Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

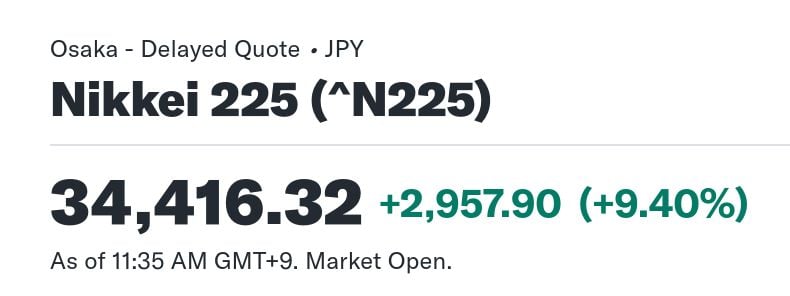

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

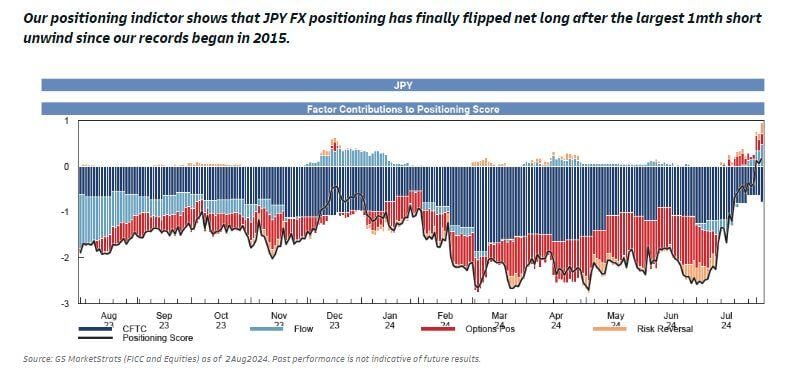

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

BREAKING: Small Caps $IWM post 3%+ declines for 3 consecutive trading days for the first time since October 1987

Source: Barchart

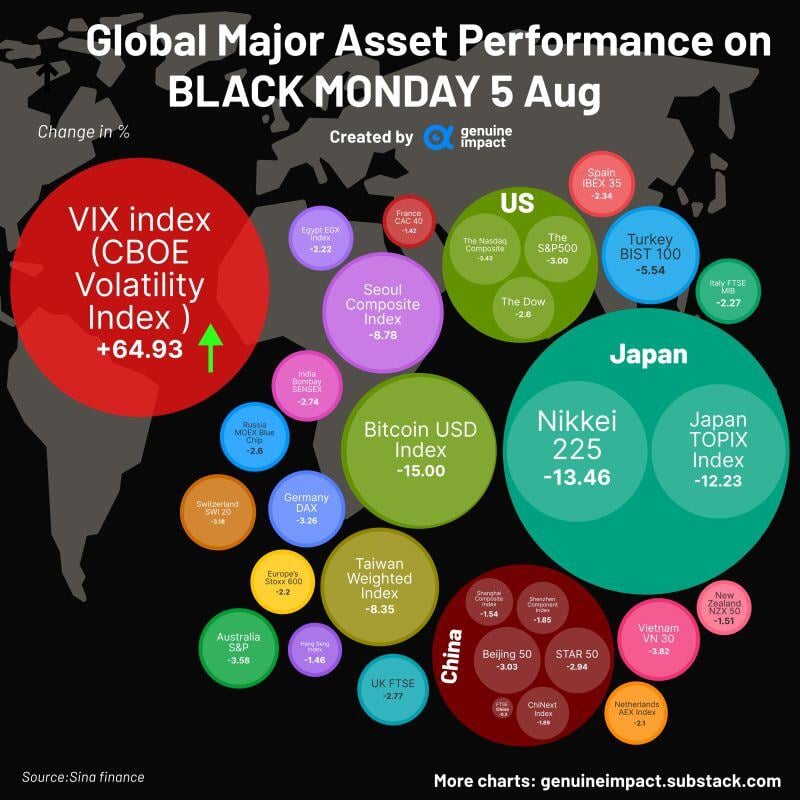

A historical market session summarized in one chart

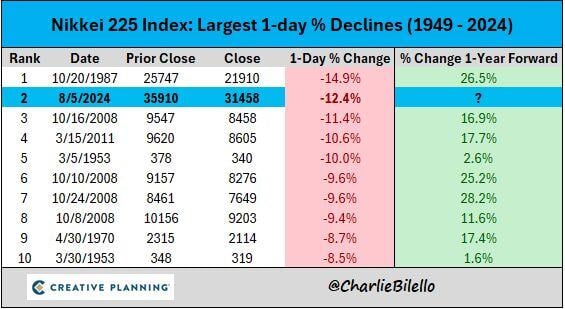

Japan’s stock market posted its worst drop since Wall Street’s Black Monday in 1987, contributing to fears of global turmoil in the markets. Concerns about a slowing U.S. economy and the unwinding of the global yen "carrytrade" are battering stocks. Source: Genuine Impact

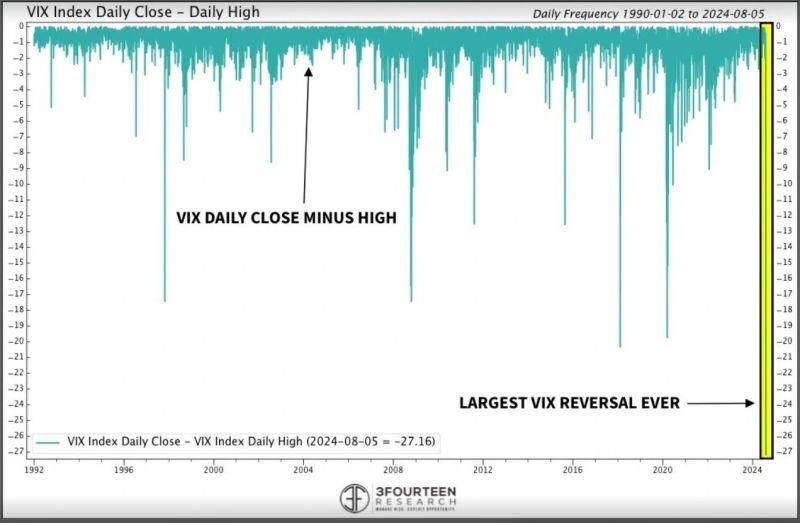

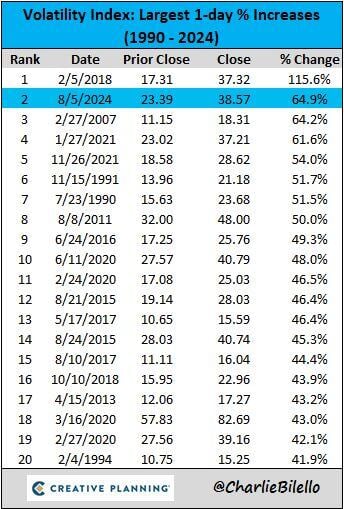

Historic day in volatility

The difference between the VIX's intra-day high (65) and close (38) was the highest EVER. Source: 3Fourteen Research thru Octavian Adrian Tanase

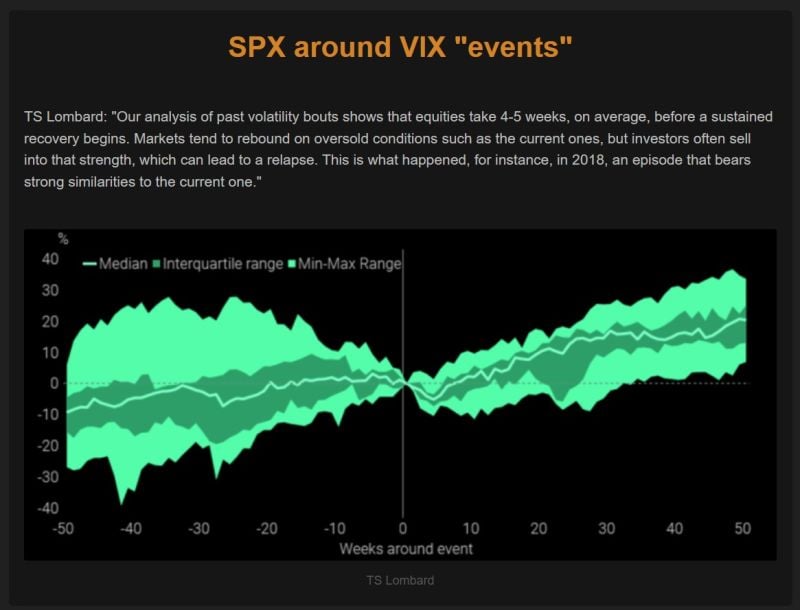

TS Lombard: "Our analysis of past volatility bouts shows that equities take 4-5 weeks, on average, before a sustained recovery begins.

Markets tend to rebound on oversold conditions such as the current ones, but investors often sell into that strength, which can lead to a relapse. This is what happened, for instance, in 2018, an episode that bears strong similarities to the current one." Source: TS Lombard, The Market Ear

The $VIX spiked 65% higher today, the 2nd largest 1-day % increase in history

(note: $VIX data goes back to 1990). Source: Charlie Bilello

Investing with intelligence

Our latest research, commentary and market outlooks