Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

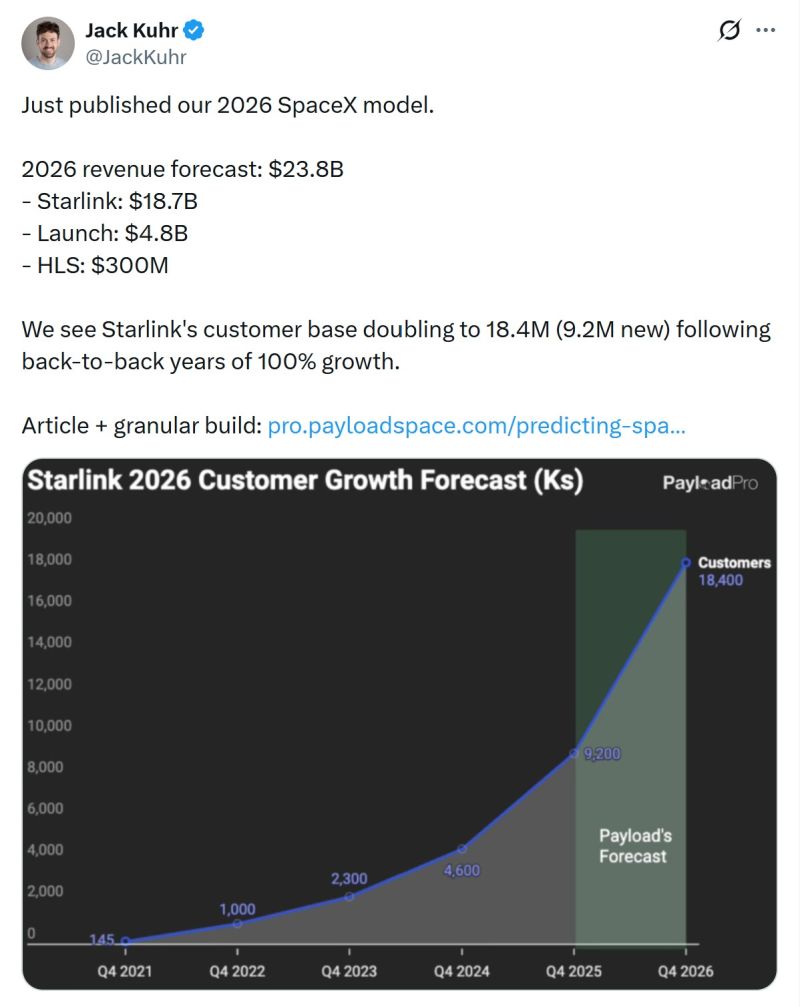

$1.5T valuation at $24B puts SpaceX at a P/S of 62.5.

Current P/S of other popular space companies: - $RKLB: 85 - $PL: 30 - $RDW: 7 - $FLY: 42 - $LUNR: 16 Source: RocketMan @RKLBMan on X

Bitcoin dropped $2,500 in the last 5 hours and liquidated $400 million worth of longs.

More than $100 BILLION has been wiped out from the crypto market today. This is a low-liquidity Sunday evening dump. The real price action will come once the US market opens on Monday. Source. Bull Theory

Historically, Treasury Yields Rise After Fed Chair Nominations

With the time until the next Fed chair arrives at the Marriner Eccles building fast approaching, BofA Hartnett reminds us that 3 months following seven nominations for Fed Chair since 1970 (Burns, Miller, Volcker, Greenspan, Bernanke, Yellen, Powell), yields were up every time (2-year +65bps, 10-year +49bps)... Source: BofA, zerohedge

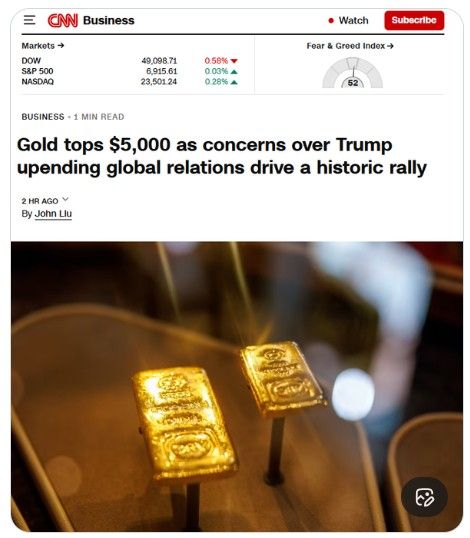

And there you have it Gold is officially trading above $5,000.

Source : Mohamed El-Erian

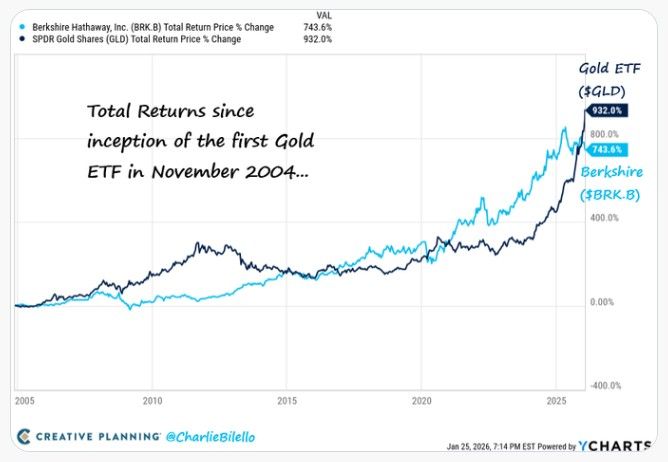

Total Returns since inception of the first Gold ETF in November 2004

Berkshire Hathaway $BRK.B: +744% Gold ETF $GLD: +932% Source: Charlie Bilello

I disagree with this headline from CNN

Gold is not rising because of Trump. It is rising because the US has $39 trillion in debt, $2 trillion in annual deficits, 25% of tax revenue goes to interest payments and Congress refuses to stop. They thus need to go through monetary debasement. This is not a bug. It is a feature of the system. And store of values are one of the way to protect purchasing power. By the way, Europe and Japan have similar debt and spending problems. Gold is at record highs against every currency, not just the dollar. Source: Wall Street Mav

Might be a bit early to say if Truflation works but if it does, this looks pretty good. Here's why Truflation could the "anti-CPI" index disrupting economic forecasting

1. Goodbye Surveys, Hello Big Data 📡 The official CPI relies on manual surveys and "judgmental adjustments." Truflation uses 18 million+ data points in real-time. It scrapes e-commerce APIs, transit data, and housing aggregates every 24 hours. 2. The "45-Day Edge" 🏃💨 Traditional inflation data is a rearview mirror. Truflation acts as a leading indicator, often sniffing out price pivots 45 days before they hit government reports. 3. Censorship-Resistant Math ⛓️ Ever feel like the "official" numbers don't match your receipt? Truflation puts its data on-chain (via Chainlink). It’s immutable. No "seasonal adjustments" or political massaging—just pure, transparent code. 4. The Current Reality (Jan 2026) 📊 While headlines debate the latest "sticky" CPI prints, Truflation’s dashboard often shows a different story: Official CPI: Hovering around 2.3% Truflation: Currently tracking closer to 1.7% The Takeaway: In a world of high-frequency trading and instant supply chain shifts, "monthly" is the new "obsolete." By the way, hashtag#blockchain is the structural backbone of Truflation. While it collects data from traditional sources (like e-commerce sites and retailers), it uses blockchain to ensure that data is verifiable, transparent, and tamper-proof. The ecosystem has its own native token ($TRUF) which handles the "business" side of the data: - Staking: Node operators (the people running the computers that verify the data) must stake tokens as collateral to ensure they provide honest numbers. - Governance: Token holders can vote on things like which new data categories should be added or how the inflation formula should be weighted. - Payments: Users often pay in tokens to access premium, high-speed data streams Source chart: Bloomberg, RBC

Investing with intelligence

Our latest research, commentary and market outlooks