Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

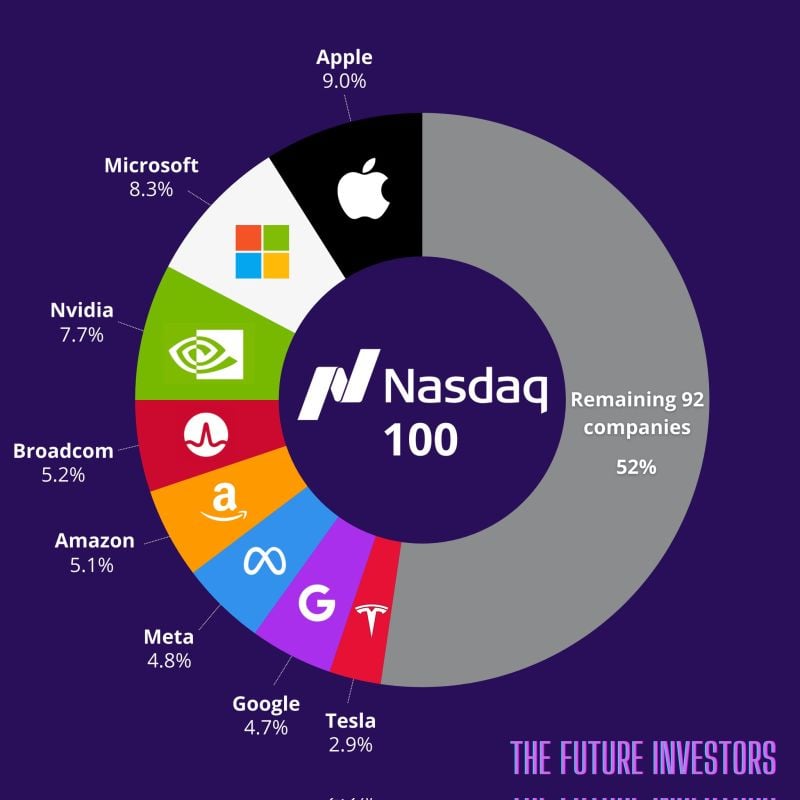

Here’s what you actually buying when you invest $1,000 in a Nasdaq 100 ETF $QQQ:

$AAPL - Apple - $90 $MSFT - Microsoft - $83 $NVDA - Nvidia - $77 $AVGO - Broadcom - $52 $AMZN - Amazon - $51 $META - Meta - $48 $GOOGL - Google - $47 $TSLA - Tesla - $29 Remaining 92 stocks: $523 Source: The Future Investors

BofA: “today the average EPS growth rate among AI ETF constituents has fallen from 18% to just 5%, below the S&P 500.”

Source: Mike Zaccardi, CFA, CMT @MikeZaccardi via @dailychartbook

Safe is risky. #DF24

Source: Vala Afshar @ValaAfshar on X, marketoonist.com

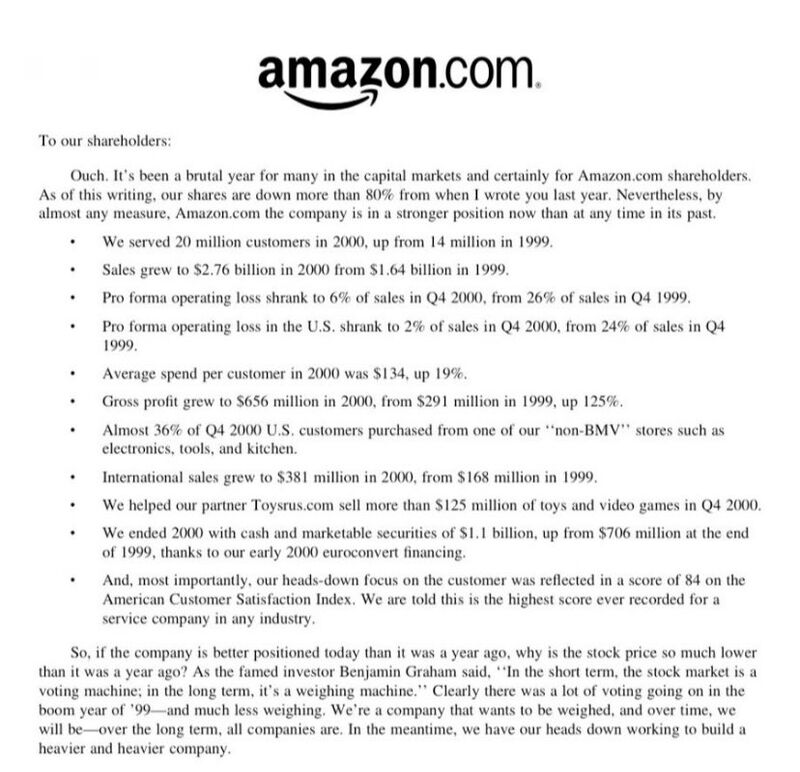

Jeff Bezos letter to shareholders when Amazon stock was down ~80%

Every investor should read this: (source: Matt Allen)

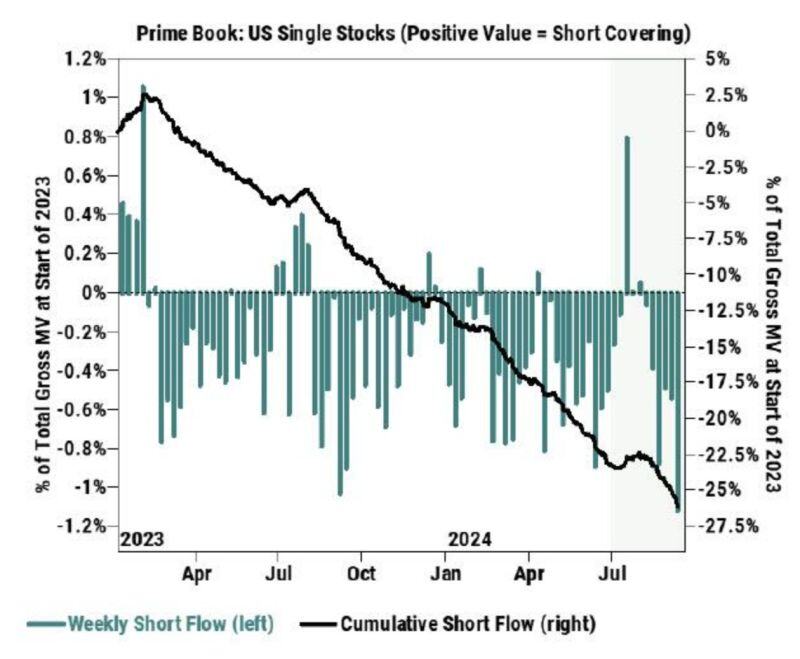

Hedgefunds piled into shorts against stocks for the fifth week in a row last week, per Goldman

Source: Markets & Mayhem

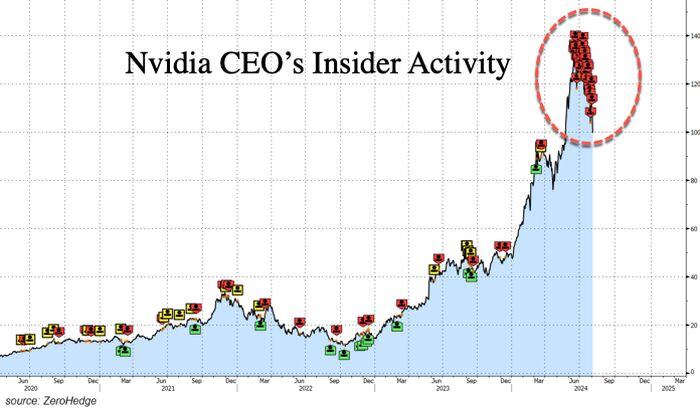

IS NVIDIA'S CEO OFF-LOADING HIS SHARES?

The dump took place on September 10th and 11th.Since the start of July, Jensen Huang has sold over 4 million shares worth ~$500 million. Huang still holds ~3.50% of the chipmaker's stock. Source: Global Markets Investor, zerohedge

Investing with intelligence

Our latest research, commentary and market outlooks