Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

The power of the apostrophe

Source: Ian Bremmer on X, The Times of India

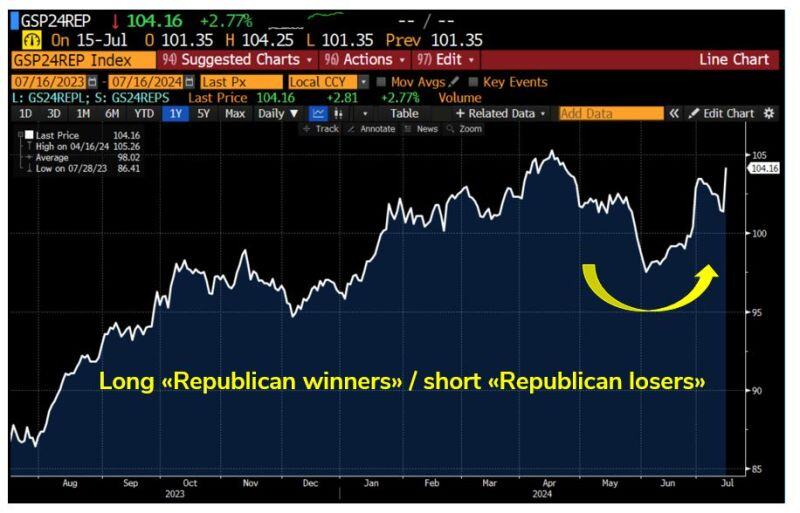

Goldman Sachs Republican winners versus losers basket (i.e long stocks likely to benefit from a Trump victory / short those who are likely to suffer from it) added 2.77% yesterday

Source: Bloomberg, RBC

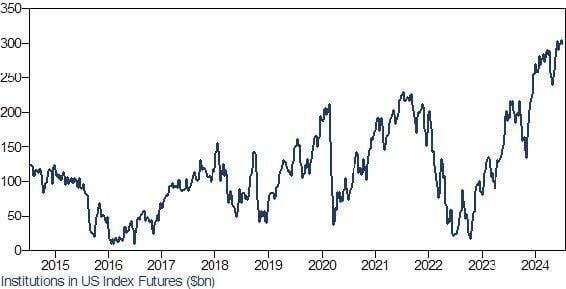

US equity futures traders have never, ever been 'longer' than they are now...

Source: GS

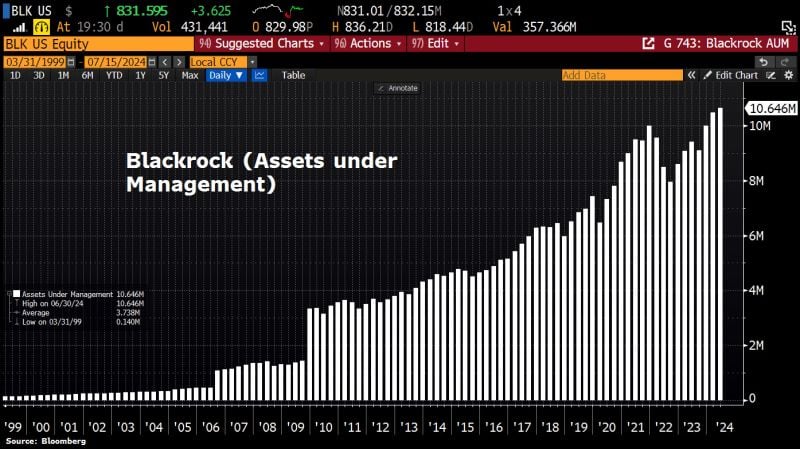

BlackRock is eating the world: World's biggest money manager hits $10.6tn asset record, driven by ETF boost.

Total net inflows were $82bn. Source: HolgerZ, Bloomberg

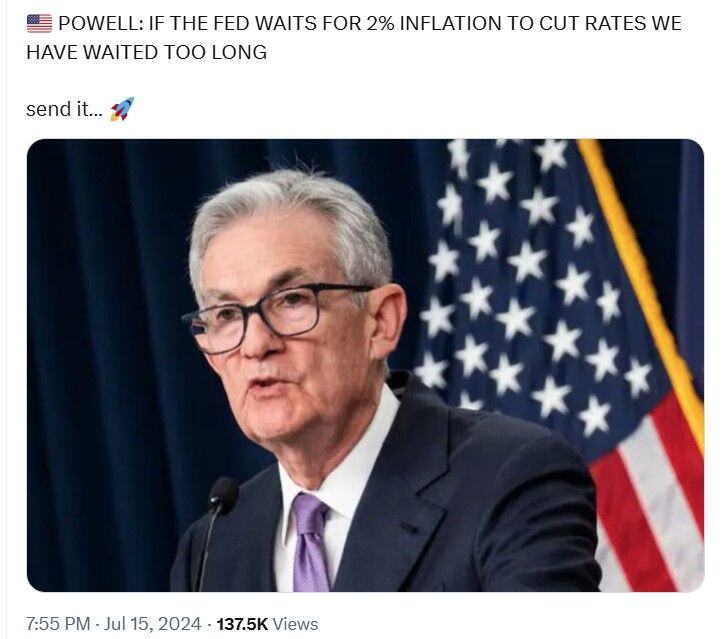

🚨 Federal Reserve Chair Jerome Powell said Monday that the central bank will not wait until inflation hits 2% to cut interest rates.

Speaking at the Economic Club of Washington D.C., Powell referenced the idea that central bank policy works with “long and variable lags” to explain why the Fed wouldn’t wait for its target to be hit. “The implication of that is that if you wait until inflation gets all the way down to 2%, you’ve probably waited too long, because the tightening that you’re doing, or the level of tightness that you have, is still having effects which will probably drive inflation below 2%,” Powell said. Instead, the Fed is looking for “greater confidence” that inflation will return to the 2% level, Powell said. “What increases that confidence in that is more good inflation data, and lately here we have been getting some of that,” he said. Powell also said he thinks a “hard landing” for the U.S. economy was not “a likely scenario.” Source: CNBC, Radar

Donald Trump has picked Senator JD Vance as his running mate, in a move that could help the former president win votes across the crucial swing states of the US’s industrial Midwest.

Ohio Sen. J.D. Vance, less than a decade ago, rose to prominence as a Trump critic. But over the last few years, Vance, 39, has emerged as a Trump loyalist, becoming one of his most vocal defenders in the Senate and a frequent surrogate on television as he called for the party to embrace Trump’s populist agenda. Vance could expand Trump’s appeal in the swing states. Indeed, he hails from the Rust Belt, which includes portions of the critical swing states of Pennsylvania, Michigan and Wisconsin. He’s also a Marine veteran, and would be the second youngest vice president — tied with Richard Nixon — if Trump wins in November. Source: FT

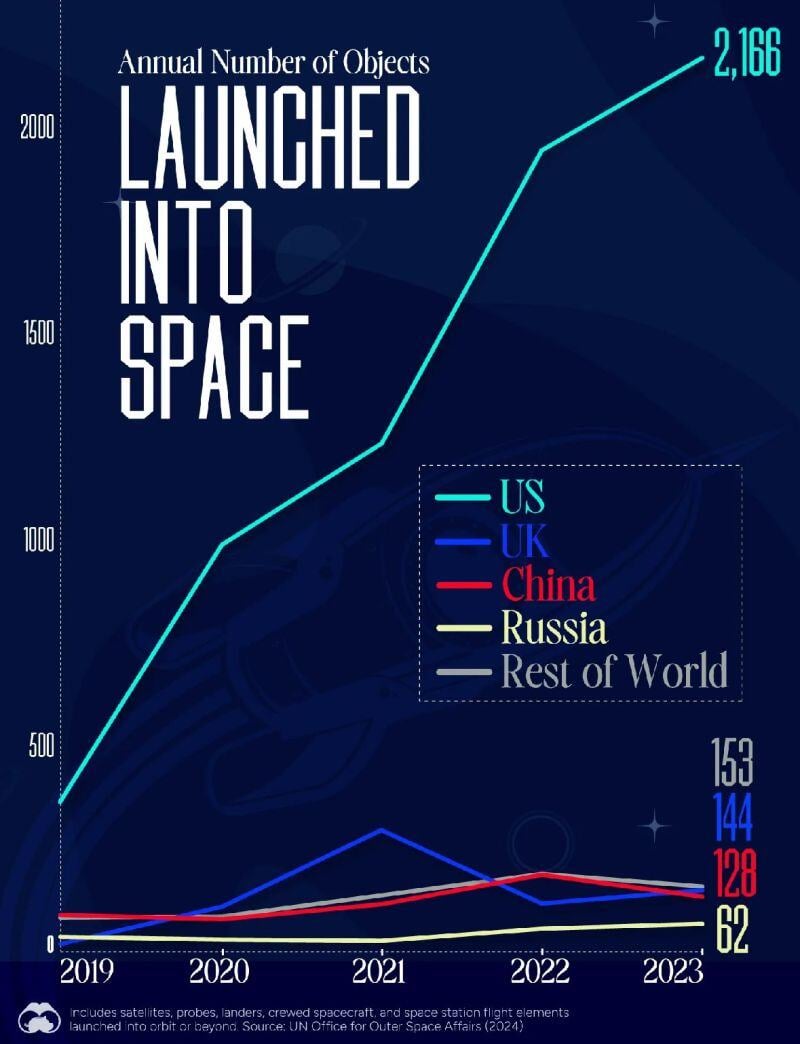

No one else even comes close to the US when we’re talking about Space 🚀 launches...

Thanks mainly to SpaceX and Elon Musk Source: Evan

Investing with intelligence

Our latest research, commentary and market outlooks