Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

The US yield curve continues to steepen.

Yields on 10-year Treasuries are the highest vs 2-year yields going back to 2022. Source: Lisa Abramowitz, Bloomberg

In case you missed it...

Intel & Amazon just Announced an Extended Multi Year Multi Billion Dollar Partnership. $INTC 📈 was up +10.85% in after hours Source: Trend Spider

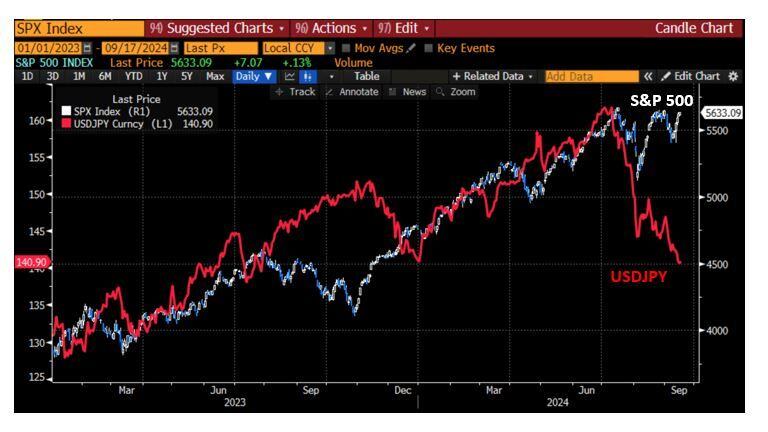

Remember when early August the strengthening of the yen and ensuing carry trade unwinding was seen as a huge threat for the equity market?

Fast forward to mid-September: the S&P 500 and USDJPY are taking two opposite directions. The market doesn't seem to care anymore about the yen... Source: Bloomberg, RBC

Food for thoughts

Russian President Vladimir Putin in response to Russia’s declining birth rate, has launched an unusual initiative: encouraging Russians to have s*x during their work breaks... Source: The Times Of India

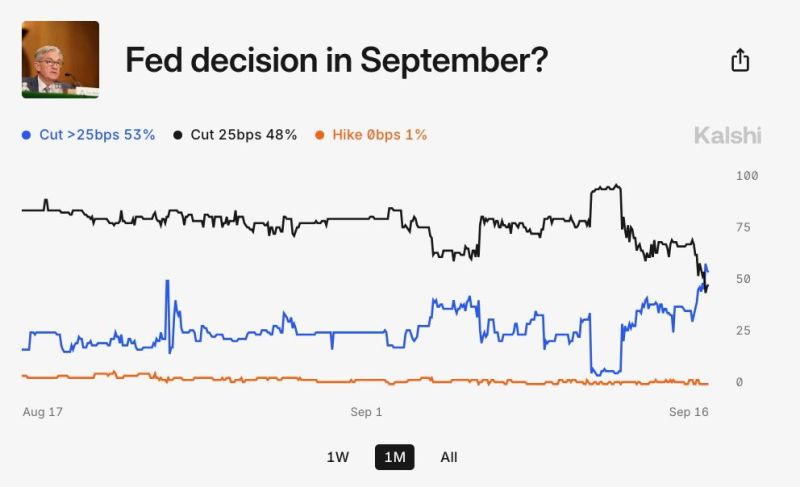

BREAKING: Prediction markets are now pricing-in a 48% chance of a 50 basis point Fed rate cut this week.

Odds of a 50 basis point rate cut have gone from 2% to 48% in just 5 days, according to Kalshi. This will be the first Fed policy decision without a 90%+ consensus since 2020... Source: The Kobeissi Letter

Is buying the dip still the best strategy? The average return when buying the dip in the S&P 500 varies based on timeframe.

Within 6 months of buying a -10% decline, the average return has been +13% compared to a +4% return when holding stocks through the pullback and recovery. Within 12 months, the "buy the dip" strategy has returned a +22% gain, beating a +5% return with the buy and hold strategy. On the other hand, buying dips over a 5-year period has returned +33%, well below a +75% from simply holding. In other words, buying the dip has been a successful strategy during periods of market volatility.

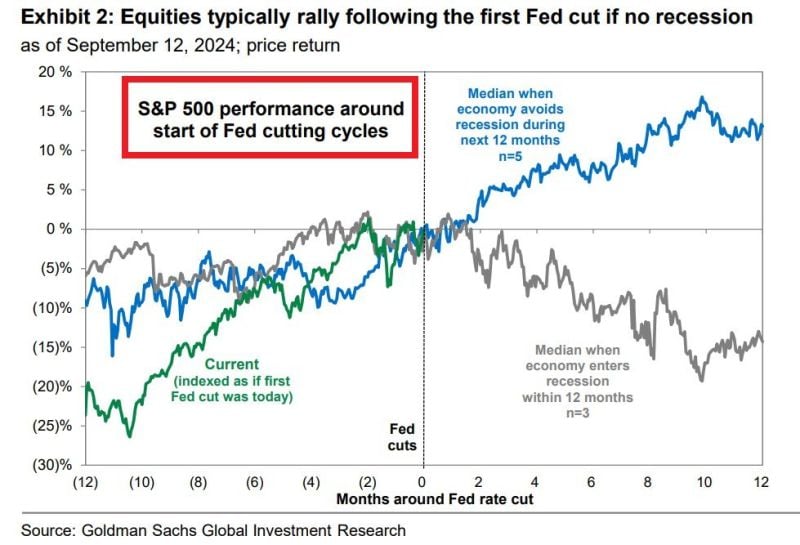

FED WILL CUT RATES ON WEDNESDAY FOR THE 1ST TIME IN 4.5 YEARS Stocks usually fall ~15% within 12 months following the 1st cut if there is a recession

If no recession, stocks rise by >10%. Key caveat is, that we will know if there was a recession a few months after the cut. Source: Global Markets Investor

Investing with intelligence

Our latest research, commentary and market outlooks