Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

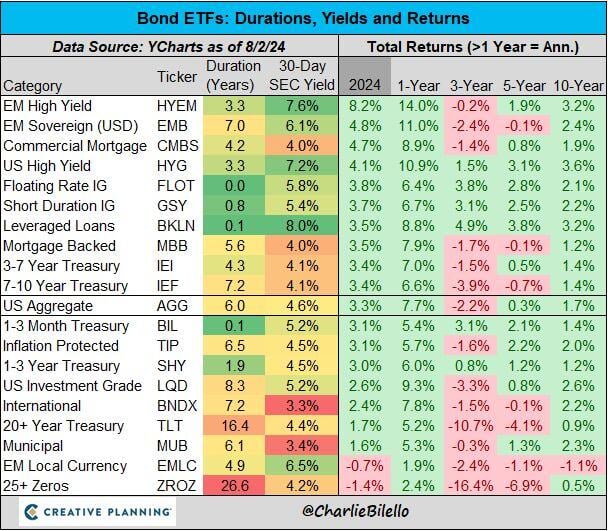

Bonds have surged higher with the collapse in interest rates and the US Aggregate Bond ETF is now up 7.7% over the past year, outperforming the Treasury Bill ETF ($BIL +5.4%)

Source: Charlie Bilello

Nvidia $NVDA Blackwell delayed by 3 months due to design flaws.

Nvidia informs its biggest customers Microsoft and Meta. Nvidia Corp.’s upcoming artificial intelligence chips will be delayed due to design flaws, The Information reports, citing two unidentified people who help produce the chip and its server hardware. The chips may be delayed by three months or more, which could affect Nvidia’s customers including Meta Platforms Inc., Google LLC and Microsoft Corp. Nvidia this week informed Microsoft about a delay affecting the most advanced AI chip models in the Blackwell series, according to an unidentified Microsoft employee and another person. The delays mean big shipments aren’t expected until the first quarter of 2025, The Information added. Read more: Elliott Says Nvidia Is in A ‘Bubble’ and AI Is ‘Overhyped’: FT A spokesperson for Nvidia wouldn’t comment on its statements to customers about the delay, according to the report, but told The Information that “production is on track to ramp” later this year. Microsoft, Google, Amazon Web Services and Meta declined to comment to the publication, while a TSMC spokesperson didn’t respond to a request for comment. Source: Bloomberg, JaguarAnalytics

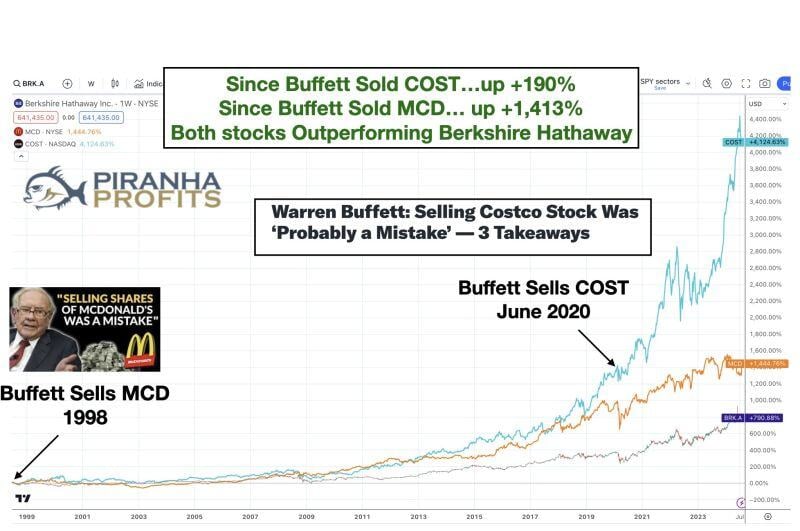

Should you sell your Apple because Buffet has been selling 50% of his Apple ($AAPL) shares?

Well, think twice. Buffett sold his entire Mcdonalds ($MCD) stock in 1998. Since then, MCD has increased +1,413%, outperforming Berkshire Hathaways returns. Buffett sold his entire Costco #($COST) stake in June 2020. Since then, COST has gained +190%, outperforming Berkshire as well. Buffett also sold all his stakes in airline stocks like Delta Airlines ($DAL) in March 2020. Since then, DAL is up +82% as well Lesson? Don't copy paste what other investors are doing, no matter how great they are. Source: Adam Khoo on X

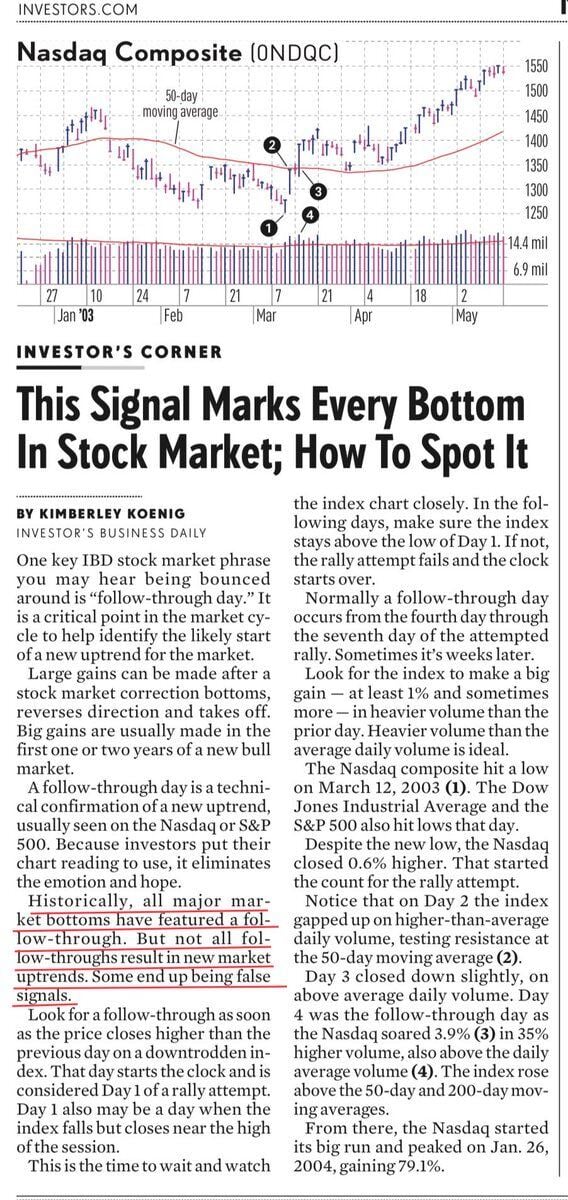

The signal for Market Bottom?

A Follow Through Day (FTD) is a concept developed by William J. O’Neil to identify an important change in general market direction, from a definite downtrend to a new uptrend. Follow Through Days occurs during a market correction when a major index closes significantly higher than the previous day, and on greater volume. It happens Day 4 or later of an attempted rally. Leading up to a FTD, an attempted rally takes place during a downtrend when a major index closes with a gain. The rally attempt continues intact as long as the index doesn’t make a new low. Follow Through Day Characteristics: Characteristics of a follow-through day include an index closing at least 1.7 – 2% higher on increased volume, positive behavior of leading stocks, and improved market action regarding support vs. resistance levels. The most powerful follow-through days often happen Day 4 through Day 7 of an attempted rally. Day 1 of an attempted rally is the first up day after a new low. Source: True market Leader @TmarketL, TraderLion

The Yen Carry trade unwind is far from over, with total net Yen shorts being barely covered...

Source: Global_Macro @Marcomadness2

Investing with intelligence

Our latest research, commentary and market outlooks