Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

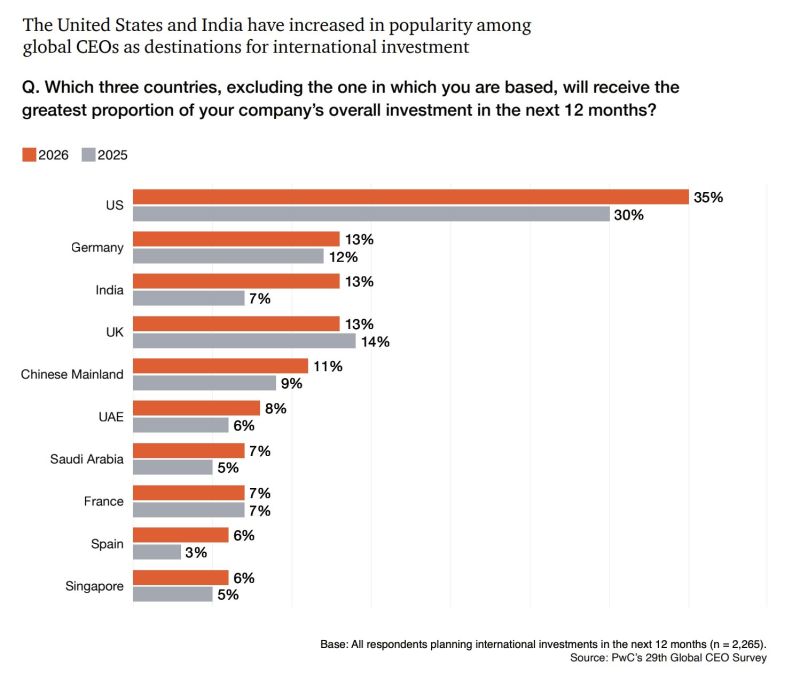

The United States has actually become more popular among global CEOs as a destination for international investment

Despite Trump’s interventions, acc to PwC’s CEO survey

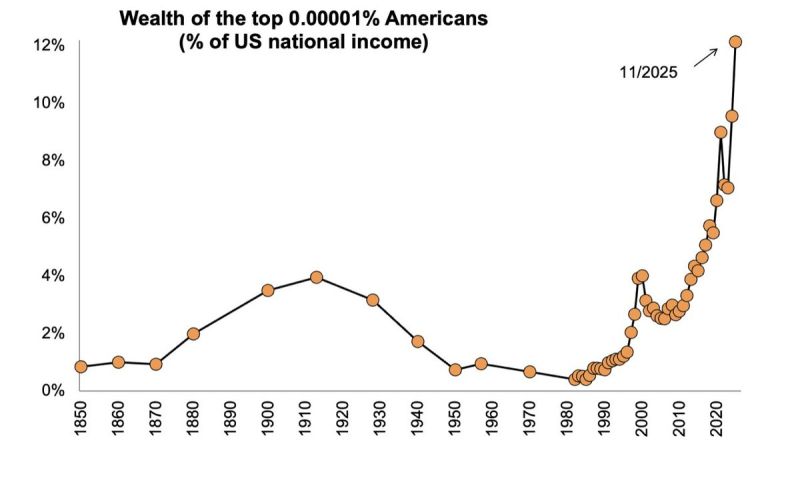

Wealth at the top: 0.00001% owns 12% of US income

At the peak of the Gilded Age in 1910, the richest 0.00001% of the US population owned wealth equal to 4% of national income. Now, the richest 0.00001% owns 12%. US billionaire oligarchs today are even wealthier than the original robber barons. Source: Ben Norton @BenjaminNorton on X

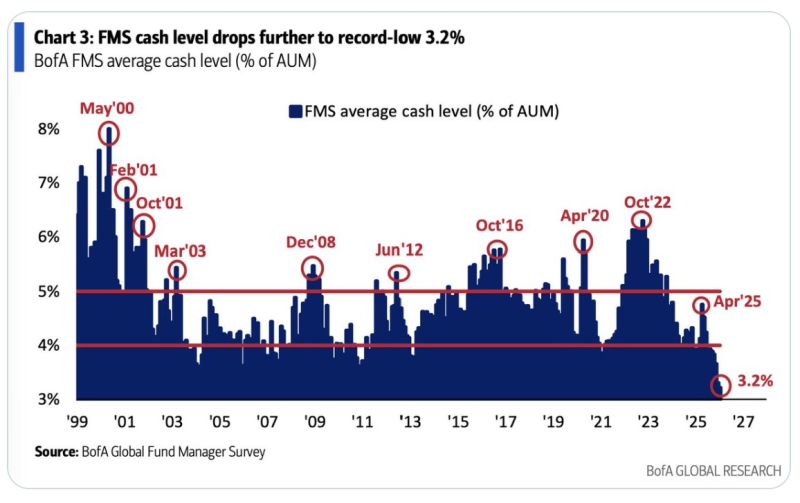

A (bearish) contrarian call?

January’s Fund Manager Survey is most bullish since Jul2021: expectations for global growth have jumped, cash levels have fallen to a record low of 3.2%, and protection against equity sell-off is at its lowest since Jan2018. BofA’s Bull & Bear Indicator flashing extreme optimism at 9.4. Source. HolgerZ, BofA

U.S. Dollar Index $DXY plunging below its 200-day moving average

Source: Barchart

GREENLAND FACT CHECK #2: The 1951 US Military Agreement

Greenland has a longstanding defense arrangement with the United States. On April 27, 1951, Denmark and the United States signed the Defense of Greenland Agreement, which remains in effect today. This treaty grants the United States significant military rights in Greenland: - The right to establish and operate military bases and “defense areas” in Greenland - Free movement of US ships, aircraft, and military vehicles across Greenland’s territory - The ability to construct facilities without paying rent or taxation to Denmark - Authorization to expand military presence if deemed necessary by NATO The most notable result of this agreement was the construction of Thule Air Base (now Pituffik Space Base) in northwest Greenland, which during the Cold War housed more than 10,000 US troops. Today, it remains the northernmost US Department of Defense installation, located 1,210 km north of the Arctic Circle. The agreement was updated in 2004 to recognize Greenland’s Home Rule government, but the fundamental military rights granted to the United States remain unchanged. The treaty continues in force as long as both countries remain NATO members.

Meloni warns Trump: NATO, not tariffs, is the answer in Greenland and the Arctic

"Imposing higher tariffs on countries that contribute to Greenland’s security is a mistake, and I do not agree with it. I share Trump’s focus on Greenland and the Arctic as a strategic region where hostile interference must be avoided. NATO is the proper framework to organize deterrence and collective security in the Arctic." Source: Mario Nawfal on X

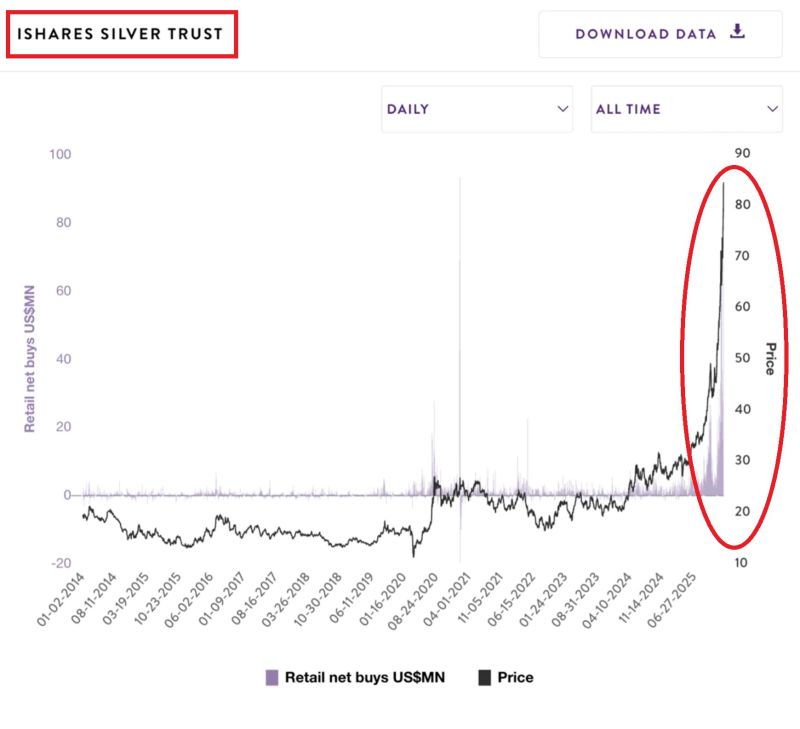

Retail investors have piled into the largest physical-backed silver ETF, $SLV, for 169 days STRAIGHT, the longest streak EVER.

All major silver-linked ETFs have attracted a record +$921.8 million in inflows over the last 30 days. Silver retail buying activity is now 2.1 TIMES higher than the 3-month moving average, and far above the 2021 silver market squeeze. Retail investors are joining the silver rally at a record pace. Source: Global Markets Investor

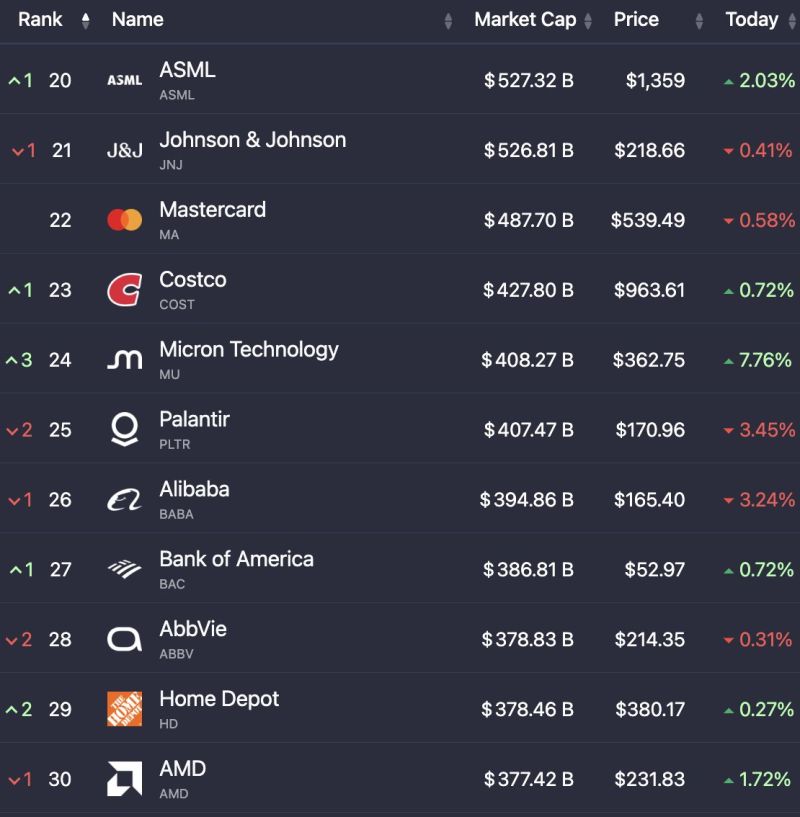

Micron $MU is now one of the top 25 largest companies in the world

Source: Evan, @StockMKTNewz

Investing with intelligence

Our latest research, commentary and market outlooks