Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

It seems that many companies are in desperate need for rate cuts...

Source: Bloomberg

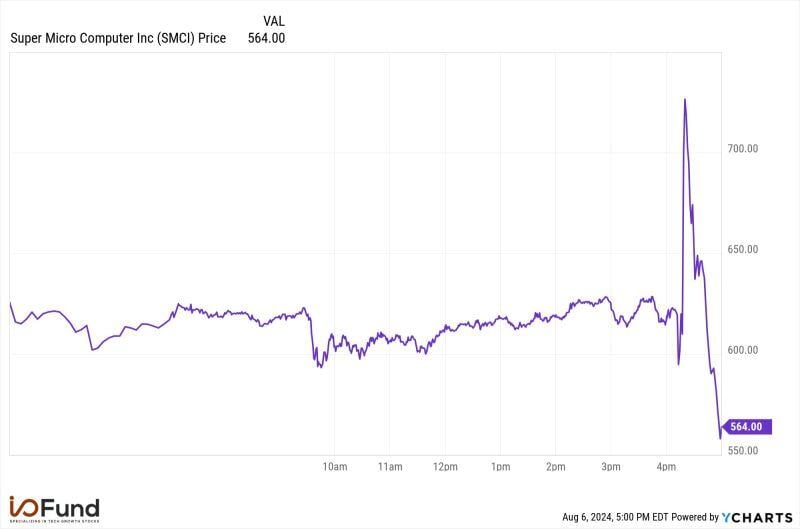

Yesterday evening after the close, Super Micro $SMCI has swung nearly $170 in 40 minutes in after hours trading, dropping from $725 to $558.

Super Micro Computer beats on revenues + announced 10:1 stock split (why?) but missed on EPS. CEO: "Supermicro continues to experience record demand of new AI infrastructure..." Source: Ycharts, Beth Kindig

BREAKING: Is the BoJ capitulating?

The Bank of Japan Deputy Governor says they WON’T raise rates when the market is unstable. The Yen is getting absolutely destroyed…and the Nikkei is up nearly +3%, Nasdaq Futures is up +1.2% A wild start of August... Source: TradingView

China’s imports grew faster-than-expected in July, while export growth came in below forecasts, according to customs data released Wednesday.

U.S. dollar-denominated imports rose in July by 7.2%, far more than the forecast of 3.5%, according to the poll. China’s imports from the U.S. surged by 24% year-on-year in July, according to CNBC calculations of official data. Source: CNBC

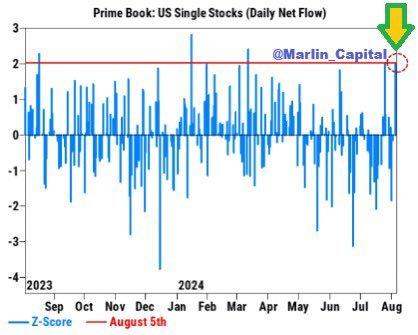

Hedge Funds bought the panic dip yesterday

US stocks saw their largest 1-day net buying in 5 months, according to GS Prime. 8 of 11 sectors were net bought, led by Tech and Defensives. $SPY $QQQ $IWM Source: David Marlin

Investing with intelligence

Our latest research, commentary and market outlooks