Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

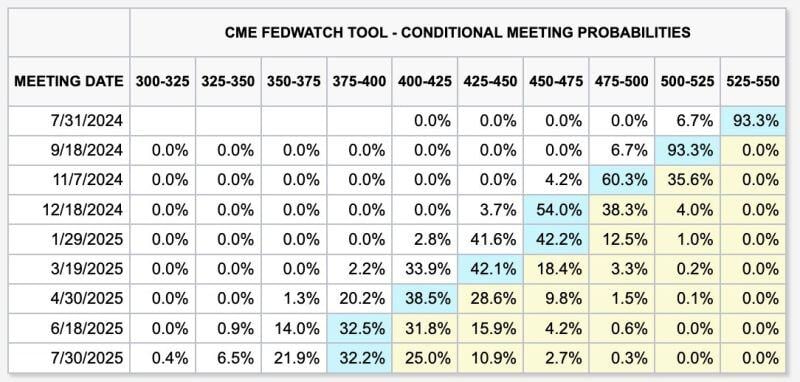

Markets now have a BASE CASE of 6 FED interest rate cuts over the next year.

The base case shows rate cuts at every meeting remaining in 2024 starting in September. Discussions of a 50 basis point interest rate cut have even begun to emerge. This feels a lot like January 2024 when the market went from pricing-in 3 rate cuts in 2024 to 7 in a matter of weeks. Source: The Kobeissi Letter, CME

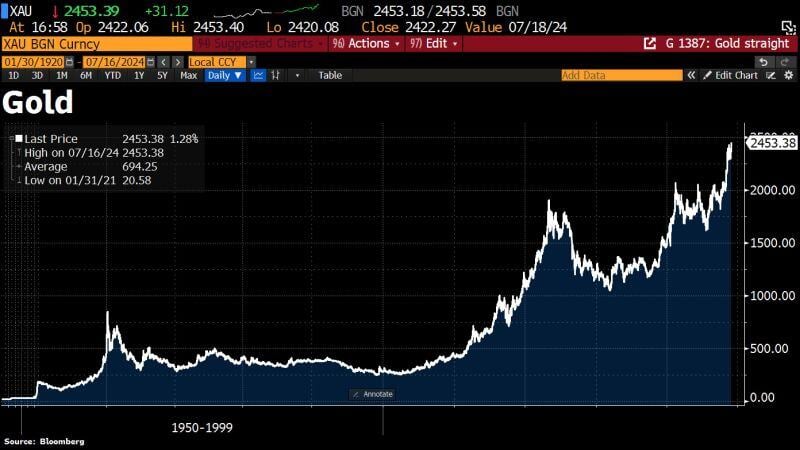

🚨 GOLD HITS $2,453 - A NEW ALL TIME HIGH 🔥

🔉 Just as Powell signals rates cuts before inflation comes down to 2%... Source: Bloomberg

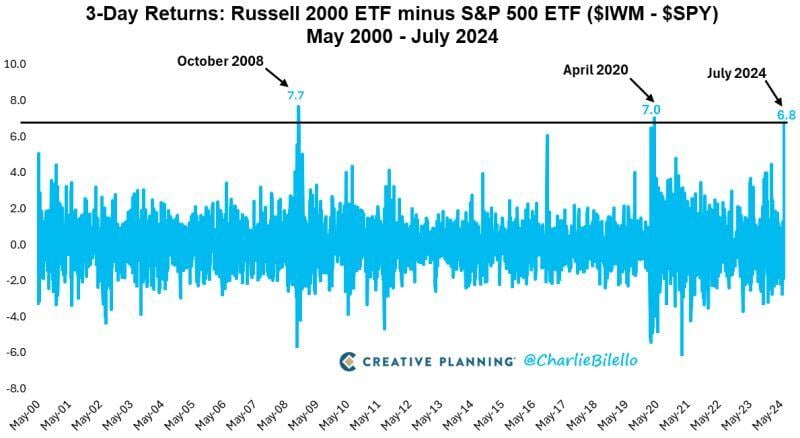

Us small caps are up 6.8% over the last 3 trading days while US Large Caps are flat.

The 6.8% spread is 6 standard deviations above the mean & the 3rd largest small outperformance since inception of the first small cap ETF in May 2000. $IWM $SPY Source: Charlie Bilello

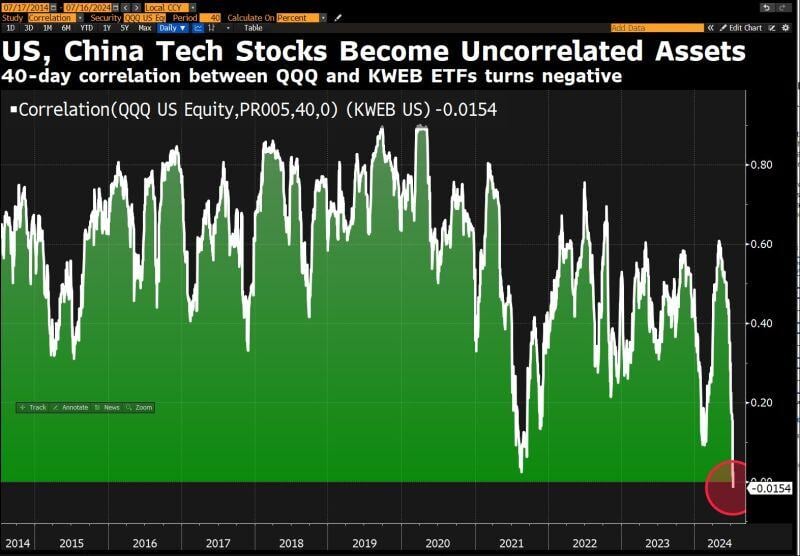

Us and China tech stocks have now become completely decoupled from each other, from a markets perspective.

David Ingles: "The 40-day correlation of $QQQ & $KWEB has turned negative. These are two behaviourally different assets FOR NOW. What might be good for one, may not necessarily boost the other. Chart underscores many global stories: difference in AI representation in each market, tech decoupling, geopolitical rifts, economies in different parts of their cycles". Source: David Ingles on X, Bloomberg

From Elon Musk to David Sacks, Silicon Valley’s Trump Backers Cheer Vance as VP Pick - Bloomberg

-> Many in the startup world rejoiced at Trump’s VP pick -> Vance has criticized big tech and has backed small players Major Silicon Valley investors hailed Donald Trump’s choice of Ohio senator and former venture capitalist JD Vance as his running mate, a move that puts the technology industry closer to center stage in Washington if the former president takes the White House in November. Elon Musk called the decision a “great choice” and said the lineup “resounds with victory” on X, the social platform he owns. David Sacks, an investor and Trump supporter scheduled to speak at the GOP convention on Monday night, called Vance an “American patriot” in a post. According to Tech Crunch >>> "Vance spent years as a venture capitalist before leaving the industry when elected to the U.S. Senate in 2022. After graduating from Yale Law School in 2013, Vance moved to San Francisco, where he was a principal at Mithril Capital, a fund co-founded by Peter Thiel and Ajay Royan. Mithril raised two funds, a $540 million and an $850 million vehicle in 2013 and 2017, respectively. Thiel was publicly active in politics in 2016, backing Trump’s first presidential campaign, and helped fund Vance’s Senate race, but has said he’s not planning to donate to any Republicans in the 2024 election. In 2017, Vance left Mithril and joined Steve Case’s Washington, D.C.-based Revolution as a managing director. His move came when his wife, Usha Chilukuri Vance, landed a role as a Supreme Court clerk. While at Revolution, Vance helped Case launch Rise of the Rest, a strategy focused on investing in startups outside the main U.S. tech hubs. At Revolution, the Republican VP nominee led deals into Michigan-based Aatmunn, a startup that develops software and wearable devices for on-the-job safety for construction workers. He also backed and served on the board of Kentucky-based AppHarvest, an indoor farming startup, that went public via a SPAC in 2021 but filed for bankruptcy protection in 2023". Source: Bloomberg, Tech Crunch

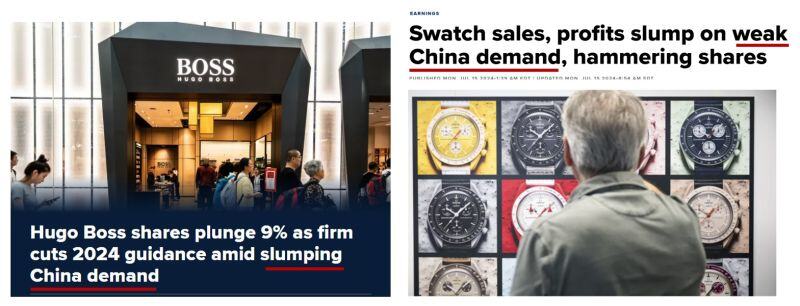

Weak China demand is weighing on European luxury & consumer discretionary stocks.

- Swatch Group (UHR SW) reported a steep fall in first half sales and earnings on Monday as the world’s biggest watchmaker struggled with weaker demand in China. The company’s drop in turnover was triggered by a slump in demand for luxury goods in China, including Hong Kong and Macau, with only the Swatch brand bucking the negative trend, increasing its sales in China by 10%, the company said in a statement. - Hugo Boss (BOSS GY) shares plunged as much as 10% Tuesday after the company cut its sales outlook. The German fashion house said Monday that it expects full-year sales of up to 4.35 billion euros ($4.73 billion) on macroeconomic challenges, particularly in China. The retailer becomes the latest high-end fashion line to warn of persistent woes in the luxury sector. Source: CNBC

Copper's $5 level reminds of the gold's critical $2,000 mark

nce gold breached that resistance, it kept moving with authority. Are we setting the stage for a similar move in copper? Source: Tavi Costa, Bloomberg

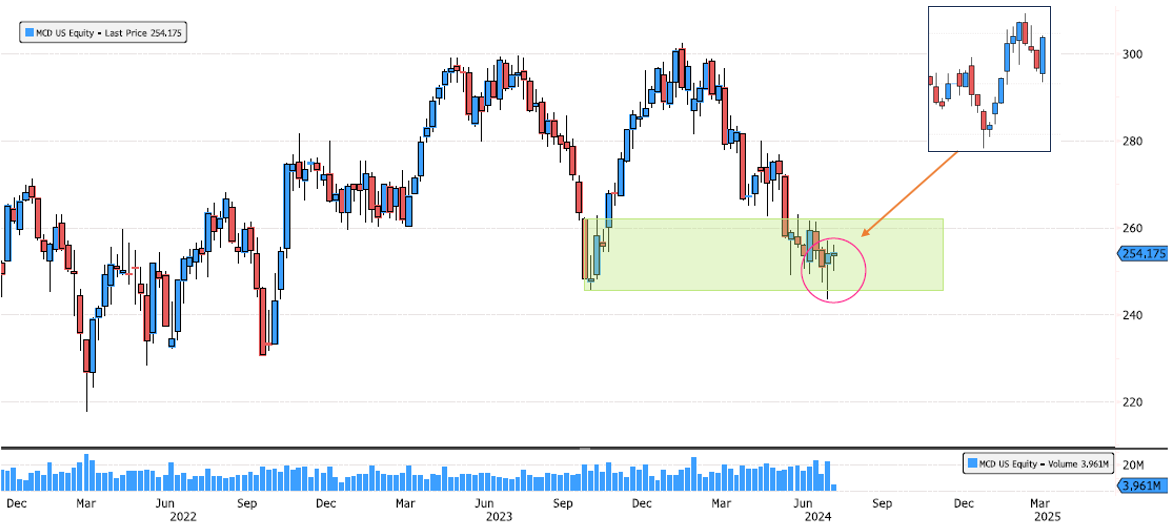

McDonald's Showing Bullish Momentum on Short Term

McDonald's (MCD US) has been in a support zone for 9 weeks! Last week, there was a false breakout below 245, but it managed to close above. On the short-term chart, there is growing bullish momentum. Keep an eye on it. Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks