Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

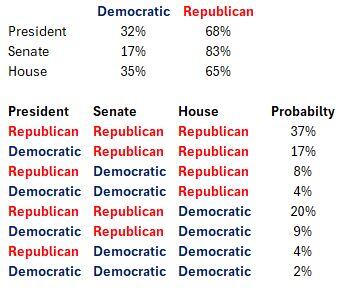

A landslide and sweep victory for Trump, this probably reduces uncertainty which is positive for stocks, BTC and the dollar.

Meanwhile, this could lead to more upward pressure on bond yields and a steepening of the yield curve. We also expect the "pro-republican" type of stocks to move higher. Pro-trump / republican seep victory sectors include Energy, Defense, Immigration-enforcement, For-profit education, Financials, some healthcare stocks, etc. Among the losers: Tech, Renewables, etc. From a geographical point of view, some US-friendly countries (India, Vietnam, etc.) might benefit from a Trump re-election. China and Mexico (and US stocks related to them) might suffer. Same for European autos exporters for instance. Source table: Bob Elliott

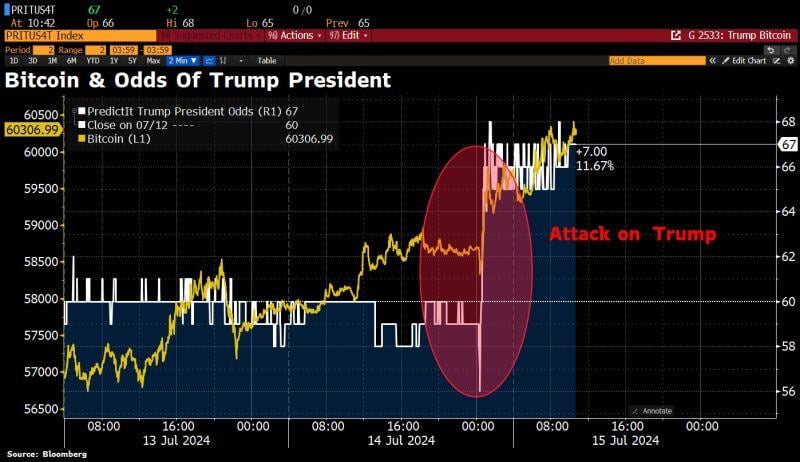

Bitcoin jumps >$60k as Trump shooting boosts Trump election odds.

Cryptos are the only assets trading 24/7. This could indicate a positive market reaction tomorrow. Source: Bloomberg, HolgerZ

Trump's strength in such a tough moment makes the contrast to Biden even larger...

This assassination attempt (the 1st of its kind in 43 years) took place 4 months before the Presidential election and days before Trump is to be officially named the Republican nominee at his party's convention. It is most likely a boost to his election - just watch the odds on PredictIt on the right. Worldwide, the image of a bloodied 78 years old man raising fist just a minute after the shooting is very powerful. But it also highlights how split America is.

In Germany, the number of corporate insolvencies up by a third.

In April 2024, the local courts reported 1,906 corporate insolvencies. The courts put the creditors' claims from the corporate insolvencies reported in April 2024 at ~€11.4bn. In April 2023, the claims had totaled ~€1.3bn. Source: HolgerZ, Bloomberg

BREAKING 🚨: Chinese Banks

40 Chinese Banks vanished during a single week in June Source: Barchart

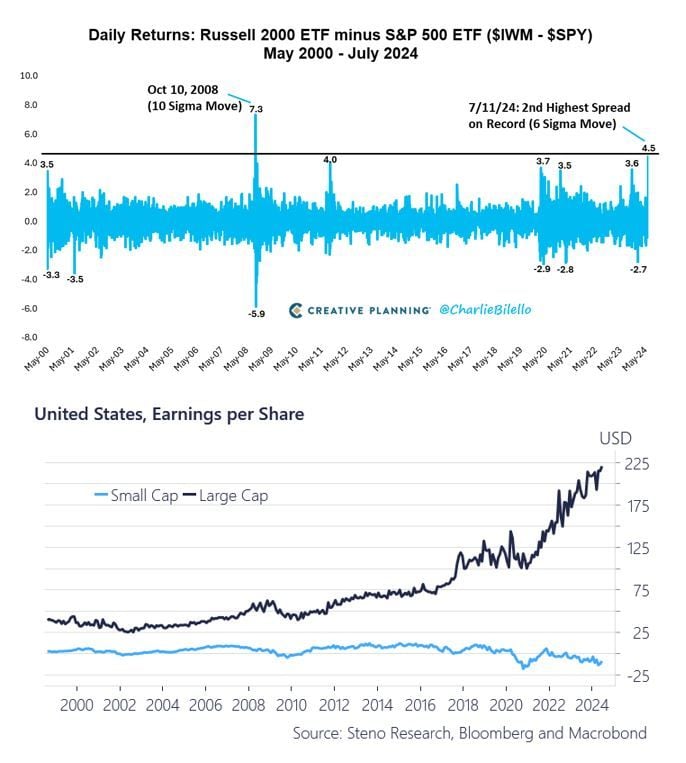

Yesterday's "SIZE" rotation put into perspective.

US small caps outperformed large caps by 4.5% on Thursday, a 6 standard deviation event and the 2nd biggest outperformance on record (trailing only the 10 sigma differential on October 10, 2008). This brutal rotation is taking place after a huge period of small-caps underperformance vs. large caps $IWM $SPY Source: Charlie Bilello, Steno Research

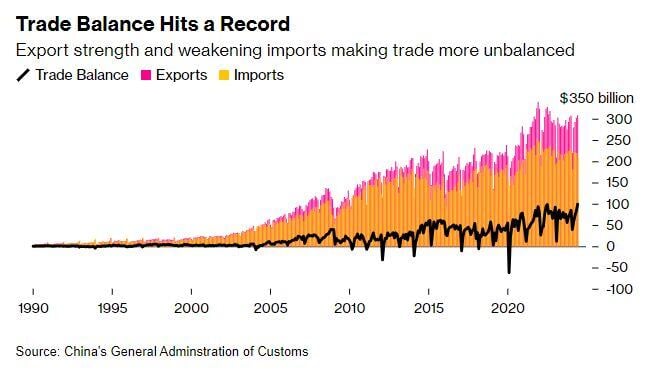

China posts biggest monthly trade surplus in at least 24 years, nearly $100B in June - Bloomberg

China’s trade surplus soared to an all-time high in June, with a jump in exports overwhelming an unexpected decline in imports and raising the risk of greater trade tensions. Exports rose to $308 billion, expanding for a third straight month to the highest level in almost two years, the customs administration said Friday. Imports fell to $209 billion, leaving a record trade surplus of $99 billion for the month. The growing imbalance has spooked China’s trade partners, who have responded with more tariffs on Chinese imports including electric vehicles. This tension has worsened ties between the European Union and Beijing, which this week opened a tit-for-tat probe into the EU’s trade barriers in what could bring the economies closer to a trade war. The surplus “reflects the economic condition in China, with weak domestic demand and strong production capacity relying on exports,” said Zhiwei Zhang, president and chief economist of Pinpoint Asset Management. However, “the sustainability of strong exports is a major risk for China’s economy in the second half of the year. The economy in the US is weakening. Trade conflicts are getting worse.” Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks