Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

US bond vigilantes managed to turn the stockmarket around.

Investors shunned a $42bn auction of benchmark 10-year US securities, which drew a yield that was well above the pre-sale indicative level. That horrible bond auction pushed stocks lower. Source: Bloomberg, @johnauthers, HolgerZ

This is what triggered a global-scale sell-off of every major asset class...

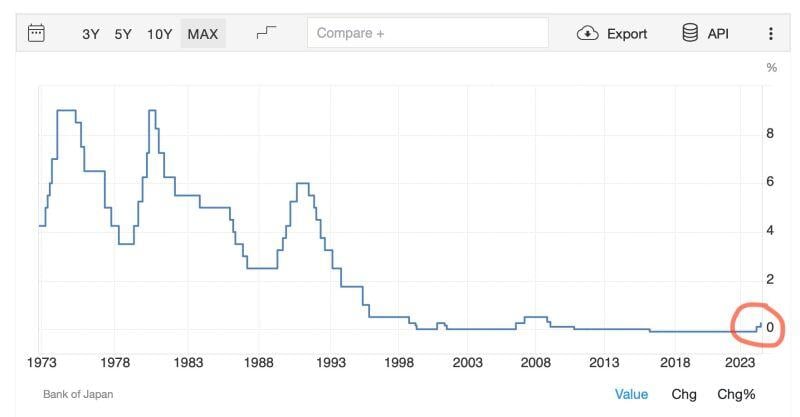

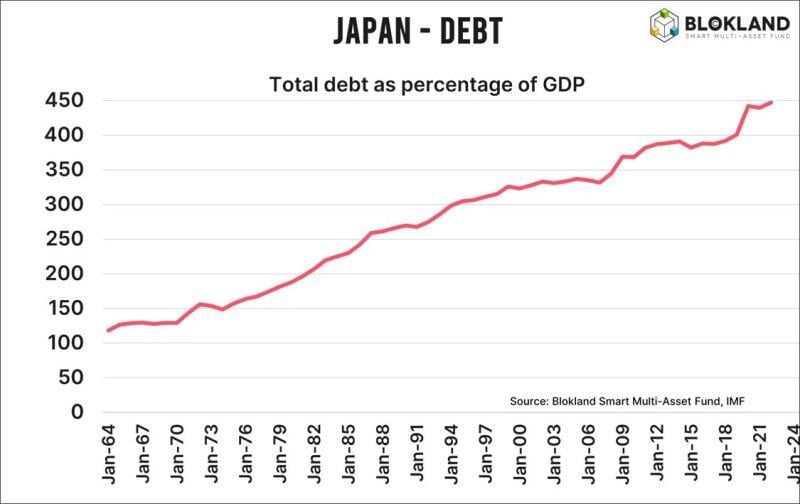

A harsh remainder how shaky the global financial system is... Source: Bank of Japan, Sina 21st Capital on X

This is the ultimate reason why the Bank of Japan ‘needs to maintain monetary easing.’ DEBT

i.e the yen carrytrade is likely to resume sooner rather than later Source: Jeroen Blokland

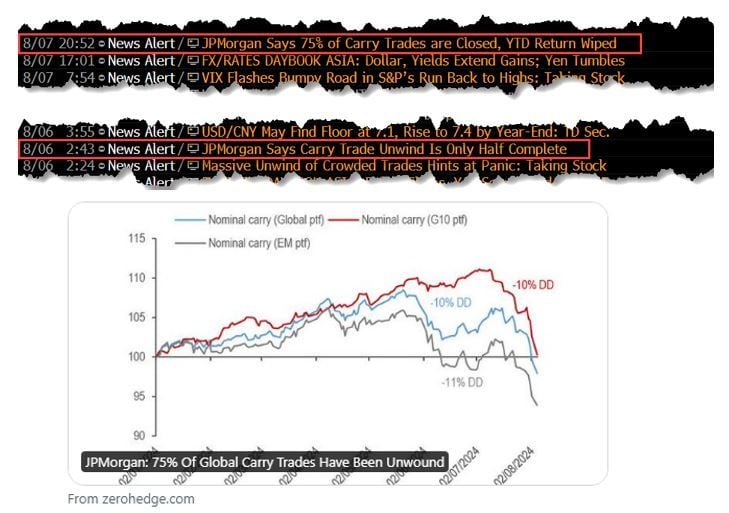

JPMorgan: 75% Of Global Carry Trades Have Been Unwound

(yesterday they said that the unwinding was only half completed...) Source: www.zerohedge.com

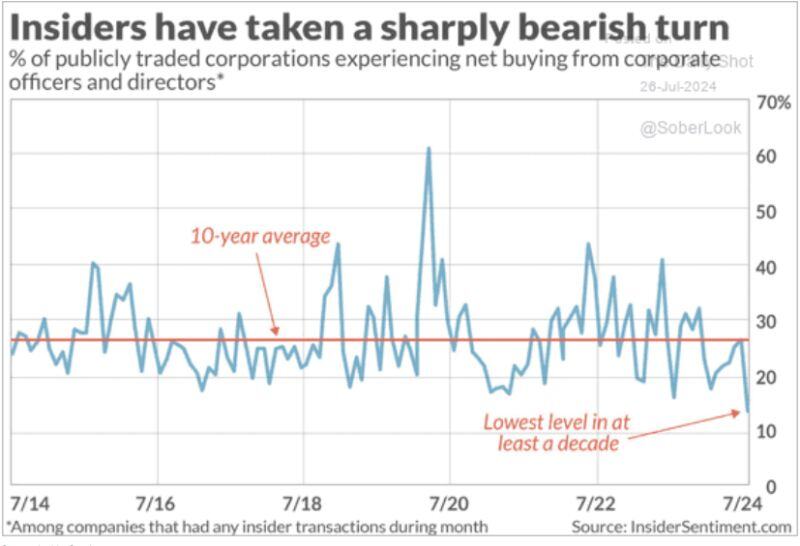

Interesting to see insiders with the most bearish flows in a decade.

Maybe just profit taking, or maybe they realize that current pricing is extreme relative to conditions. Source: Bob Elliott

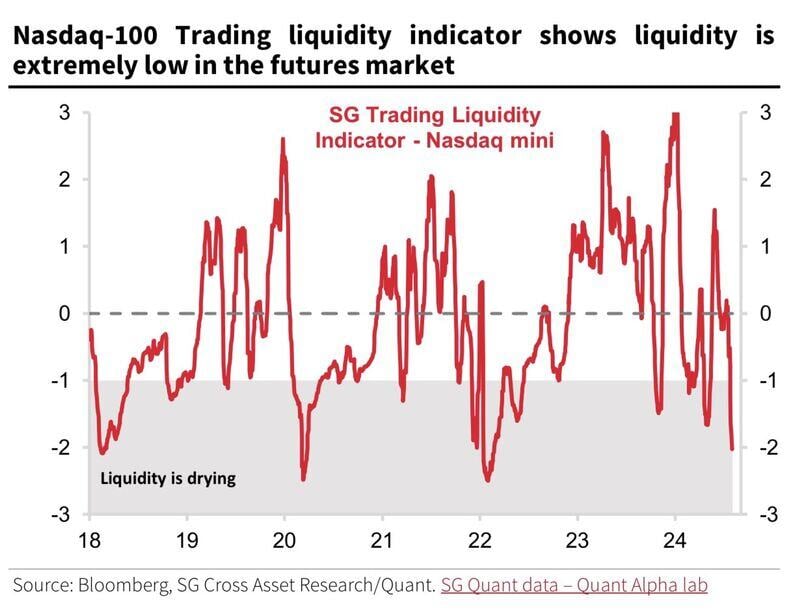

Liquidity has been deteriorating in August, which is known to be the largest month of the year for outflows.

Source: David Marlin, Soc Gen

Super Micro Computer stock, $SMCI, just swung from UP +20% to DOWN -20% in 24 hours.

The stock rose to an after hours high of $729.00 yesterday and is trading at $486.00 in after hours today. $SMCI is now down 60% from its high seen just 5 months ago. Source: The Kobeissi Letter

The last 10 minutes of trading on Wall Street today...

Source. Markets & Mayhem

Investing with intelligence

Our latest research, commentary and market outlooks