Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

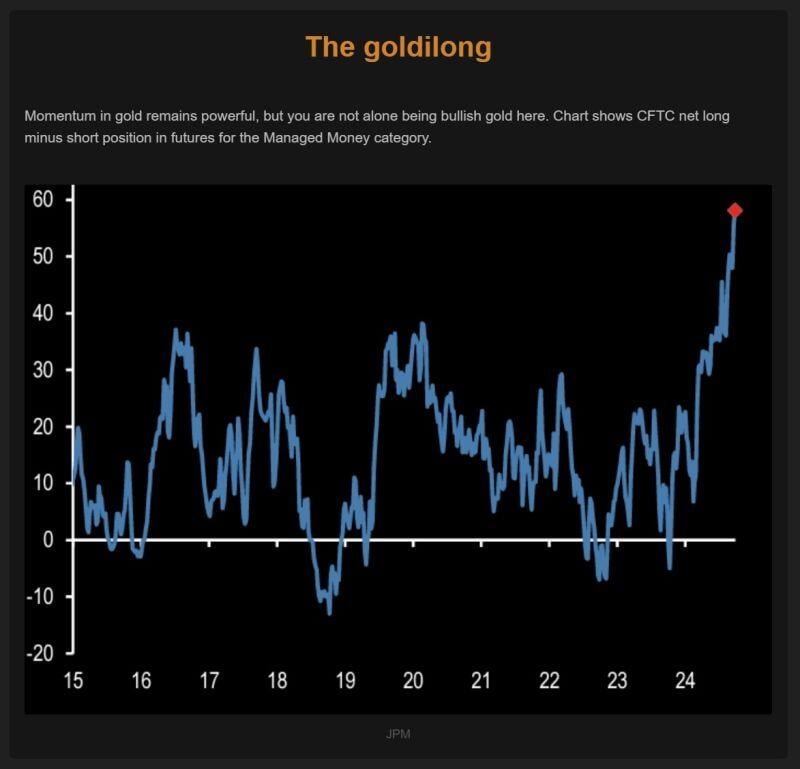

😱 The shocking chart of the day: Too many goldilongs?😱

Momentum in gold remains powerful, but you are not alone being bullish gold here... The chart below shows CFTC net long minus short position in futures for the Managed Money category. Source: The Market Ear, JPM

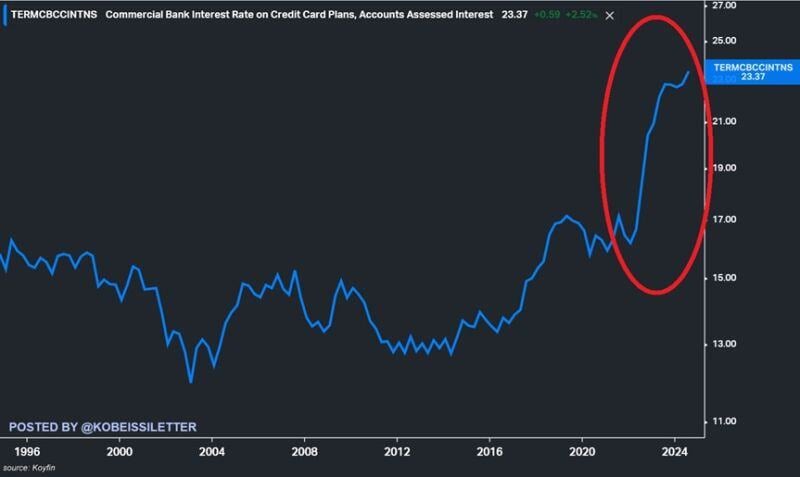

US credit card interest rates hit 23.4% in August, a new record.

Over the last 2 years, rates have soared by 7 percentage points. US consumers now have a record $1.36 trillion in credit card debt and other revolving credit meaning they pay a massive $318 billion annual interest. To put this into perspective, Americans paid just half of that in 2019 at ~$160 billion. Meanwhile, credit card serious delinquency rates are at 7%, the highest level since 2011. Source: The Kobeissi Letter

NEARSHORING... 🚨FOXCONN TO BUILD WORLD’S LARGEST NVIDIA SUPERCHIP PLANT IN MEXICO

Foxconn announced plans to construct the world’s largest manufacturing facility for assembling Nvidia’s GB200 superchips in Mexico, key to Nvidia’s next-gen Blackwell computing platform. The Taiwanese tech giant is capitalizing on the surging demand for AI servers. Foxconn execs revealed the plant's "enormous" capacity, with the company already investing over $500 million in Mexico. Source: Reuters, Mario Nawfal on X

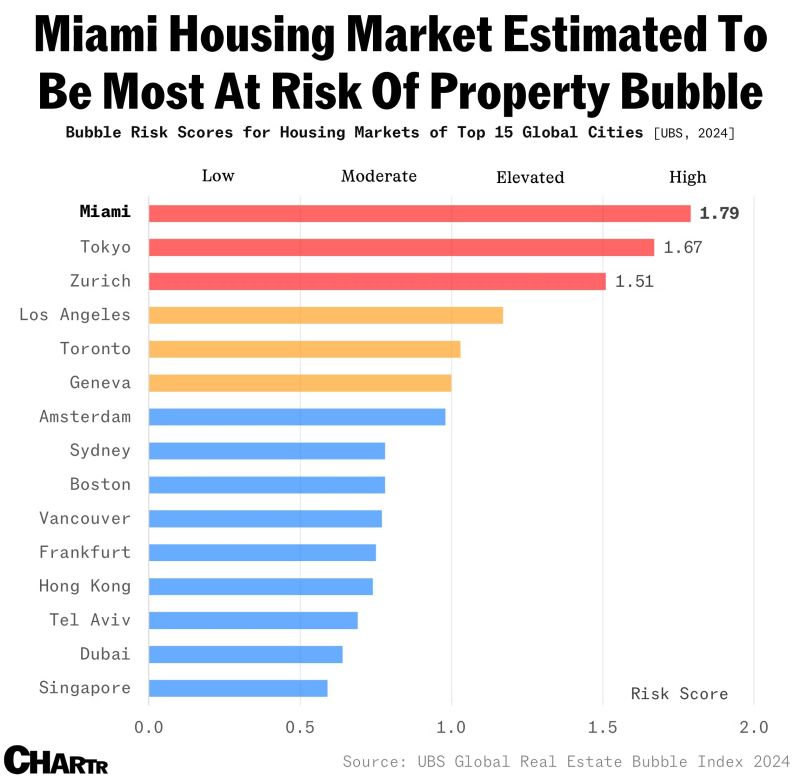

Miami tops a global list of cities most at risk of a housing bubble.

The annual UBS Global Real Estate Bubble Index for 2024, which analyzes residential property prices in 25 major cities worldwide, revealed that Miami’s soaring housing market had the highest bubble risk with an index score of 1.79 — beating Tokyo and Zurich for the top spot. Source: Chartr, UBS

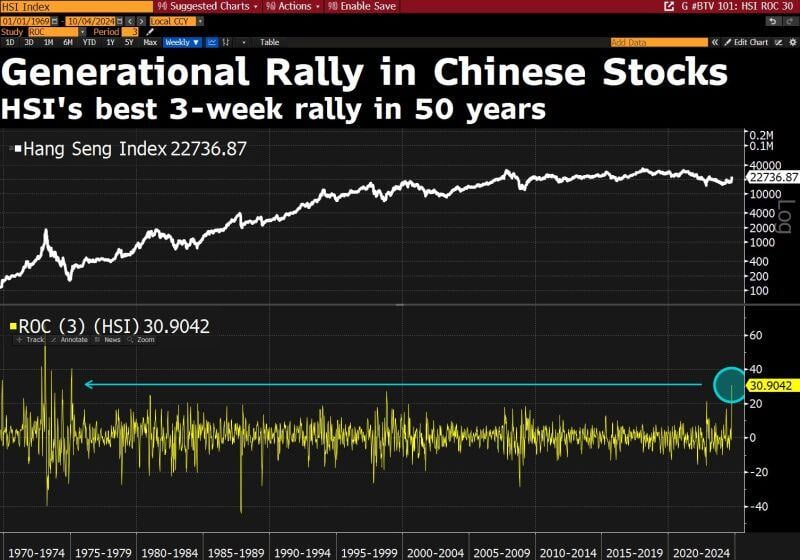

Hang Seng Index capped its best 3-week stretch since 1975

Source: Bloomberg, David Ingles on X

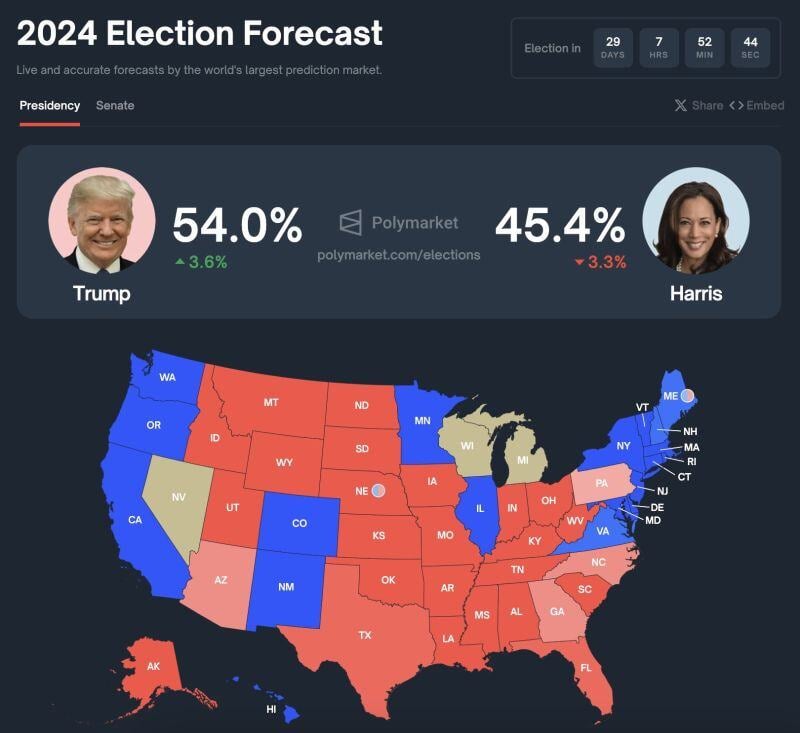

BREAKING: Polymarket’s prediction markets now show Donald Trump nearly 9 percentage points ahead of Kamala Harris.

This is nearly his largest lead since Kamala Harris entered the election. Source: The Kobeissi Letter on X

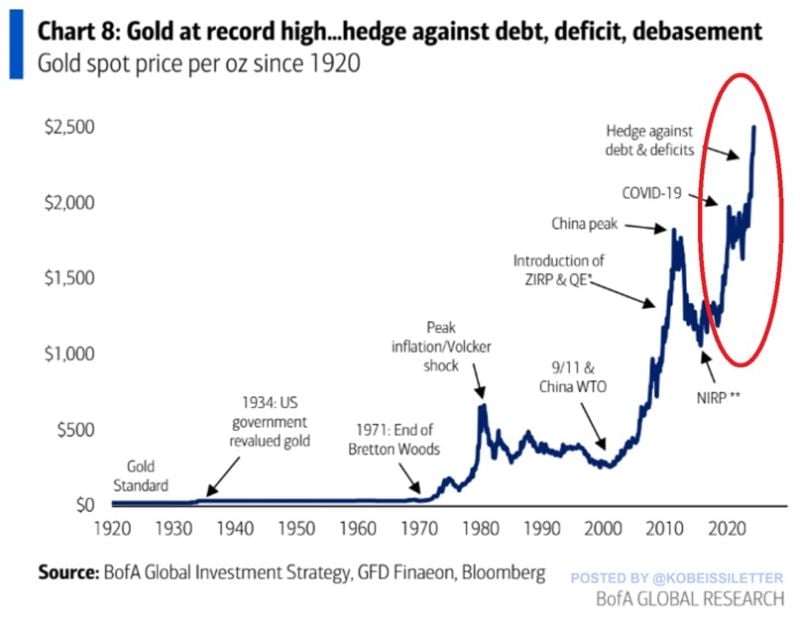

Gold as the ultimate store of value?

Over the last decade, gold prices have more than DOUBLED, marking one of the best rallies in modern history. Over the last 5 years alone, gold is up 76% and on track to be the best-performing asset class of the year, excluding bitcoin. So why gold keeps rising? Ever-rising debt and money debasement seem to be the main culprits. Since the pandemic, US national #debt has soared by $12 trillion while the US dollar lost ~25% of its value. Source: The Kobeissi Letter, BofA

Investing with intelligence

Our latest research, commentary and market outlooks