Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

The dichotomy between gold (orange line( and the US 10-year real rate (the red line) is becoming massive...

Source: www.zerohedge.com, Bloomberg

Police fatally shot a man Tuesday about a mile away from the main Republican National Convention venue in Milwaukee, CNN affiliate WISN reported.

Witnesses told the station that two men were fighting in a local park when one of them pulled a knife out. Witnesses said the men were startled when officers responded and the man with the knife was shot by multiple officers, WISN reported, noting those details had not been confirmed by police. Source: CNN

The quickest way to build a business? Focus on retention! 💡

As highlighted by Corporate Rebels, here’s how a firm can make work more fun and turn customers into lifelong fans: ✅ Prioritize customer service over profits to earn loyalty. ✅ Treat employees like owners and give them autonomy to keep customers happy.

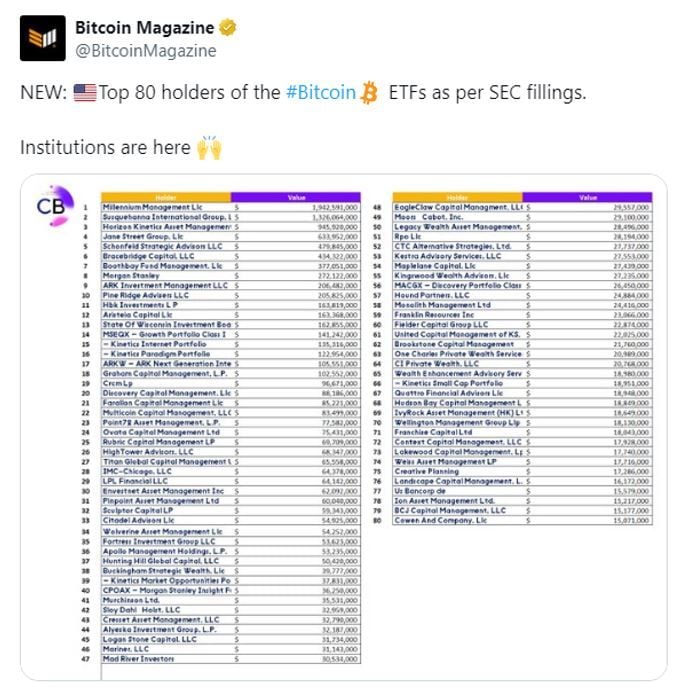

Even just combining the 80 companies found manually in SEC filings accounts for 17% of the total bitcoin ETF holdings.

While not all can be considered institutional investors, significant numbers are included - e.g Millenium, Susquehanna, Horizon Kinetics, Jane Street Group, Schonfeld, Morgan Stanley, Point72, Farallon, tc. Viewing ETF inflows solely as retail contributions seems inappropriate. Source: Ki Young Ju

Investing with intelligence

Our latest research, commentary and market outlooks