Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

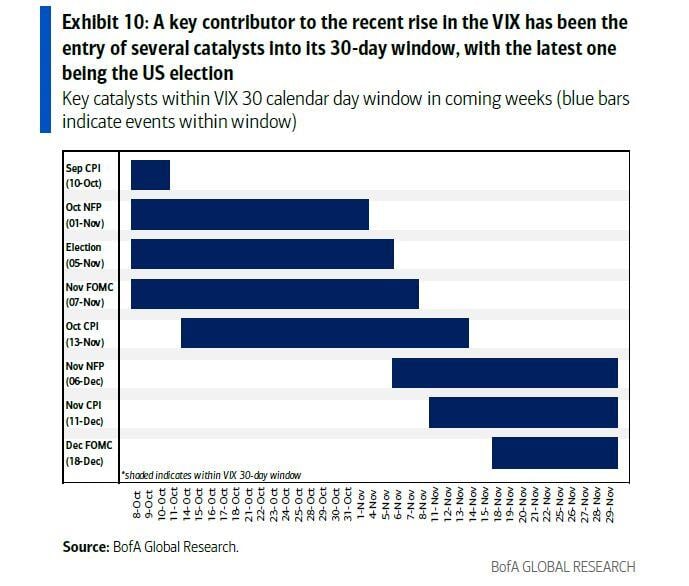

Why the VIX is acting bananas: look at the events that are now in its 30 day window

Source: BofA, zerohedge

$UBER has launched an $18 shuttle service from Manhattan to LaGuardia Airport -- with plans to expand to more airports

Source: Shay Boloor on X

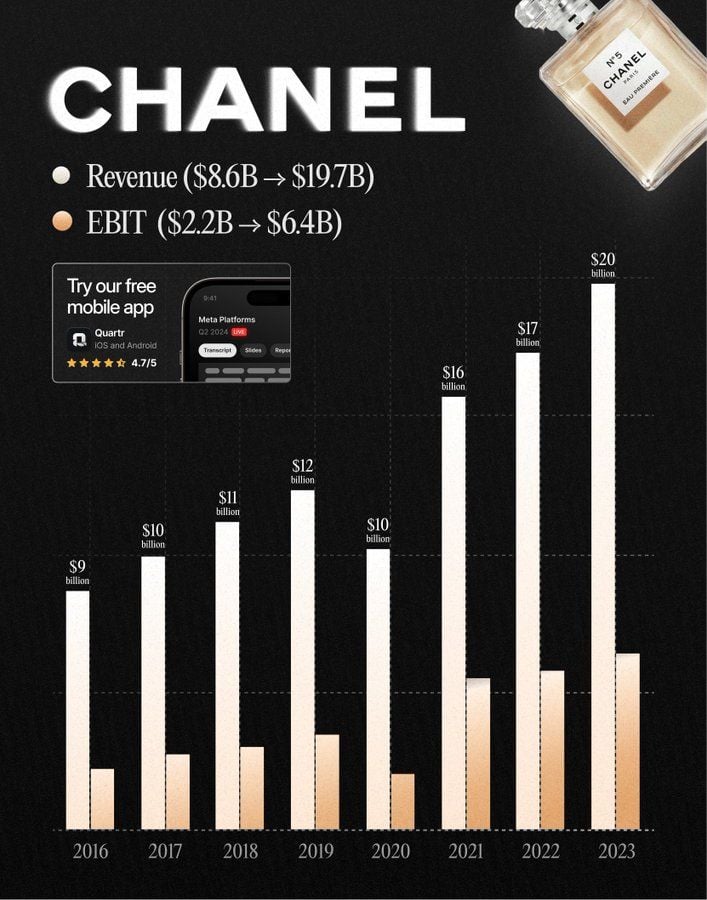

Chanel has had remarkable growth in recent years.

In 2023, it generated more revenue than Hermès $RMS.PA and approximately the same amount as Kering $KER.PA and Richemont $CFR.SW, at around $20 billion. The 114 year-old luxury giant is privately owned by the Wertheimer brothers, whose grandfather was a business partner of Coco Chanel. When the CEO, Leena Nair, was asked about an IPO last year, she said: “We’re going to stay a private, independent company. Rumours always float around, but you can put those to rest." Source: Quartr

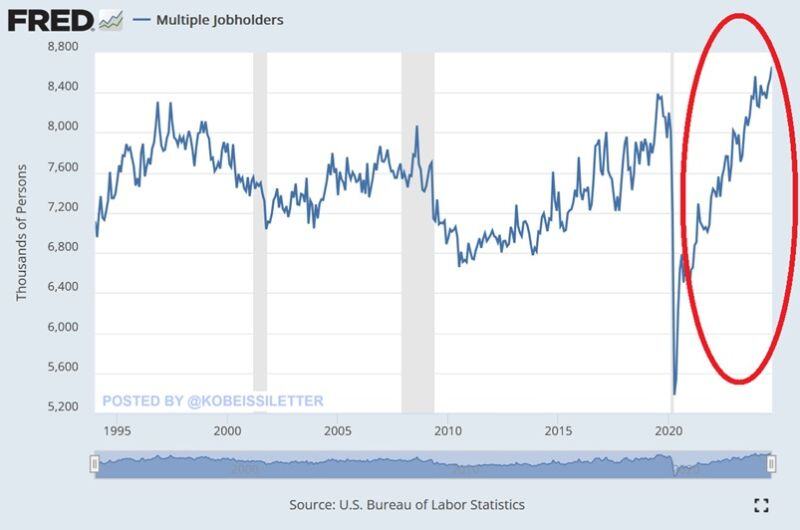

BREAKING: The number of people working MULTIPLE jobs in the US hit 8.66 million in September, a new record.

This is ~300,000 above the peak seen before the pandemic and ~600,000 above the 2008 peak. Furthermore, the number of part-time jobs has jumped by ~3 million over the last 3 years to a near-record 28.2 million. Concerningly, full-time employment has declined by 1 million since November 2023. Multiple jobholders have been rapidly rising over the last few years as Americans are fighting record-high prices. Millions of Americans are working multiple jobs to afford basic necessities. Source: The Kobeissi Letter

$META is up 70% this year and has soared 550% since bottoming in October 2022

If you invested $10,000 in October 2022, you would have over $65,000 Source: Stocktwits

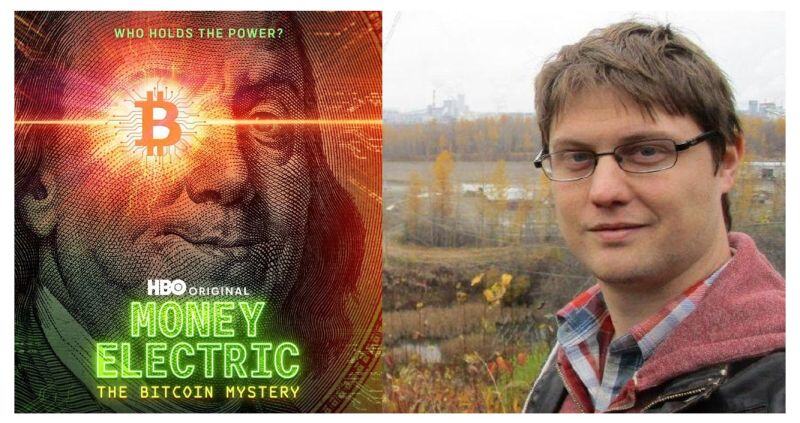

Satoshi Nakamoto

HBO documentary film maker Cullen Hoback has named Peter Todd, a bitcoin core developer who has been involved with bitcoin since 2010, as who he believes to be the real-world identity of Satoshi Nakamoto. If it is true, it means that this man holds about 1.1m BTC tokens (around $70 billion...) in about 22,000 different addresses. Source: Bitcoin Magazine

Exactly what someone who's Satoshi would say ???

Source: Wall Street Silver

Investing with intelligence

Our latest research, commentary and market outlooks