Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

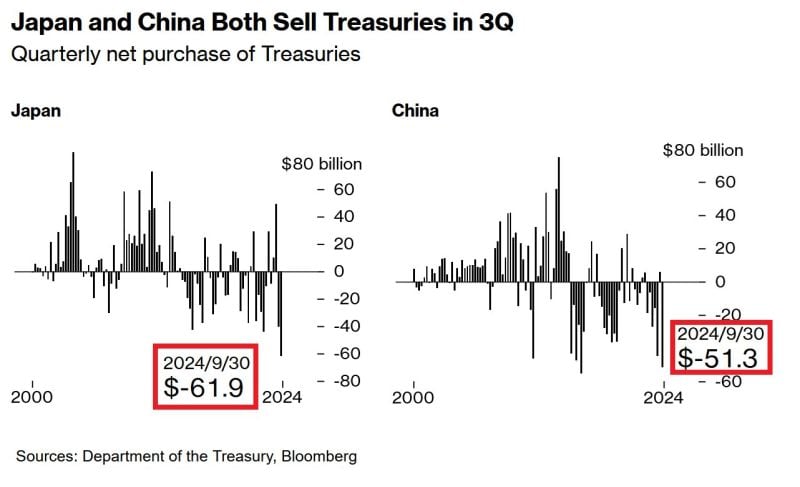

CHINA AND JAPAN ARE DUMPING US TREASURIES

Japanese investors sold $61.9 billion of Treasuries in Q3 2024, the most on RECORD. Chinese funds dumped $51.3 billion, the second largest on record. Japan and China are two world's biggest foreign holders of US government debt. Source: Global Markets Investor

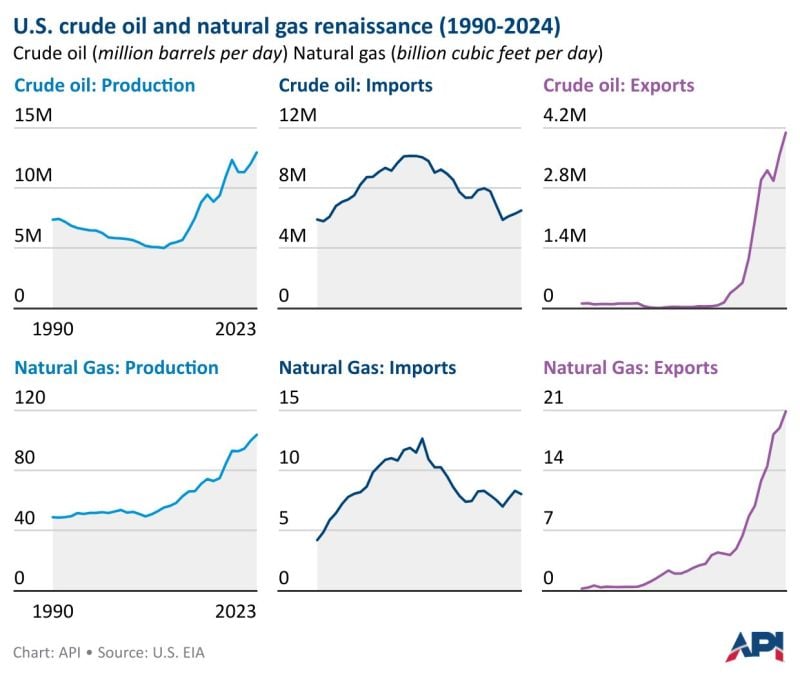

The U.S. crude oil and natural gas renaissance, in one panel chart...

Source: Mason Hamilton, API

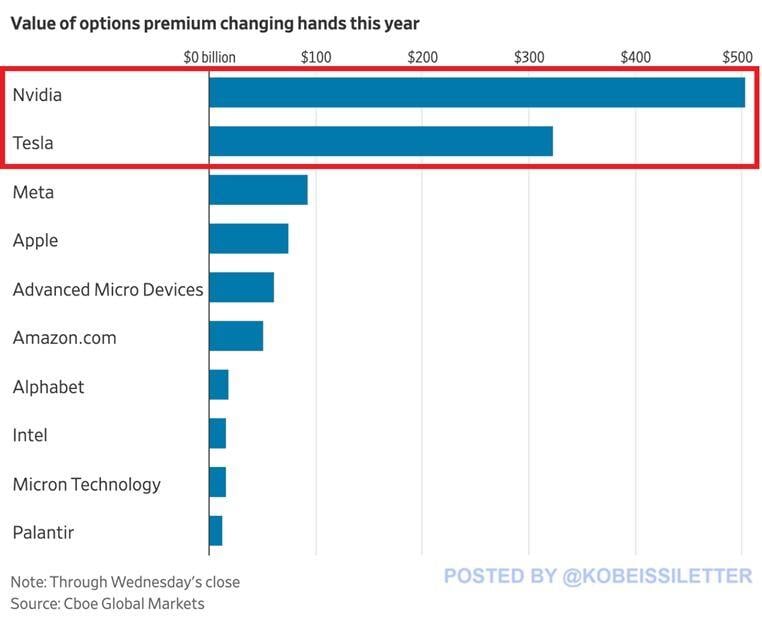

A whopping ~$504 billion worth of Nvidia’s, $NVDA, options have been traded year-to-date, the most for any single stock.

This is ~$200 billion more than Tesla, $TSLA, the second-hottest stock in the market this year. This is also more than Meta, $META, Apple, $AAPL, AMD, $AMD, Amazon, $AMZN, and Alphabet, $GOOGL, COMBINED. Today, the options market is implying a 12% move after earnings are released. Source: The Kobeissi Letter

Record numbers of US executives are selling shares in their companies

as corporate insiders from Goldman Sachs to Tesla and even Donald’s Trump’s own media group cash in on the stock market surge that has followed his election victory. The rate of so-called insider sales has hit a record high for any quarter in two decades, according to VerityData. The sales, by executives at companies in the Wilshire 5000 index, include one-off profit-taking transactions as well as regular sales triggered by executives’ automatic trading plans. The Wilshire 5000 is one of the broadest indices of US companies. While insider selling is routine — especially as the stock market was already breaking records before Trump’s win — the surge following November 5 underscores how US executives are already profiting personally from his return before he re-enters the White House. https://lnkd.in/eYWW3E5M Source: FT

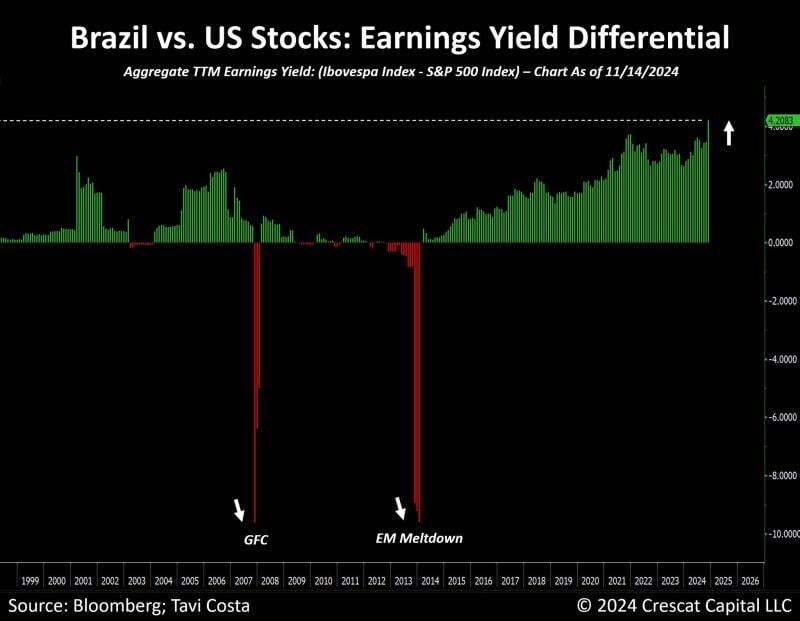

Based on earnings yield, Brazilian equities have never been cheaper relative to US stocks.

Source: Bloomberg, Tavi Costa

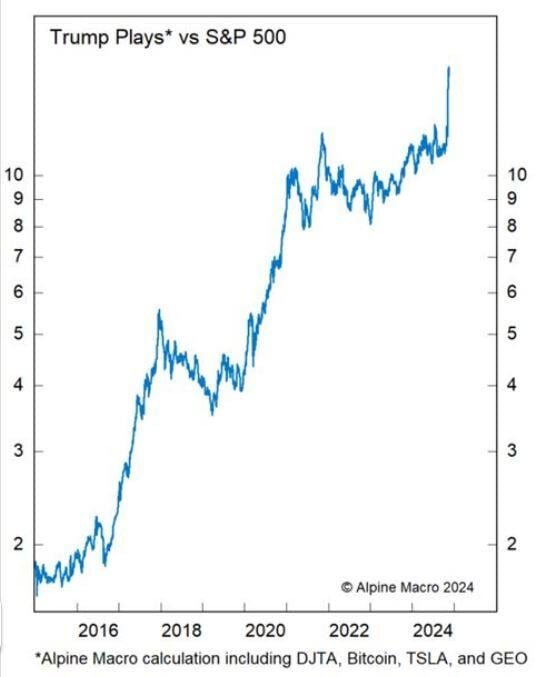

Here's the outperformance (vs. S&P 500) of a pure play Trump index created by Alpine Macro.

It owns DJTA, Bitcoin, Tesla and GEO equally-weighted

Investing with intelligence

Our latest research, commentary and market outlooks