Us inflation is now at 1.2% according to truflation

Source: Anthony Pompliano

Countries With the Most Natural Resources:

1.🇷🇺Russia $75.0 Trillion 2.🇺🇸United States $45.0 Trillion 3.🇸🇦Saudi Arabia $34.4 Trillion 4.🇨🇦Canada $33.2 Trillion 5.🇮🇷 Iran $27.3 Trillion 6.🇨🇳China $23.0 Trillion 7. 🇧🇷Brazil $21.8 Trillion 8.🇦🇺Australia $19.9 Trillion Source: Jack Prandelli

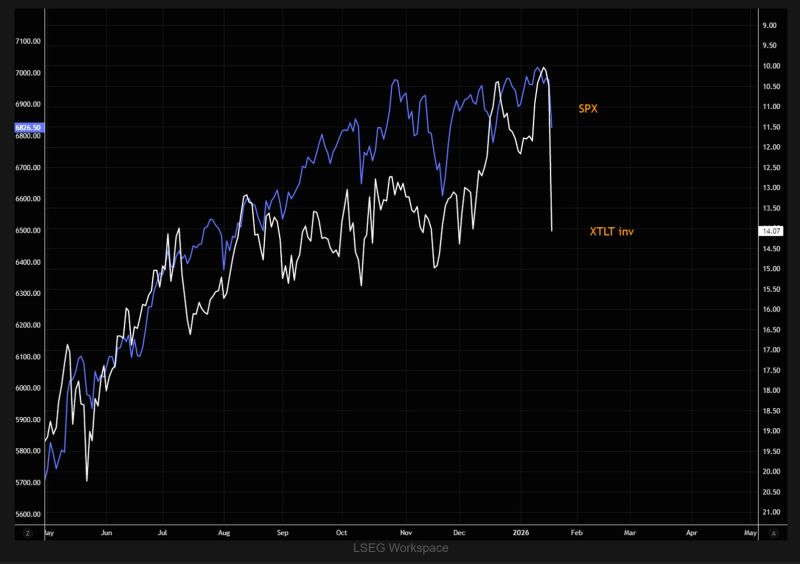

Bond vol matters

SPX vs VXTLT (inverted) needs little commenting. Source: TME

S&P 500 technicals

$SPX has reversed near the top of the range and is now breaking below the short-term trend line. Zooming out, the market still lacks a clear medium-term trend, with price sitting right on the 50-day and RSI suddenly at its most oversold since the December shakeout. First meaningful support comes in around 6,800 (futures). Source: LSEG, TME

Investing with intelligence

Our latest research, commentary and market outlooks