Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

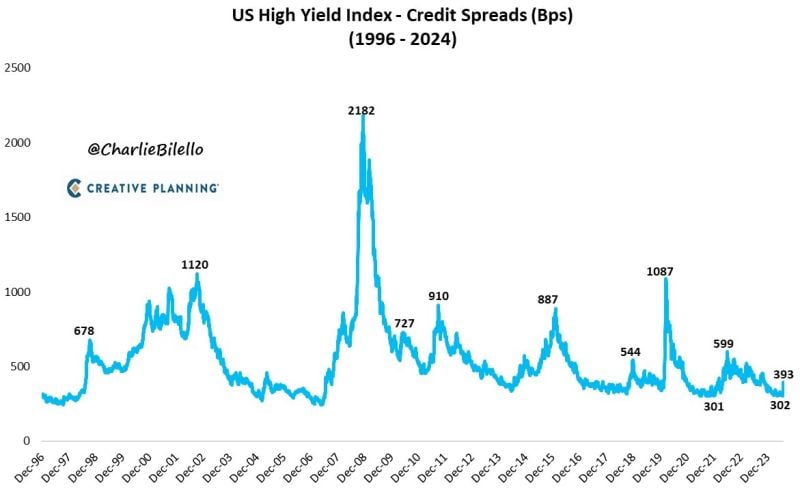

2 weeks ago, US High Yield credit spreads were nearly at their tightest levels since 2007 (302 bps).

Spreads have since increased 91 bps to their widest levels since Nov 2023 (393 bps). The last 3 recessions all saw spreads move over 1,000 bps at some point. We're not close to pricing in that scenario today. Source: Charlie Bilello

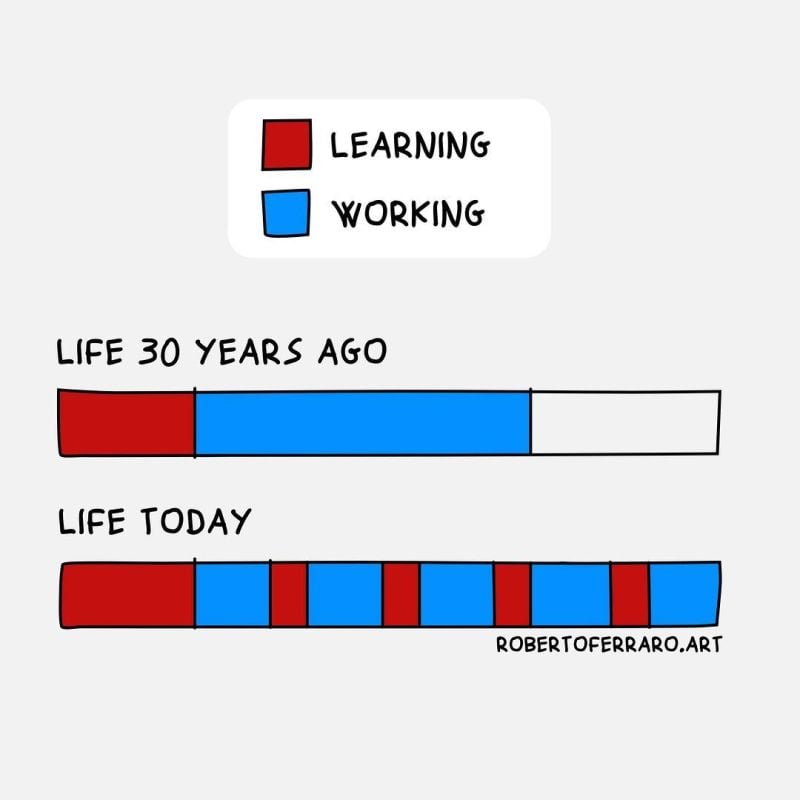

30 years ago, careers were a straight line: Get an education ➡️ Secure a job ➡️ Climb the ladder ➡️ Retire

Today? It’s a loop: Learning ➡️ Working ➡️ Learning ➡️ Working ➡️ Repeat To thrive in this cycle, you should embrace lifelong learning and stay flexible. Source: Corporate Rebels

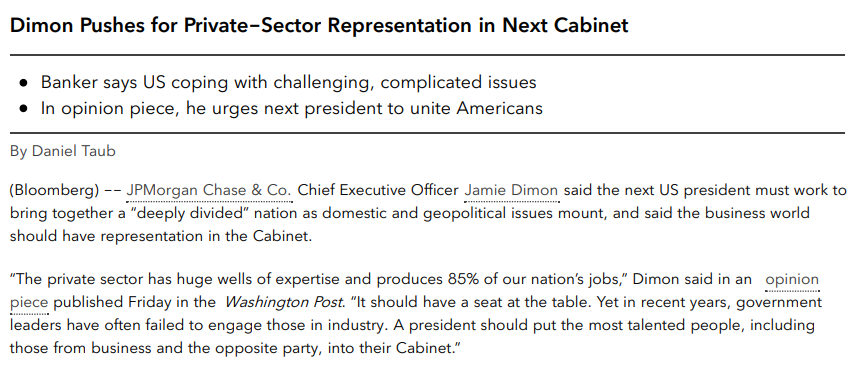

JP Morgan's Jamie Dimon pushes for private-sector representation in next cabinet

Source: Bloomberg

The Japanese Yen Carry Trade unwinding is only 50% complete warns JP Morgan

Source: Win Smart

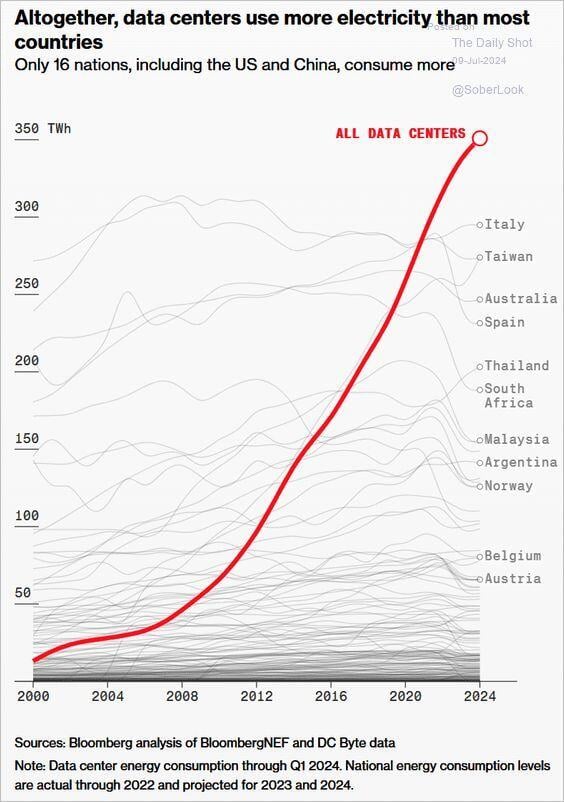

Data centers altogether use more electricity than most countries.

Bloomberg via The Daily Shot thru Tilo Marotz

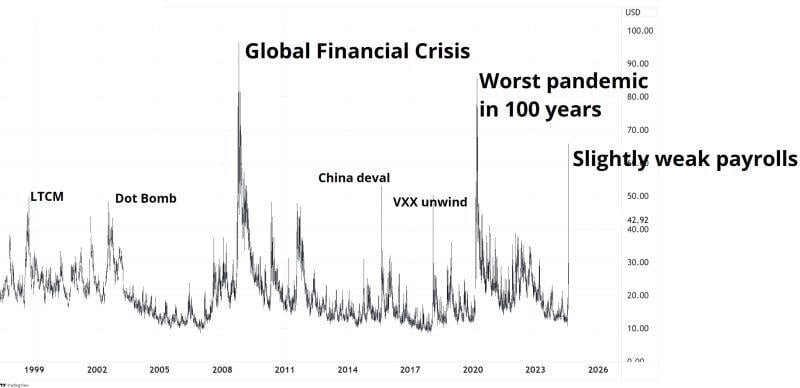

Putting yesterday's VIX intra-day high at 65 into historical perspective...

Source: Bloomberg, RBC

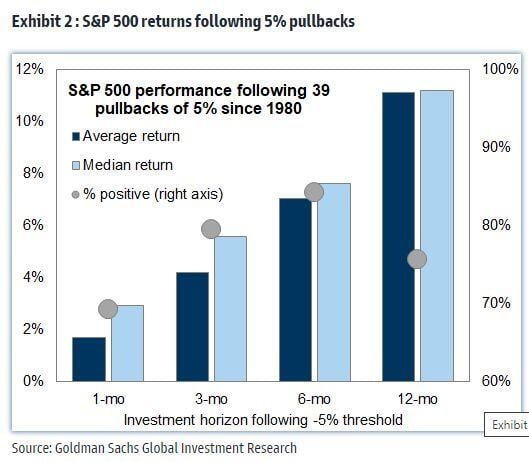

Buying the dip often pays off

Since 1980, an investor buying the sp500 index 5% below its recent high would have generated a median return of 6% over the subsequent 3 months, enjoying a positive return in 84% of episodes. Source: Goldman Sachs, Mike Z.

Investing with intelligence

Our latest research, commentary and market outlooks