Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

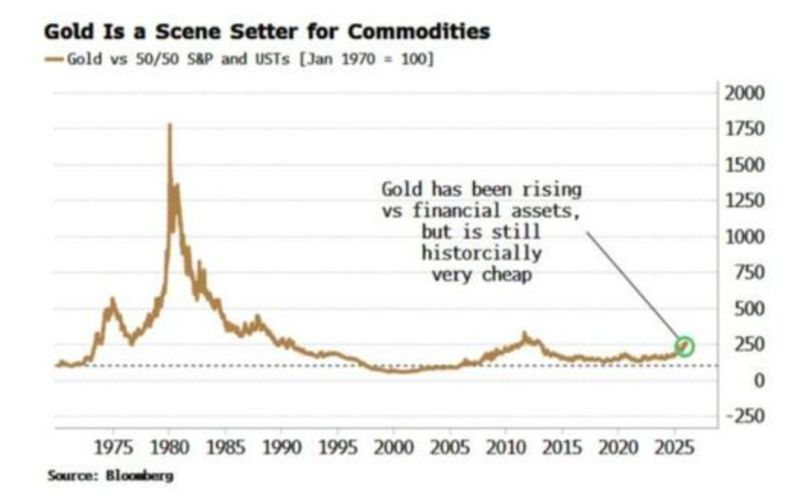

A shocking chart while Gold is flirting with $5,000/oz, it remains historically undervalued versus a 50/50 (S&P 500 / US Treasuries) portfolio

Source: Bloomberg, www.zerohedge.com

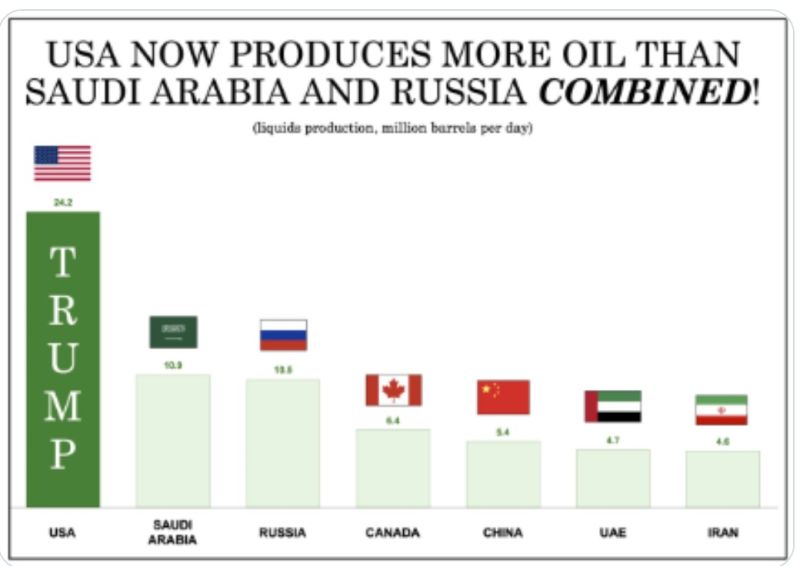

The United States now produces more oil than Saudi Arabia and Russia combined

This also explains why oil shocks today tend to be shorter-lived than in the past. There is simply more swing capacity in the system, and a lot of it sits in the US... Source: Jack Prandelli @jackprandelli

That was just another new low today for the Nasdaq100 relative to the Russell2000 small-caps.

Look at that collapse since last summer Source: J-C Parets

Excellent comments by German Chancellor Friedrich Merz in Davos today

Europeans have damaged their economies. They must fix it.

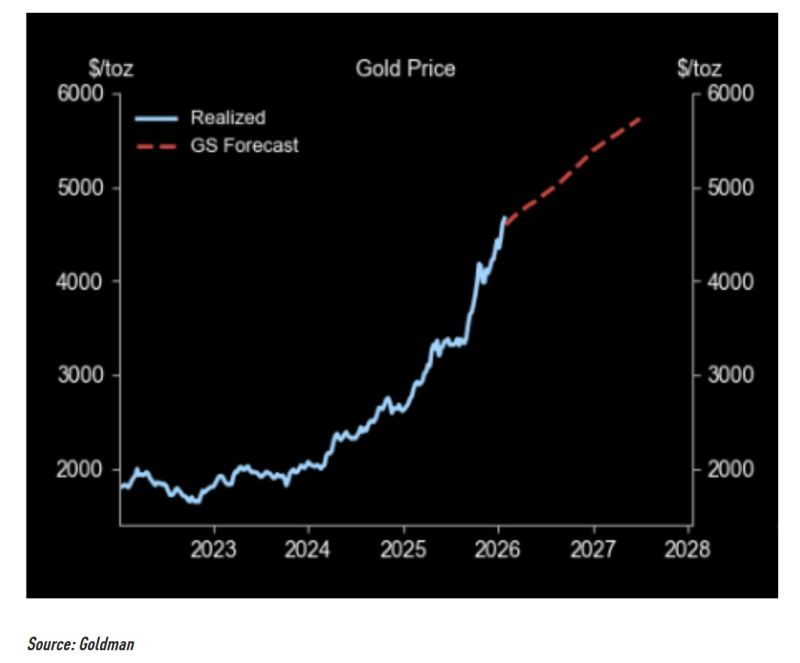

Goldman is raising Gold price target to $5,400

"We raise our Dec2026 gold price forecast to $5,400/toz (vs. $4,900 prior) because the key upside risk we have flagged--private sector diversification into gold--has started to realize. We assume private sector diversification buyers, whose purchases hedge global policy risks and have driven the upside surprise to our price forecast, don't liquidate their gold holdings in 2026, effectively lifting the starting point of our price forecast." Source: TME

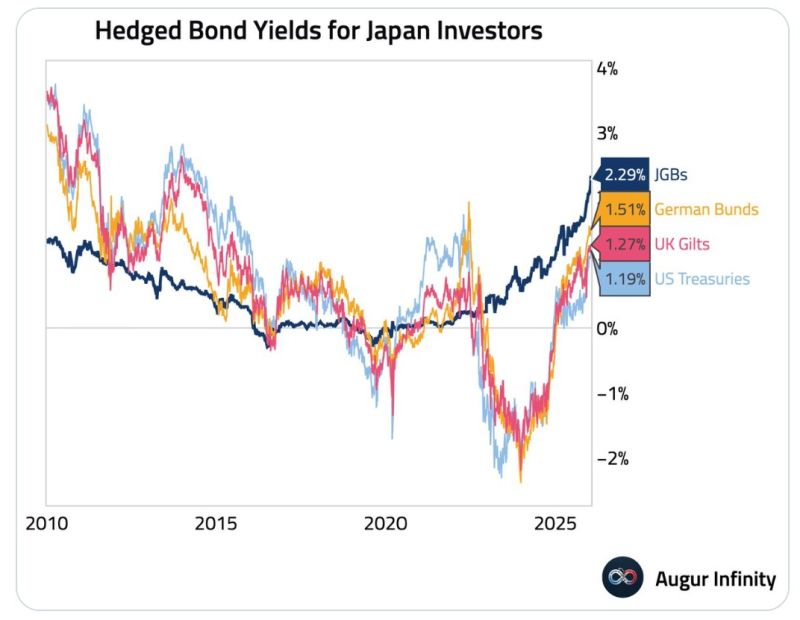

🇯🇵 For Japanese investors, domestic JGBs are now more attractive than hedged foreign bonds from a yield perspective.

Source: Augur Infinity @AugurInfinity on X

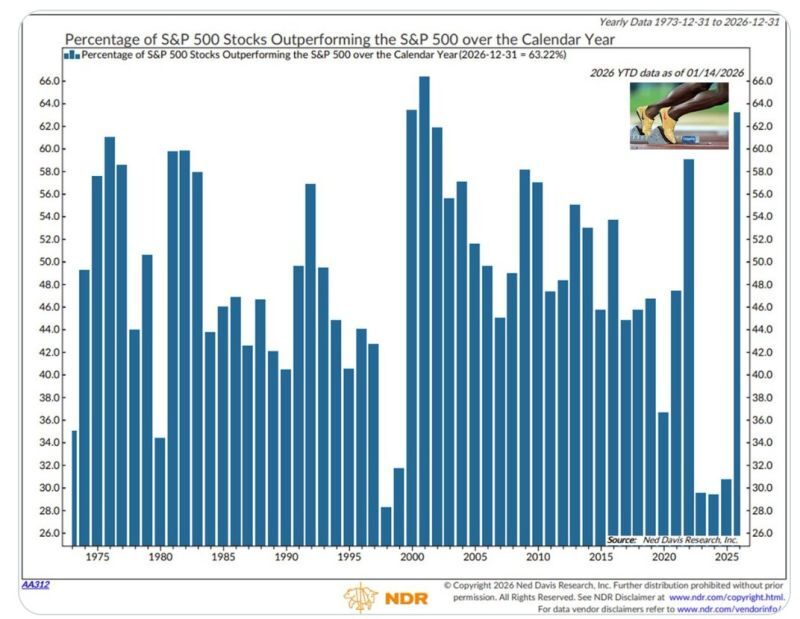

Everyone’s Winning. 63% of S&P 500 stocks are beating the index YTD (from NDR, as of Jan 14).

This is the best market participation since 2001. As of yesterday’s close, this number is now up to 65% the second best in 50 years. *Will the market’s strength continue? Source: Macro Charts @MacroCharts NDR

Investing with intelligence

Our latest research, commentary and market outlooks