Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

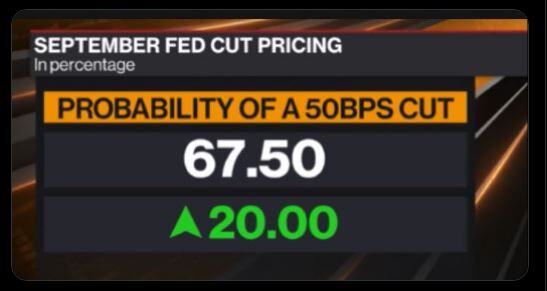

Market pricing now suggests a 50bps cut from the Fed is now base case (nearly 70% probability)

Source: Bloomberg, David Ingles

A tweet by Mario Nawfal on X: "TRUMP'S GOLF OUTING WAS SPONTANEOUS, RAISING QUESTIONS ABOUT SUSPECT'S TIMING

In a significant development, CNN reports that Trump's golf game on Sunday was an impromptu decision. According to two sources familiar with the matter, the outing was a last-minute addition to Trump's schedule, which originally had no public events planned for the day. This revelation adds a puzzling layer to the alleged assassination attempt. It raises critical questions about how the suspect, identified by as Ryan Wesley Routh, could have known Trump would be on the course at that specific time. The spontaneous nature of Trump's golf outing contradicts earlier speculations about the suspect's "high degree of planning," as suggested by former FBI Deputy Director Andrew McCabe. Source: CNN, Mario Nawfal

Saud Central Bank Secretly Bought 160 Tonnes Of Gold In Switzerland - www.zerohedge.com.

According to Jan Nieuwenhuijs via Money Metals (and published on zerohedge), the Saudis have joined other Asian countries in ditching their long-term sensitivity to the gold price. Evidence suggests the Saudi central bank has been covertly buying 160 tonnes of gold in Switzerland since early 2022, contributing to the current gold bull market.

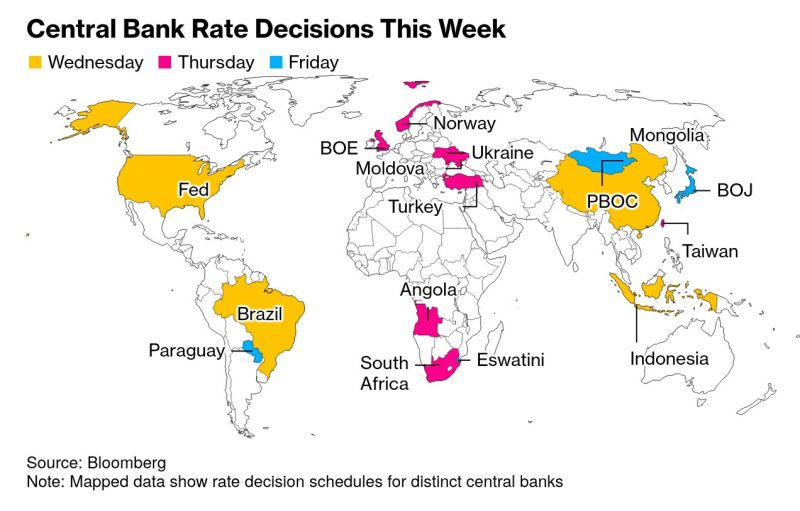

This is a big week for central bank decisions! We've got the fed, PBoC, boe, boJ and many more!

Source: Bloomberg

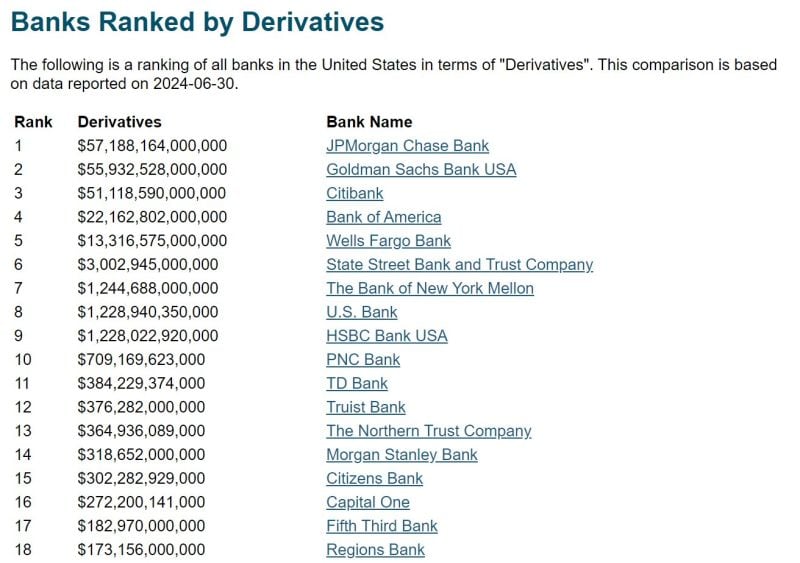

JP Morgan now owes the MOST derivatives at $57 Trillion

Source: PHIL 4 REAL @StretchItSomeMo

Investing with intelligence

Our latest research, commentary and market outlooks