Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

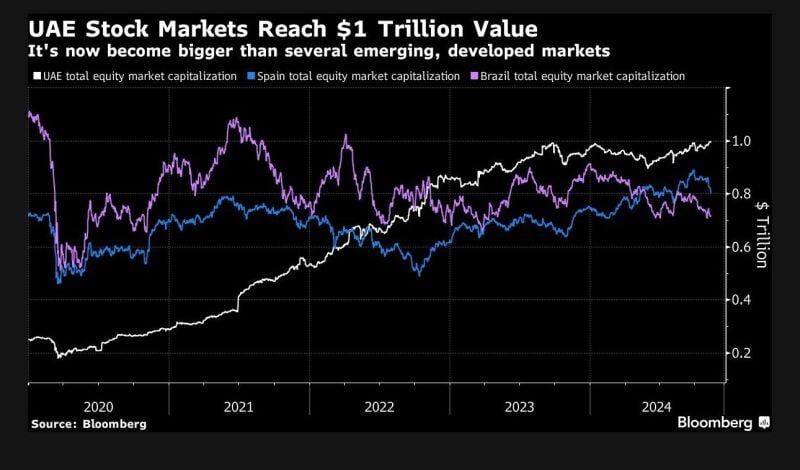

In a new milestone, the combined market capitalization of Dubai and Abu Dhabi stock exchanges has reached $1 trillion value for the first time.

The surge in market cap is driven by a string of new share listings in the last couple of years.

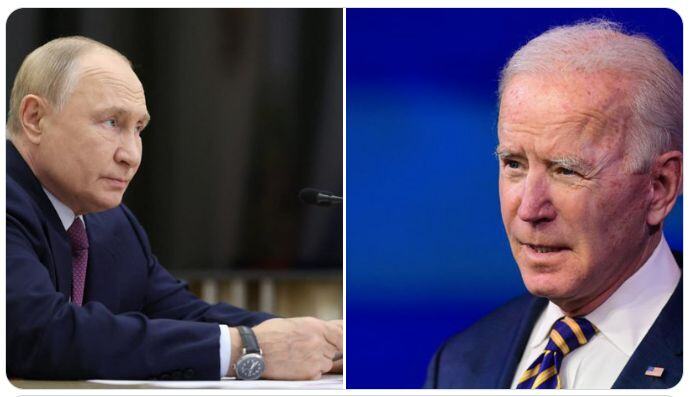

In "Major Policy Shift" Biden Authorizes Ukraine's Use Of US Missiles To Hit Targets Inside Russia.

Why is he doing this 2 months before leaving the White house? President Joe Biden’s administration will allow Ukraine to use U.S.-provided weapons to strike deep into Russian territory, three sources familiar with the matter said, in a significant change to Washington’s policy in the Ukraine-Russia conflict. Ukraine plans to conduct its first long-range attacks in the coming days, the sources said, without revealing details due to operational security concerns. The move by the United States two months before President-elect Donald Trump takes office on Jan. 20 follows months of requests by Ukrainian President Volodymyr Zelenskyy to allow Ukraine’s military to use U.S. weapons to hit Russian military targets far from its border. Source: CNBC

REMINDER: PUTIN HAS SAID THAT IF U.S. WEAPONS ARE USED TO ATTACK INSIDE RUSSIA - IT’S WAR

“This would in a significant way change the very nature of the conflict. It would mean that NATO countries, the US, European countries, are at war with Russia. If that’s the case, then taking into account the change of nature of the conflict, we will take the appropriate decisions based on the threats that we will face.” Source: The Hill thru Mario Nawfal on X

The S&P 500 $SPY P/E Ratios Heat Map.

Besides Banks and Energy, everything is wildly overvalued. $SPY Source: Jesse Cohen @JesseCohenInv

Donald Trump’s foreign policy team will seek to ratchet up sanctions on Tehran, including vital oil exports, as soon as the president-elect re-enters the White House

https://on.ft.com/48Soa7w Source: FT

Investing with intelligence

Our latest research, commentary and market outlooks