Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

It seems that many companies are in desperate need for rate cuts...

Source: Bloomberg

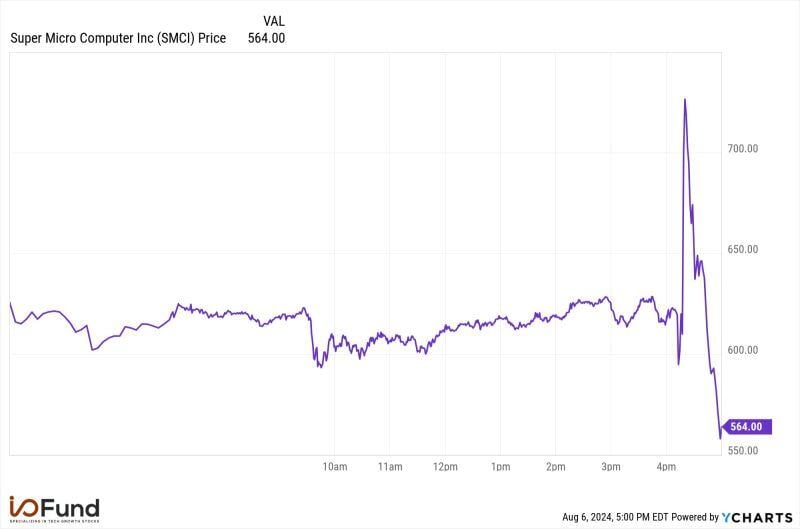

Yesterday evening after the close, Super Micro $SMCI has swung nearly $170 in 40 minutes in after hours trading, dropping from $725 to $558.

Super Micro Computer beats on revenues + announced 10:1 stock split (why?) but missed on EPS. CEO: "Supermicro continues to experience record demand of new AI infrastructure..." Source: Ycharts, Beth Kindig

BREAKING: Is the BoJ capitulating?

The Bank of Japan Deputy Governor says they WON’T raise rates when the market is unstable. The Yen is getting absolutely destroyed…and the Nikkei is up nearly +3%, Nasdaq Futures is up +1.2% A wild start of August... Source: TradingView

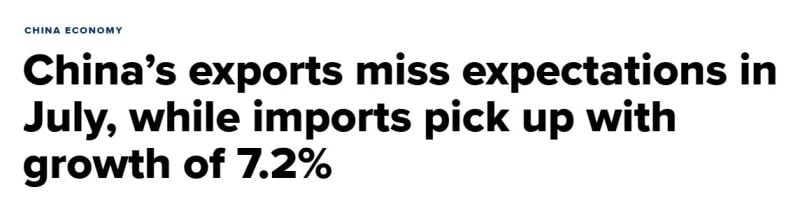

China’s imports grew faster-than-expected in July, while export growth came in below forecasts, according to customs data released Wednesday.

U.S. dollar-denominated imports rose in July by 7.2%, far more than the forecast of 3.5%, according to the poll. China’s imports from the U.S. surged by 24% year-on-year in July, according to CNBC calculations of official data. Source: CNBC

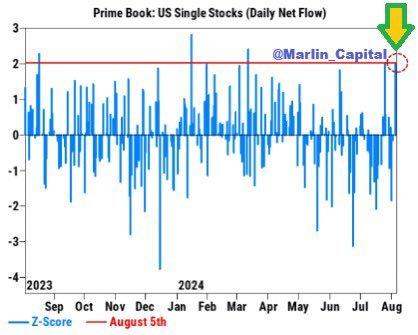

Hedge Funds bought the panic dip yesterday

US stocks saw their largest 1-day net buying in 5 months, according to GS Prime. 8 of 11 sectors were net bought, led by Tech and Defensives. $SPY $QQQ $IWM Source: David Marlin

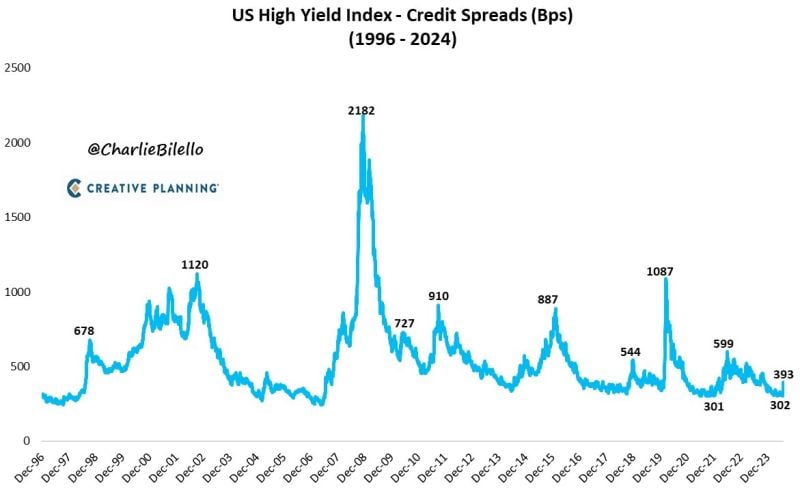

2 weeks ago, US High Yield credit spreads were nearly at their tightest levels since 2007 (302 bps).

Spreads have since increased 91 bps to their widest levels since Nov 2023 (393 bps). The last 3 recessions all saw spreads move over 1,000 bps at some point. We're not close to pricing in that scenario today. Source: Charlie Bilello

Investing with intelligence

Our latest research, commentary and market outlooks