Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

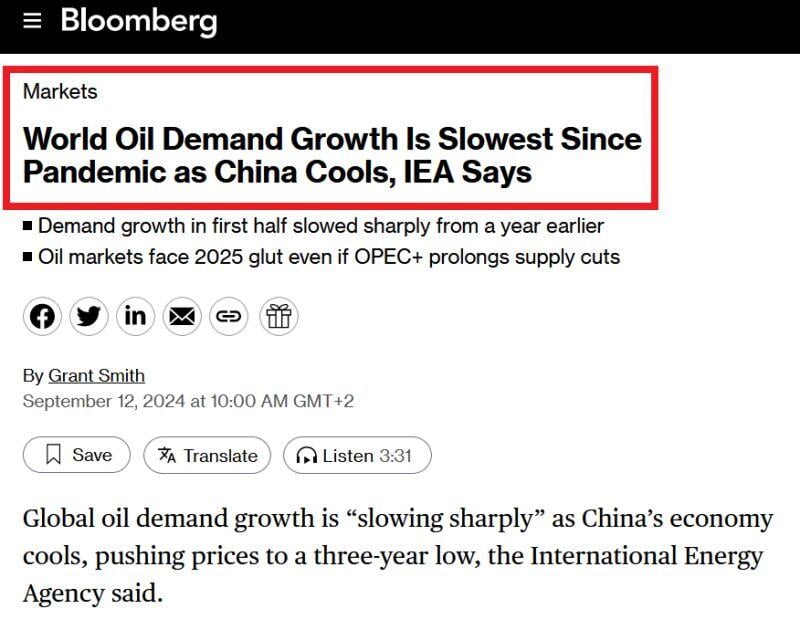

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Ozempic is selling so well that an insurer requests USD 1 bn in payments back

Source: Bloomberg

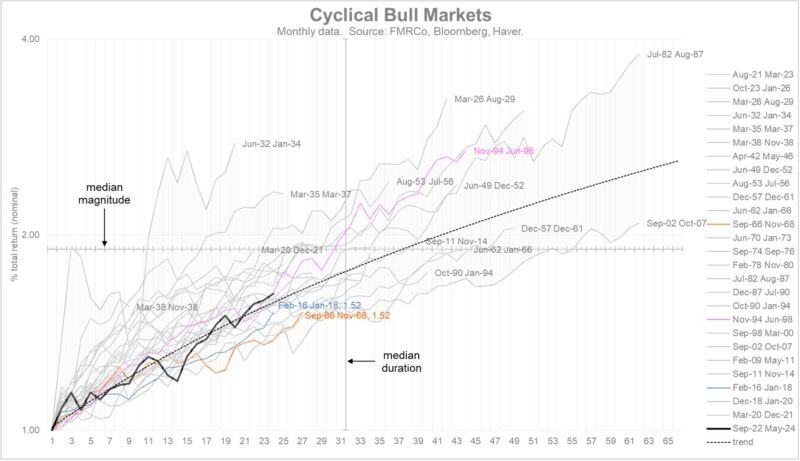

US equities bull market => are you afraid to be too late to the party?

If history is any guide, you aren't. As shown on the chart below, history shows there is still rooms to go for this bull market in terms of duration AND magnitue. Source: RBC

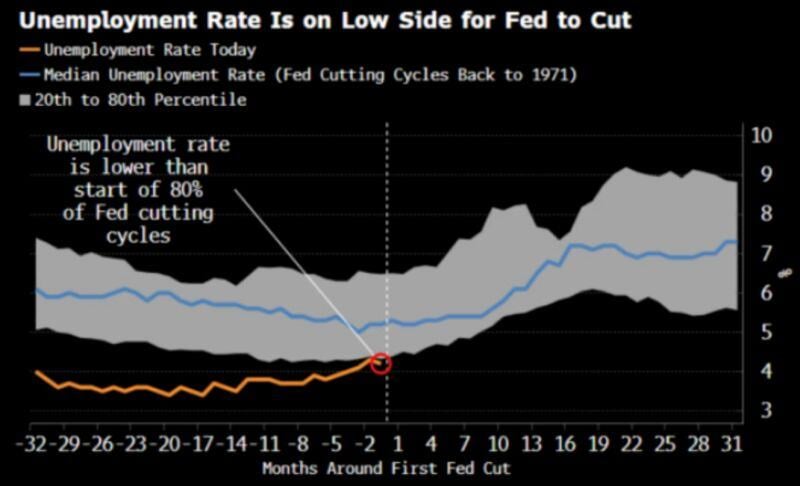

Should the FED cut rates next week, the easing cycle will start with an unemployment rate which is on the low side vs. history

Source: RBC, Bloomberg

The old playbook is back thus far this week. Semis and AI leading back bid, growth outperforming.

Source: RBC, Bloomberg

One of the most striking charts this year: China’s startup ecosystem has almost completely collapsed in the last 5 years

Source: FT thru Alec Stapp on X

Investing with intelligence

Our latest research, commentary and market outlooks