Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

🚨 Largest Producers in the World 🚨 :

Source: General Knowledge for UPSC @GuideforAll

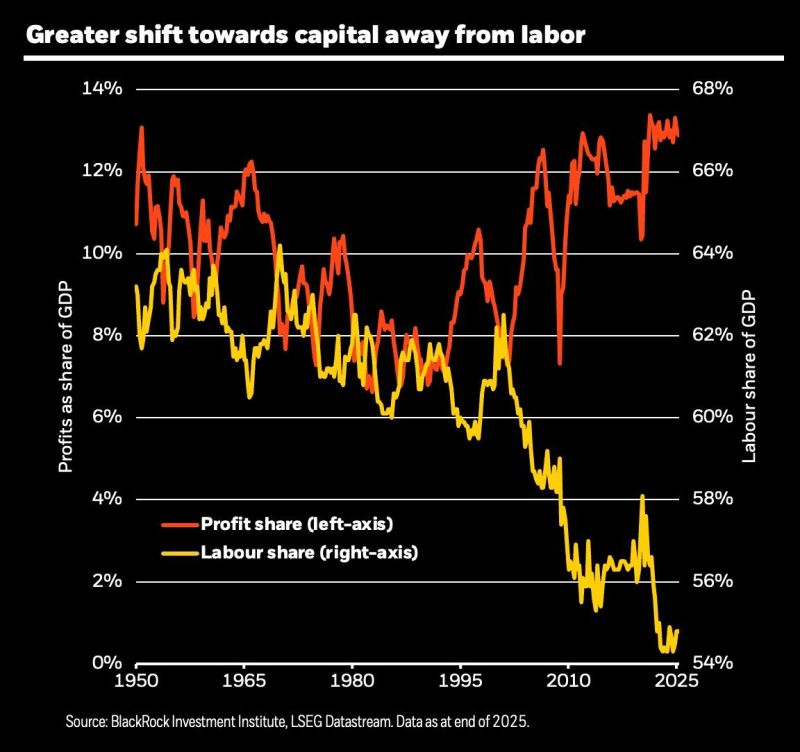

The K-shaped economy is becoming even more K-shaped...

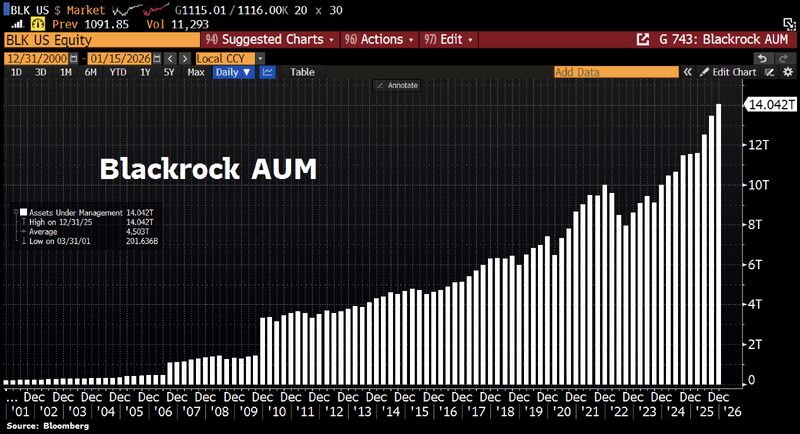

The shift towards capital away from labor is one of the reason Source chart: Blackrock

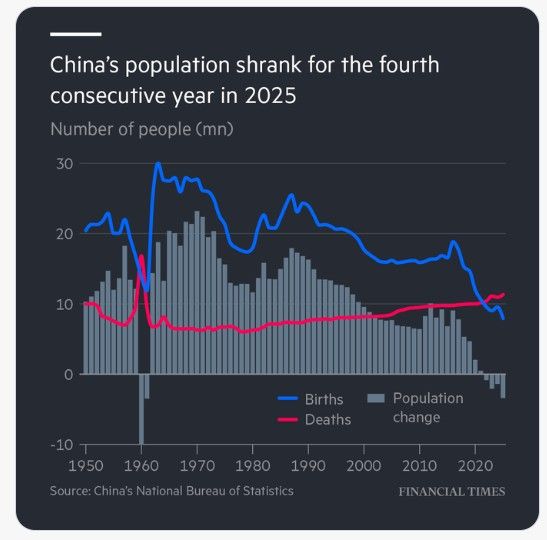

China last year registered the lowest number of births since records began

This marks the fourth consecutive year of population decline as policymakers grapple with a demographic crisis. Source: FT

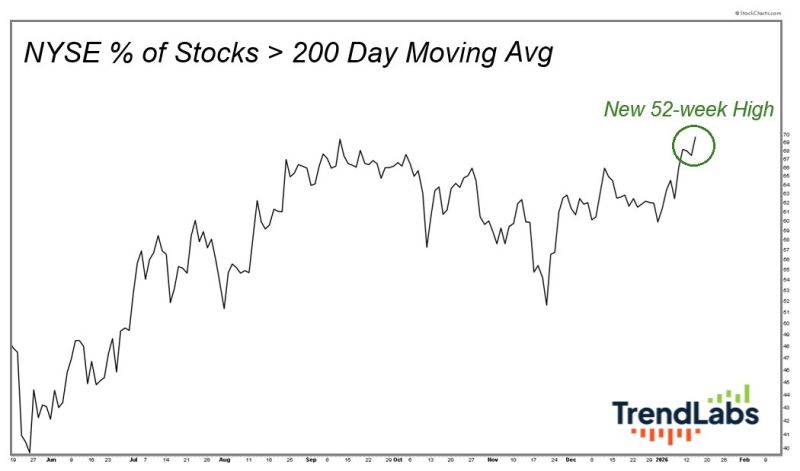

There are more stocks on the NYSE in uptrends right now than an any other point since 2024. Is so much winning a bad thing for investors?

Source: J.C. Parets @JC_ParetsX

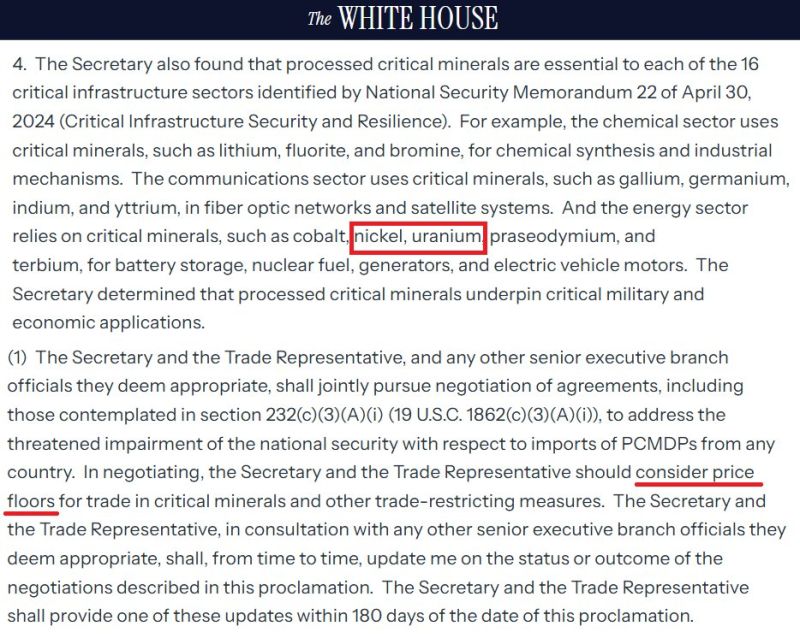

From Ghost Industry to National Priority

This White House statement on critical minerals explicitly listed uranium as a critical mineral, and it looks like they’re actually considering a price floor guarantee. The US used to be a powerhouse in uranium, but the industry is basically a ghost of its former self now. The government seems to be stepping up and back producers with some real institutional support. Things like strategic stockpiling or a price floor could be a massive game-changer. Between the skyrocketing power demand and energy security needs, support seems to be coming. Source: JH @CRUDEOIL231

BlackRock is eating the world. Total assets under management hit a record $14 TRILLION after the firm pulled in $342bn of client money in Q4 alone.

Source: HolgerZ, Bloomberg

$7.8 Trillion is now sitting in Money Market Funds, a new all-time high

Source: Barchart

Investing with intelligence

Our latest research, commentary and market outlooks