Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

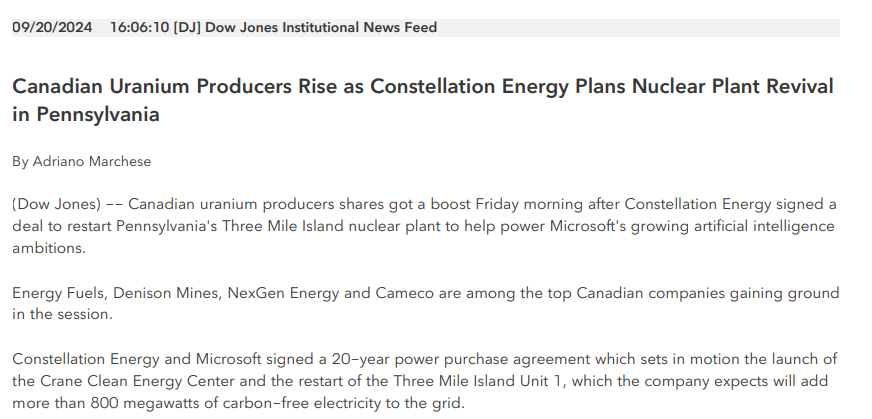

Microsoft in a nuclear power deal with Constellation Energy for AI data centers

Source: Bloomberg

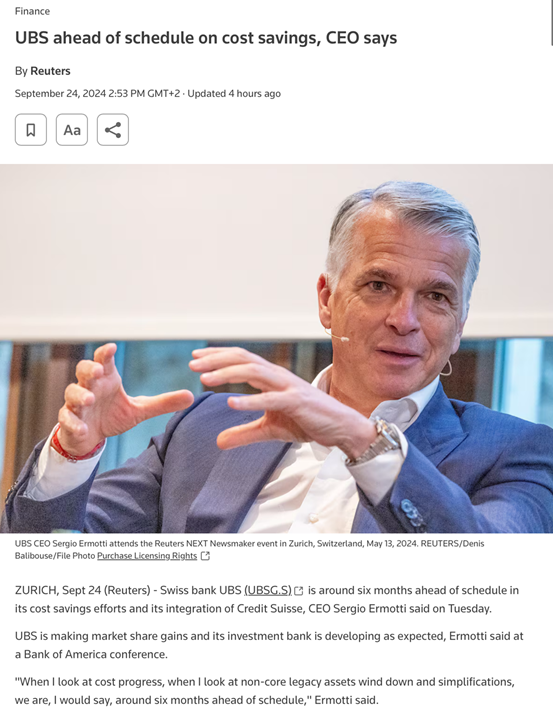

UBS is ahead of schedule on cost savings according to CEO S. Ermotti

Source: Reuters

The outcomes of reshoring are already becoming apparent.

Thanks to chipact, the US can benefit from Taiwan Semiconductors $TSMC knowhow in Mobile processors on their home turf. TSMC Arizona is shipping wafers now. Source: 🌿 litho @lithos_graphein on X

Anthropic, OpenAI’s largest startup competitor, has started talking to investors about raising capital in a deal that could value the startup at $30 billion to $40 billion

roughly doubling its valuation from a funding that closed early this year, according to an existing investor who spoke to company leaders. Source: www.theinformation.com https://lnkd.in/eQ9ZKAFC

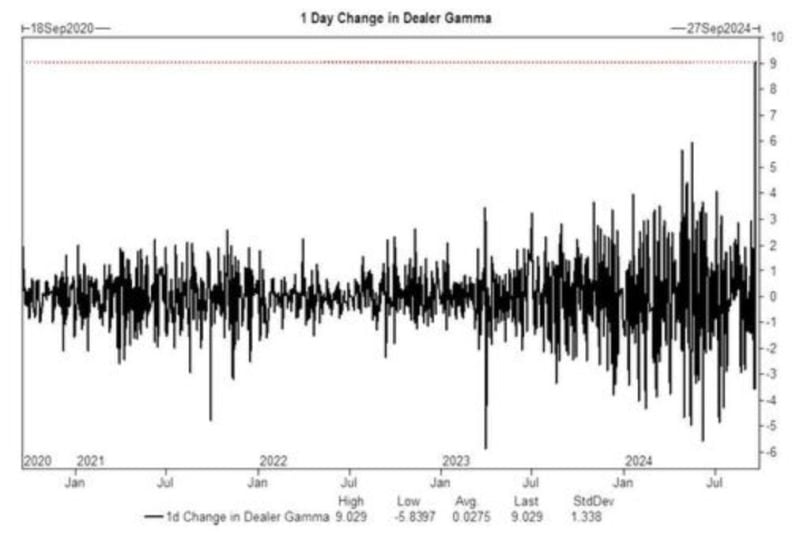

Friday's daily change in S&P 500 Dealer Gamma, $9 Billion, was the largest in history

Source: Barchart

Investing with intelligence

Our latest research, commentary and market outlooks