Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Probably the best aerial pic of Saturday's drama via @nypost

.

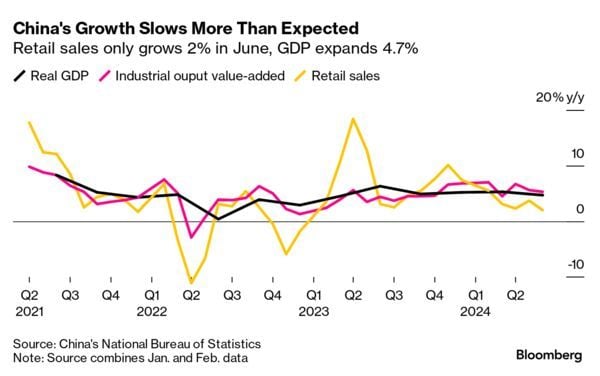

China Q2 GDP growth slowed more than expected (+4.7% yoy vs. +5.1% yoy expected), but the big surprise is just how weak retail sales were - growing only 2% in June.

-> China’s National Bureau of Statistics on Monday said the country’s second-quarter GDP rose by 4.7% year on year, missing expectations of a 5.1% growth, according to a Reuters poll. -> June retail sales also missed estimates, rising 2% compared with the 3.3% growth forecast. -> Industrial production, however, beat expectations up by 5.3% in June from a year ago, higher than Reuters estimate of 5% growth. -> Urban fixed asset investment for the first six months of the year rose by 3.9%, meeting expectations. Investment in infrastructure and manufacturing slowed their pace of growth on a year-to-date basis in June versus May, while real estate investment declined at the same 10.1% rate. The National Bureau of Statistics did not hold a press conference for the data release. China’s high-level policy meeting, the Third Plenum, kicks off Monday and is set to wrap up Thursday. Source: Bloomberg, CNBC

The "ChatGPT era"...

The Nasdaq 100 post-ChatGPT at just over 400 days is now up more than it was following any of the other major technological releases of the last half-century. But if we are to follow the Netscape blueprint we have a lot of more bull left... Source: Bespoke, TME

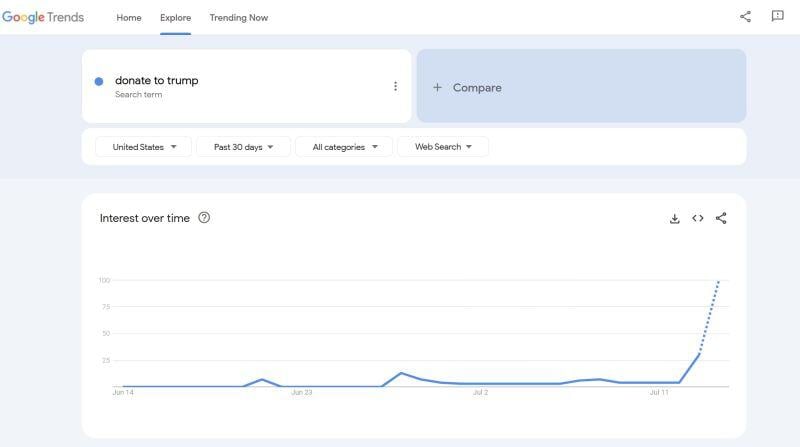

Surge In "Donate To Trump" Searches After Assassination Attempt

Source: Google Trends

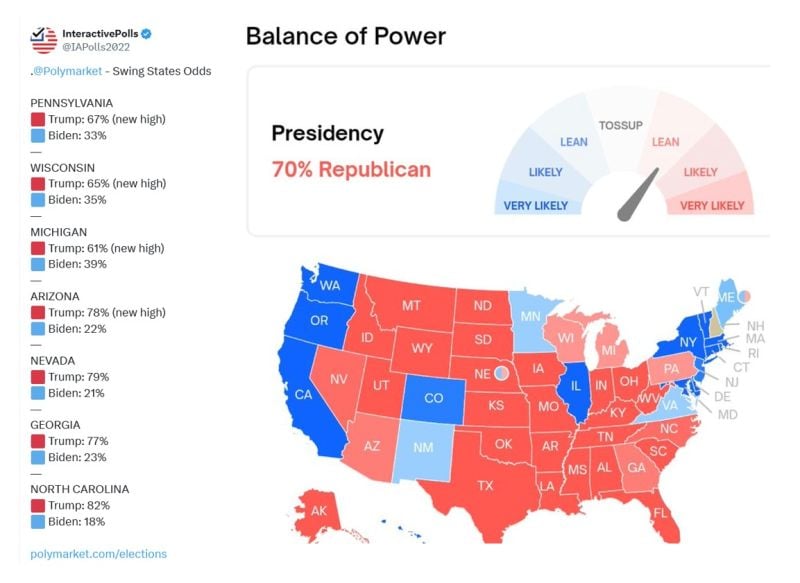

Swing States Odds by https://lnkd.in/eEVhR_yt

Source: Interactive Polls

Investing with intelligence

Our latest research, commentary and market outlooks