Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

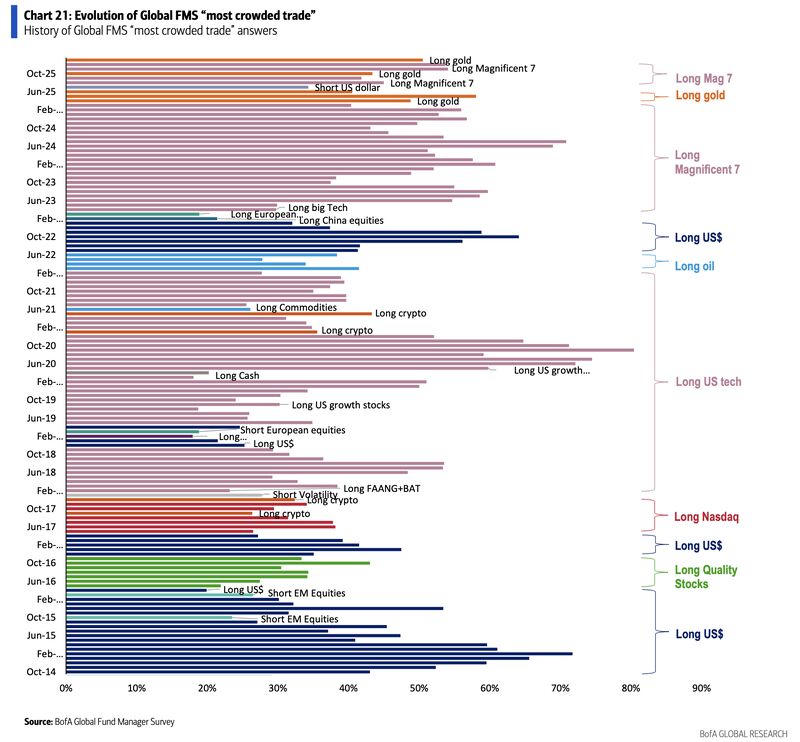

Gold is now the most “crowded trade”, acc to BofA’s monthly Global Fund Manager Survey.

Source: Holger Zschaepitz @Schuldensuehner BofA

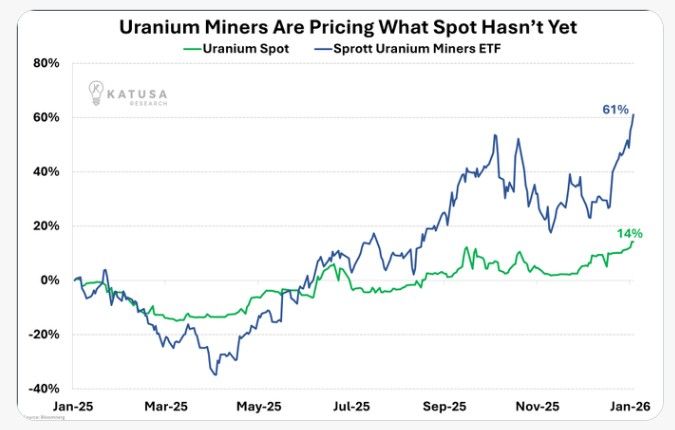

Watch Uranium

Almost 30% of Uranium is uncontracted, resulting in poor spot price performance. Utilities keep waiting for cheaper pounds that aren't coming. And every month they wait, the deficit grows. When they finally buy, spot won't walk higher. It'll gap. Source: Kasuha Research on X

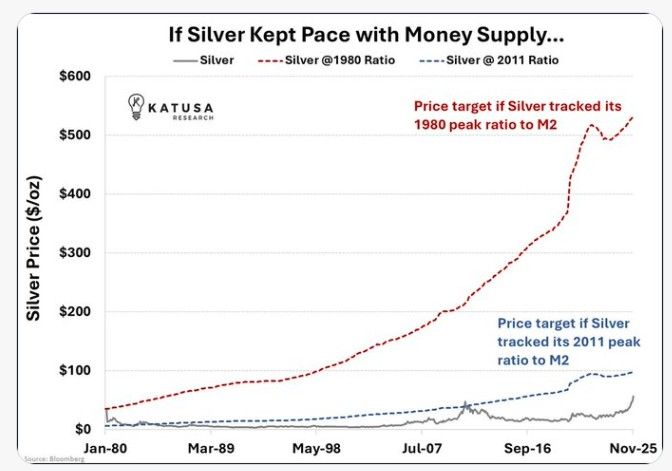

Silver is actually cheap relative to the global currency fiat money supply.

At $90, everyone knows that silver is at nominal all-time highs. But relative to M2, it’s well below a historical peak. This suggests significant upside potential if the market catches up to full monetary expansion. ▪️ If silver matches its 2011 money-supply ratio, you’re looking at about $97 per oz. (we're almost here) ▪️ If silver matches the 1980s ratio, it’s about $531 per ounce. Source: Kasuha Research on X

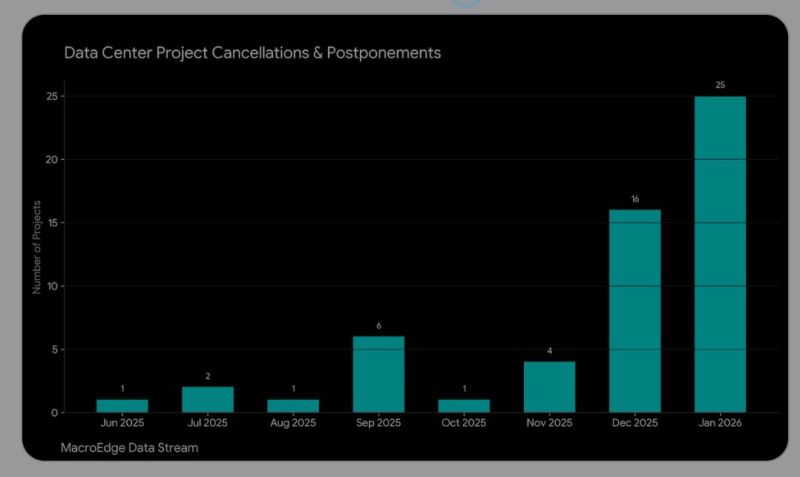

Already 25 data center cancellations and postponements this month, expecting to see a 100+ month towards midterms (excludes local/county moratoriums)

Source: Don Johnson @DonMiami3 on X

Emerging Market Stocks have formed a Potential Inverse Head & Shoulders Pattern against the S&P 500

Source: Barchart

GREENLAND fact check #1: Greenland is NOT part of the European Union, despite being an autonomous territory within the Kingdom of Denmark, which is an EU member state.

Greenland has a unique history with the EU, being the only territory to ever leave it. Originally joining in 1973 as part of Denmark, Greenland’s population consistently opposed European integration. 1972 Referendum: 70% voted against joining the European Communities, but Greenland joined anyway as part of Denmark. 1982 Referendum: After gaining home rule in 1979, 52% voted to leave, driven by disputes over the Common Fisheries Policy, control of natural resources, and a sense that the EC ignored Greenland’s interests. Turnout was 74.9%. 1985 Withdrawal: Greenland formally left the EC on January 1, 1985, via the Greenland Treaty, becoming an Overseas Country and Territory (OCT) associated with the EU, maintaining some economic ties while regaining sovereignty over its fisheries.

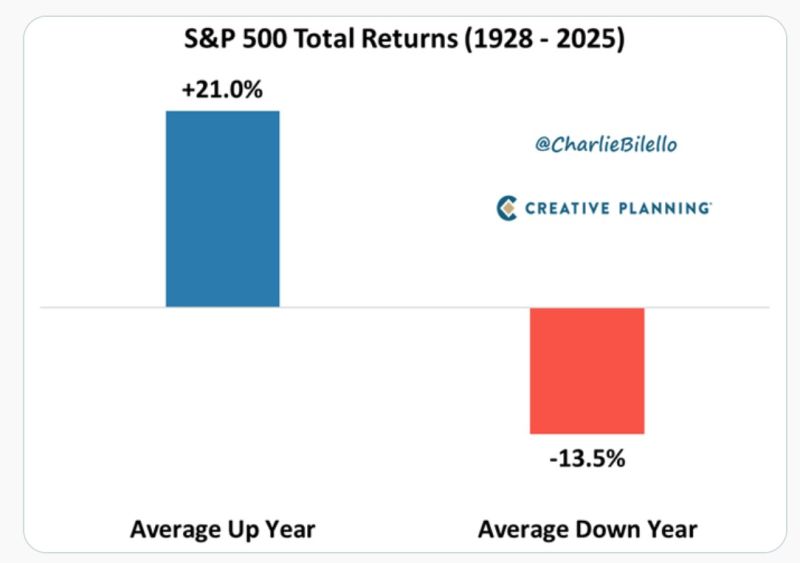

The average stock market return of 10% is misleading

Most years aren’t average - they’re extreme. Big gains. Sharp losses. That’s how long-term returns are made. Source: Peter Mallouk @PeterMallouk

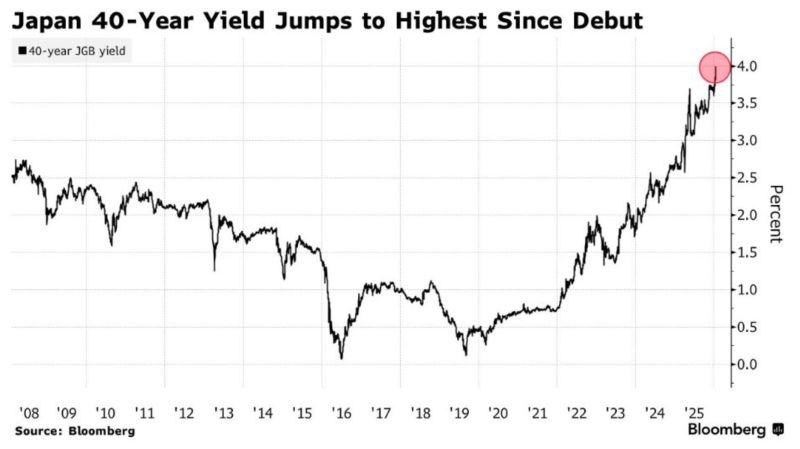

Japan's 40-year bond just hit 4% for the first time ever

Source: Joe Weisenthal @TheStalwart

Investing with intelligence

Our latest research, commentary and market outlooks