Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

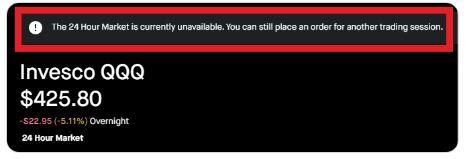

Fed's emergency rate cut never happened when the VIX was below 40.

It seems that we are getting there... Source chart: Yahoo finance

💥 Treasuries surge as traders bet on emergency Fed rate cut 💥

.

Volatility is back...

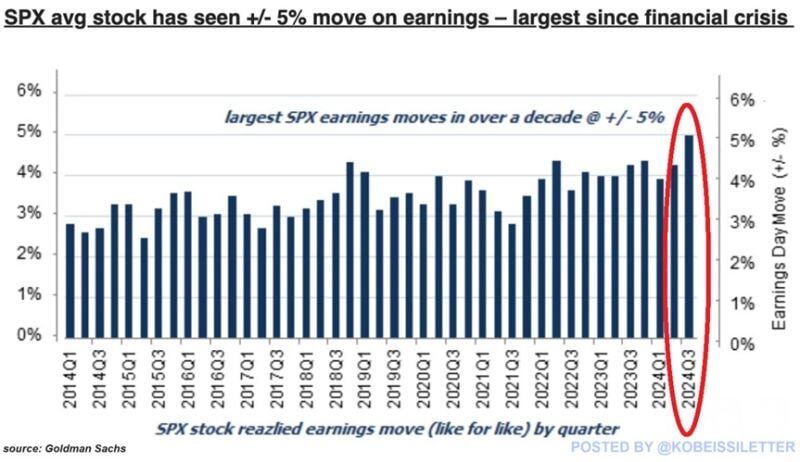

The average S&P 500 stock has seen a 5% one-day move after releasing Q2 2024 earnings. This marks the most volatile earnings season since the 2008 Financial Crisis, according to Goldman Sachs. By comparison, in Q1 2024 and Q4 2023, the average stock moved by ~4% one day after the release. The volatility index, $VIX, is now up ~95% over the last month alone. Volatility is opportunity for traders. Source: The Kobeissi Letter

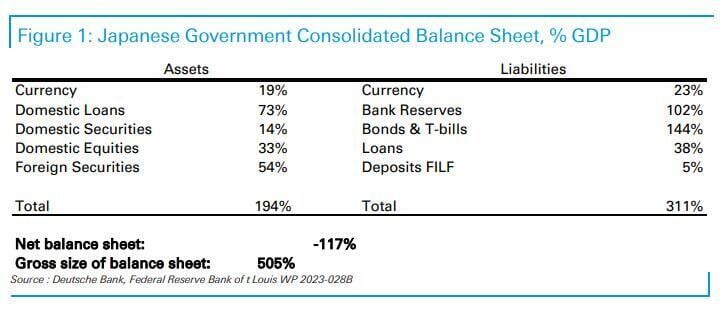

Deutsche Bank: "Why the BOJ has no choice and is merely prolonging the inevitable*

"at a gross balance sheet value of around 500% GDP or $20 trillion, the Japanese government's balance sheet is, simply put, one giant carry trade."

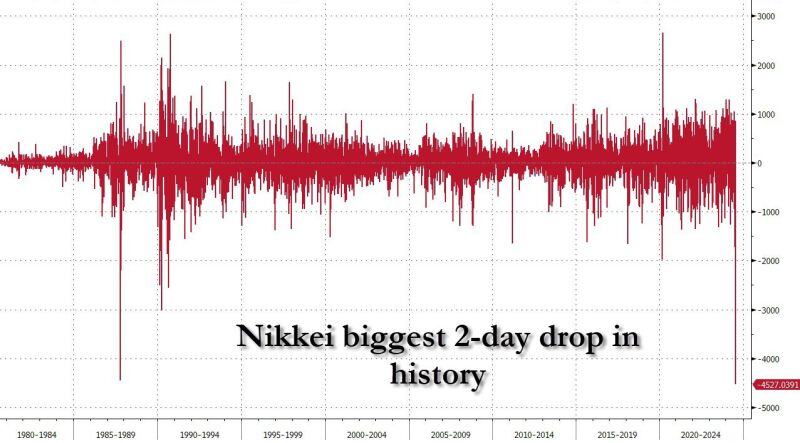

Japan Equities Crash, how significant?

Nikkei 225 lost 20% or more within a 3-week period? 1. 1990: -21%, (February 14 - March 7), asset price bubble plunge in Japan. 2. 2008: -23%, (September 26 - October 16) post the Lehman collapse. 3. 2013: -21%, (May 22 - June 13), economic stimulus panic. 4. 2020: -23%, (February 21 - March 13), the COVID pandemic panic of 2020. Source: Lawrence McDonald, Bloomberg

This is the biggest 2-day drop for the Nikkei in history, surpassing Black Monday

Source: www.zerohedge.com, Bloomberg

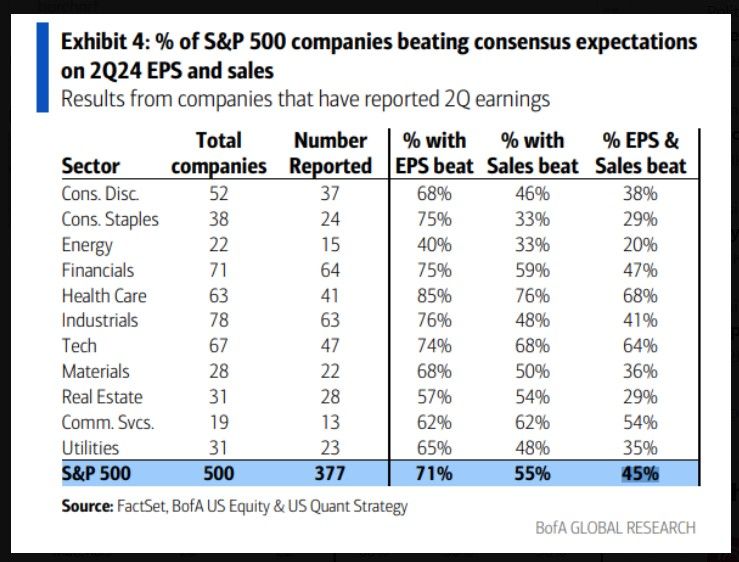

US earnings: The beat rate is the smallest since 4th quarter of 2022 377 S&P 500 companies (80% of index EPS) have reported, beating consensus by 2%, the smallest since 4Q22.

71%/55%/45% beat on EPS/sales/both Source: BofA, Mike Z.

Investing with intelligence

Our latest research, commentary and market outlooks