Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

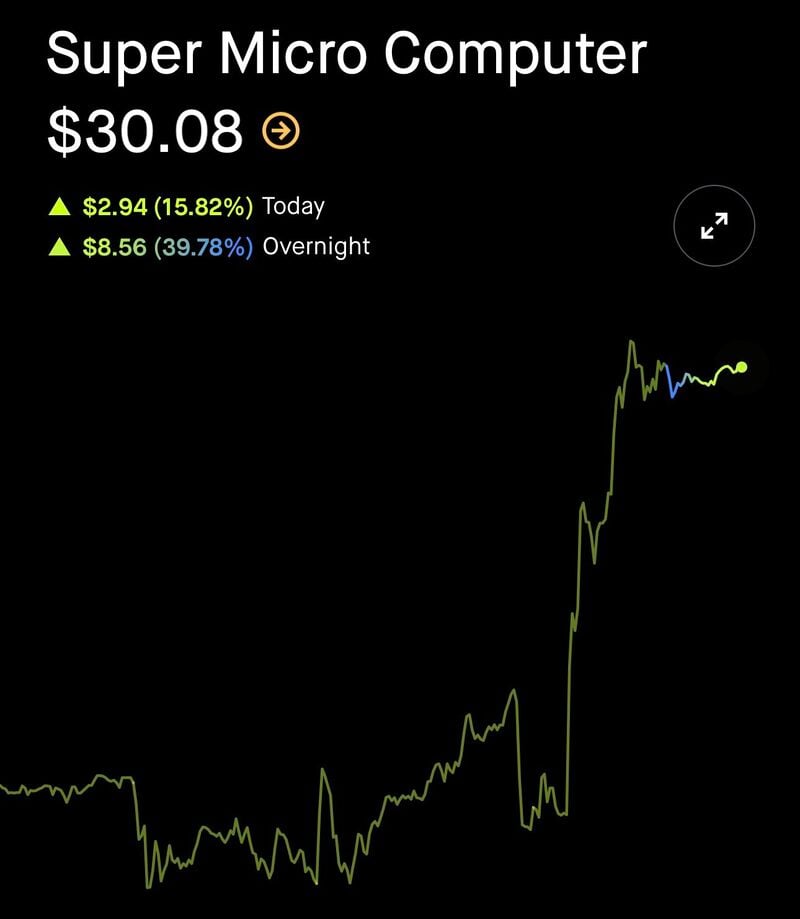

Super Micro Computer $SMCI is up almost 40% overnight 🚀🚀🚀

as the company announced the immediate appointment of BDO USA as its independent auditor and the filing of its compliance plan with Nasdaq !!! Source: Stocktwits @Stocktwits

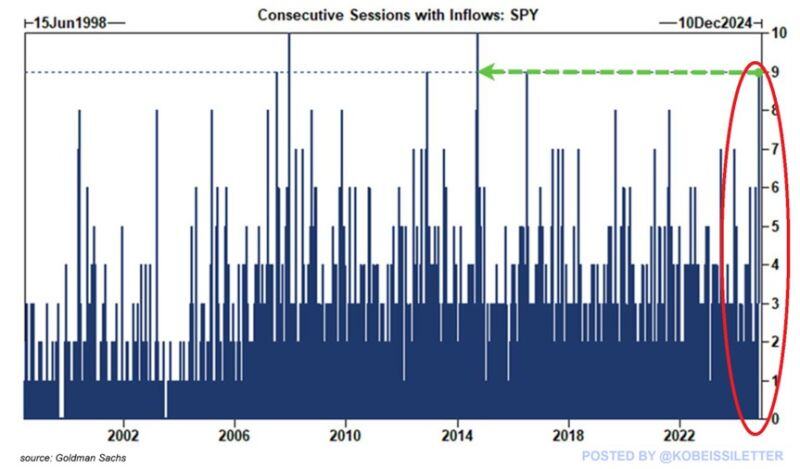

The S&P 500 ETF, $SPY, just saw 9 consecutive days of money inflows, the longest streak since 2014.

Investors have poured $18 billion into $SPY over these 9 days as post-election buying continues. Since 2000, $SPY has only seen 4 streaks with 9 to 10 straight days of inflows: in 2007, 2013, 2014, and 2016. Massive inflows supported the 5%+ run in the S&P 500 following the election. Over the last 13 months, the S&P 500 has now added more than $15 TRILLION of market cap. Source: The Kobeissi Letter, Goldman Sachs

According to the best source of Chinese gold and silver data – @oriental_ghost – China is on a silver consumption BENDER

Source: ale Gold great again

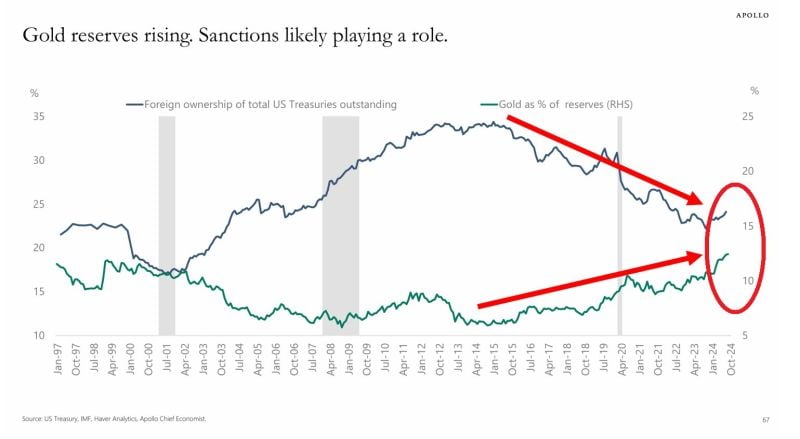

WORLD INVESTING LANDSCAPE IS CHANGING

Global central banks gold reserves hit 13%, the highest in at least 3 decades. At the same time, foreign ownership of US government bonds fell to ~24%, near the lowest in 2 decades. World is embracing gold at the expense of Treasuries. Source: Global Markets Investor, Apollo

Space stocks are breaking out from a large consolidation base.

Relative chart also broke out Source: The Strazza Letter

Investing with intelligence

Our latest research, commentary and market outlooks