Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

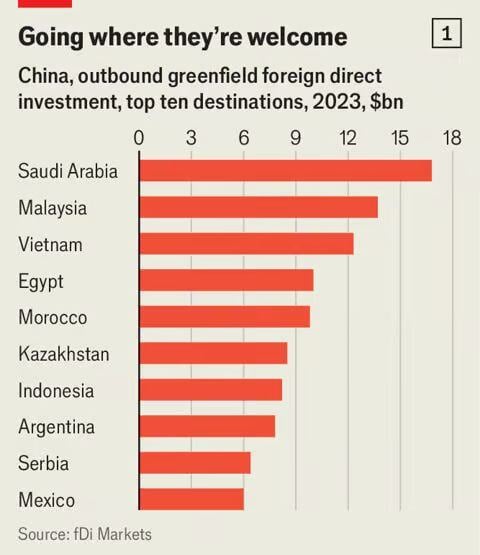

Chinese firms are fast turning away from US and Europe for greenfield FDI

• China is de-risking, too, by reducing reliance on western markets for trade and investment • In countries 👇 imports from China of intermediate goods used in manufacturing have tripled since 2013 Source: Agathe Demarais, The Economist

A tectonic shift in Predict Presidential elections odds

Source: Predict It

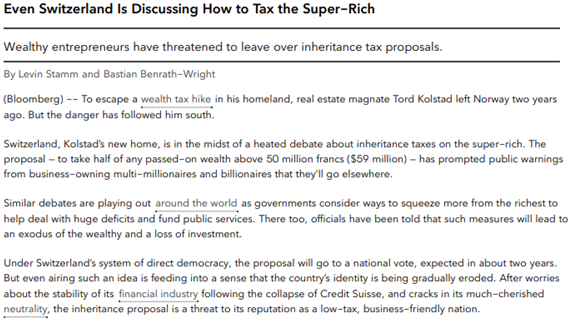

Switzerland is considering imposing a tax on large inheritance targeting the super-rich

Source: Bloomberg

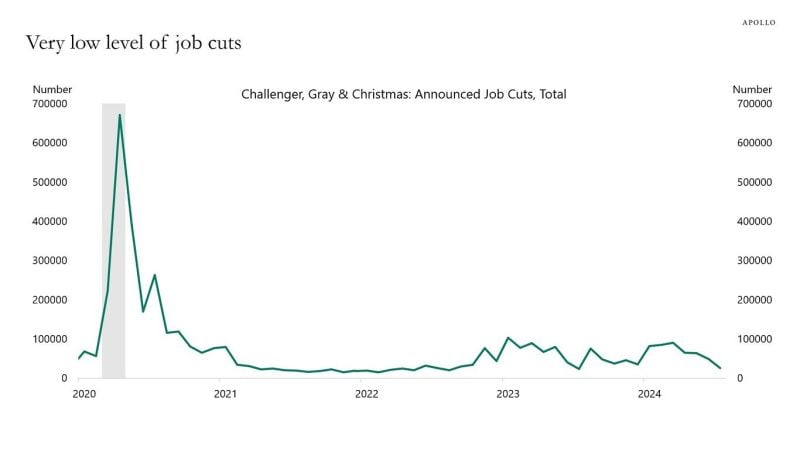

A very important chart which goes AGAINST hard landing scenario

"The source of the rise in the us unemployment rate is not job cuts but a rise in labor supply because of rising immigration. That is the reason why the Sahm rule doesn’t work. The Sahm rule was designed for a decline in labor demand, not a rise in immigration." - Torsten Slok (Apollo) Source: Mike Z. on X

Modi's budget could send Indian stocks higher

Source: Bloomberg 3 July 2024

Investing with intelligence

Our latest research, commentary and market outlooks