Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

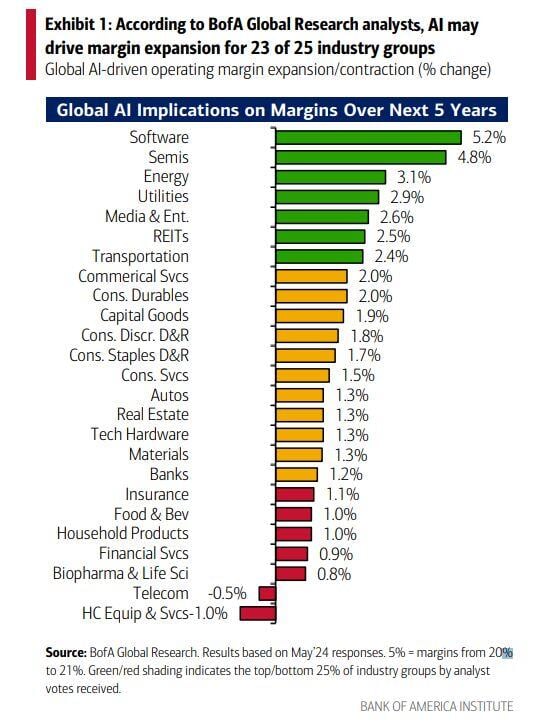

BofA: AI may drive margin expansion for 23 of 25 industry groups

Source: Mike Zaccardi, CFA, CMT, MBA

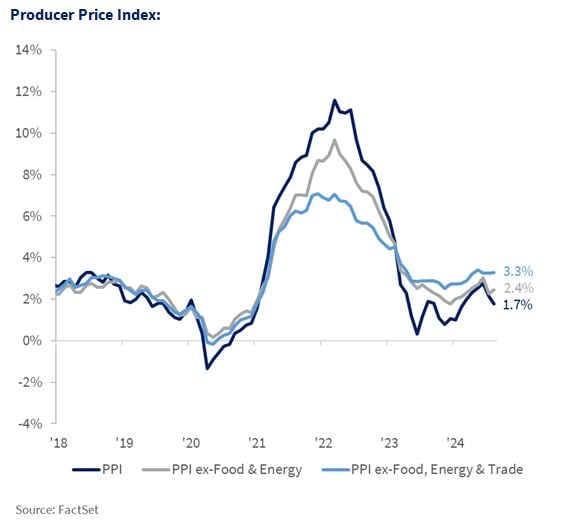

📈 BREAKING: August PPI inflation falls to 1.7%, below expectations of 1.8%.

Core PPI inflation was unchanged, at 2.4%, below expectations of 2.5%. PPI inflation is now at its lowest level since February 2024. On a sequential basis (MoM), the picture is not the same: August's core PPI rose more than expected, driven by higher service prices, while goods prices stayed flat. PPI 0.2% MoM, Exp. 0.1% PPI Core 0.3% MoM, Exp. 0.2% Source: Ali Dhanjion X, Factset

ECB's Lagarde: ECB decision on the size of the depo rate cut was unanimous.

Says inflation will drop to 2% in course of 2025. Our take: 👉 As widely expected, the ECB just cut its key rates for the second time this year after a first move in June. The Deposit Facility Rate (the rate at which commercial banks’ deposits at the ECB are remunerated) was lowered by 25bp to 3.50%. The main Refinancing rate (the rate applied to short-term liquidity lent by the ECB to commercial banks) was lowered to 3.65%. 👉After those rate cuts, monetary policy remains restrictive, as short-term interest rates are still significantly above the inflation rate of the euro area. However, this is “another step in moderating the degree of monetary policy restriction”, as stated by the ECB. 👉The ECB appears willing to proceed cautiously and gradually in bringing back its monetary policy stance to a neutral level, as domestic inflation remains higher than its target and wages are still rising at an elevated pace. The encouraging trend toward slowing wage growth witnessed recently has apparently not fully relaxed ECB’s concerns on the risk of persistent underlying inflationary pressures. 📈 ECB macroeconomic projections ECB staff’s projections have been revised slightly lower for GDP growth this year and in the following two. As reflected by the most recent economic data, growth will be soft this year, but it is expected to gradually accelerate in the next two years. Inflation is still expected to slow down toward the 2% target by 2026, with already a significant deceleration due next year. “Core inflation” projections have been marginally revised up for this year and the next on the back of firmer-than-expected price pressures in the service sector. 🚨 Conclusions • Since the rate cut was widely anticipated, today’s main news lies in the outlook for ECB rates. • A rate cut in December already appeared highly likely before today’s meeting and it remains so today, in the continuation of the quarterly pace initiated in June. • There was uncertainty around a potential additional rate cut at the October meeting, with future markets previously assigning a 34% chance on another rate cut at the ECB next meeting in October. • As inflation projections have not been revised lower today (even marginally higher for “core” inflation), and GDP growth expectations have only been marginally lower, the case for a step up in the pace of rate cuts appears less pressing now. The probability of an October rate cut dropped immediately after the announcement, to only 17%. Adrien Pichoud Source chart: Bloomberg

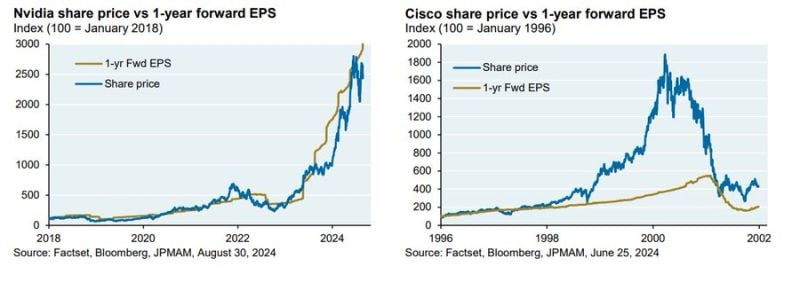

Why Nvidia is a different story than Cisco in 2 charts...

Source: JPAM

In case you missed it...

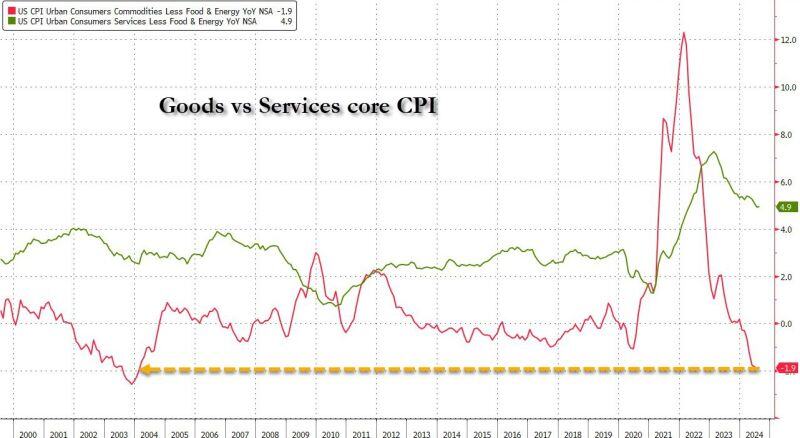

Goods deflation in the US is the biggest in 20 years... Source: www.zerohedge.com

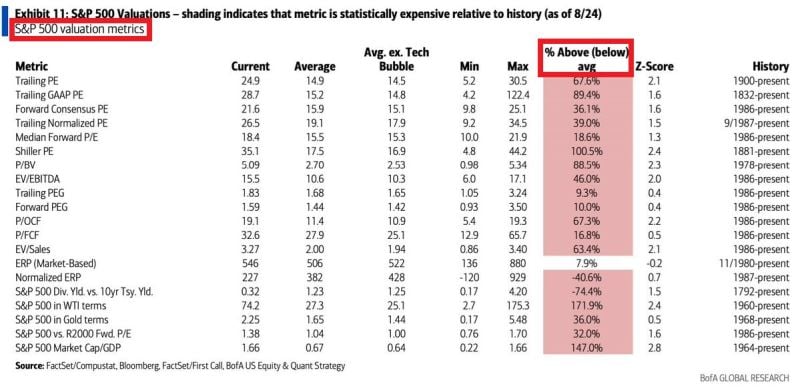

🚨 THIS IS ONE OF THE MOST EXPENSIVE MARKETS IN HISTORY 🚨

valuation remains a headwind for US equities (out of the 5 pillars of our investment process, valuation is the only negative one) . S&P 500 is expensive on 19 out of 20 metrics according to the Bank of America analysis. Some metrics are over 100% above historical averages. Shiller P/E and S&P 500 Market Cap to GDP are now 101% and 147% above averages. Source: Global Markets Investor, Facset, Bloomberg, BofA

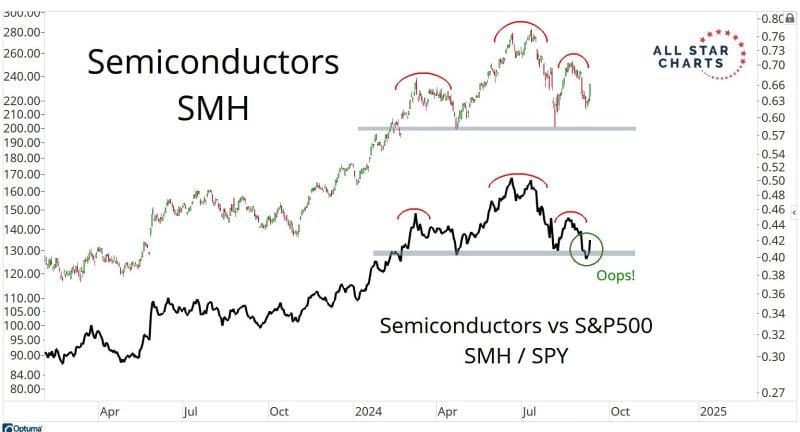

Semiconductors index: Was it a "head & shoulders top" (going to bring down the entire stock market)?

Or is it just a correction in a bull market??? Source: J-C Parets

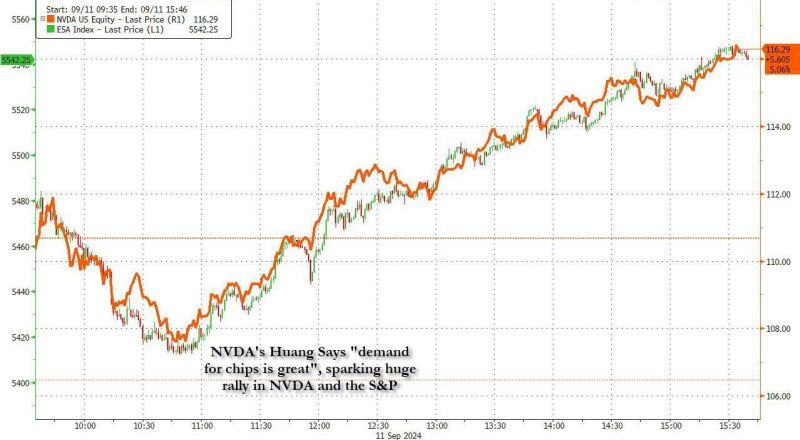

All it took was 5 words... Nvidia's Huang says "demand for chips is great", sparking huge rally in $NVDA and the S&P...

NVIDIA CLOSED THE DAY UP 8%. NVDIA ADDED $220 BILLION DOLLARS TODAY FOR CONTEXT INTEL IS WORTH JUST $80 BILLION NOW THAT MEANS NVIDIA ADDED ALMOST 3 INTELS JUST TODAY 🤯 Source: www.zerohedge.com, GURGAVIN

Investing with intelligence

Our latest research, commentary and market outlooks