Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

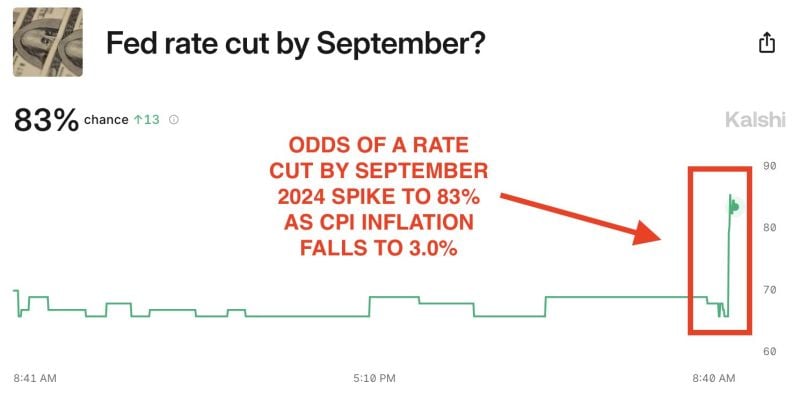

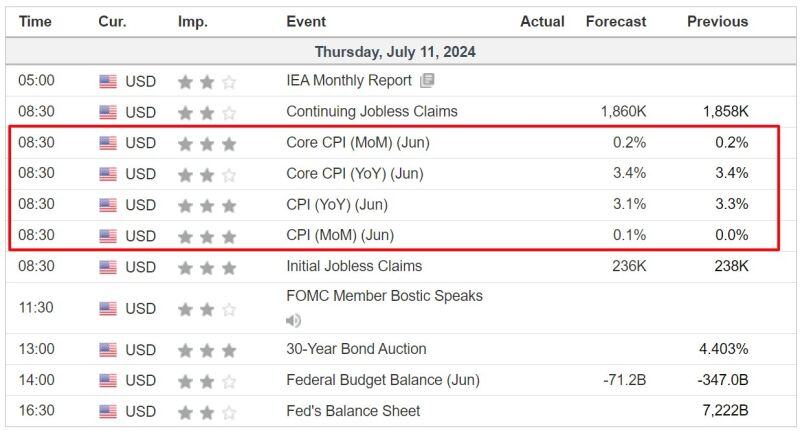

BREAKING: Odds of a Fed rate cut by September 2024 skyrocket to 83% after June CPI inflation, according to Kalshi.

June 2024 marked the first NEGATIVE month-over-month inflation print since May 2020. Headline inflation is now at a 12-month low and 100 basis points away from the Fed's 2% target. Prior to the CPI inflation report today, prediction markets saw a 67% chance of rate cuts by September. Exactly 1 year ago, the Fed stopped raising interest rates. Does the Fed have the green light to cut rates? Source: The Kobeissi Letter

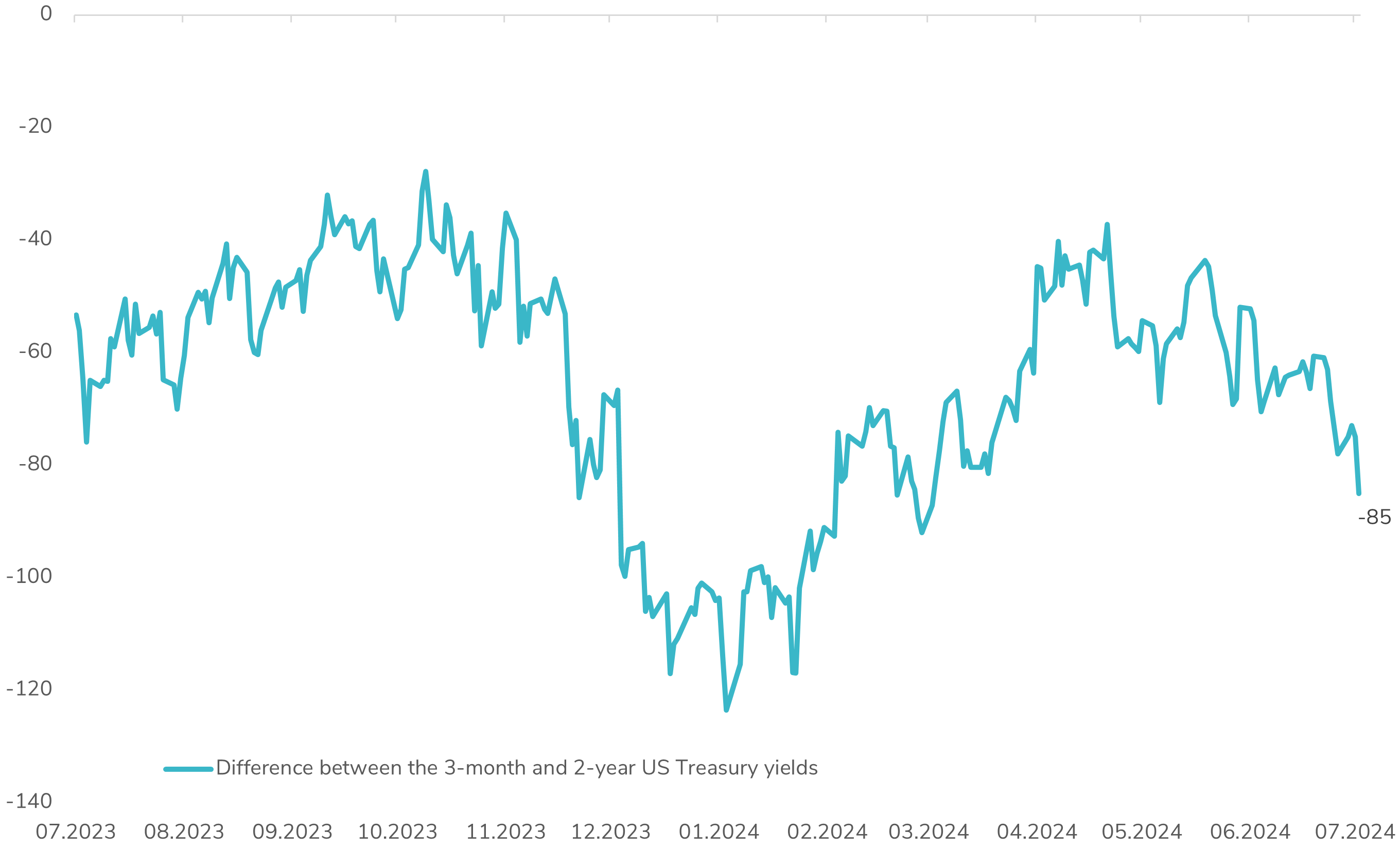

📉 Is a Fed Rate Cut on the Horizon Before the Elections?

Recent economic data, especially in the job market, has underperformed, and Fed Chairman Jerome Powell's dovish remarks at the Sintra Forum have shifted market expectations. Reinforcing this sentiment, the just-released US Core CPI came in below expectations at 3.3%. Investors are now buzzing about a potential rate cut as early as the Fed’s September meeting, right before the US Presidential Elections. This is clearly reflected in the yield curve, with the spread between the 3-month and 2-year US Treasury yields dropping sharply from -60 bps to -85 bps over the past three days. This significant drop indicates an 85% probability that the market is pricing in a rate cut by September. The critical question remains: Will the US macroeconomic landscape deteriorate enough to prompt the Fed to start normalizing its monetary policy before the elections? #Fed #MonetaryPolicy #InterestRates #EconomicOutlook #Investing #FinancialMarkets #SyzGroup

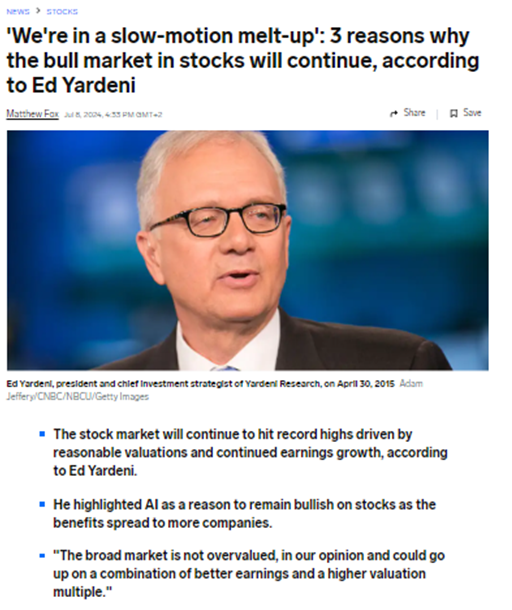

We're in a slow-motion melt-up according to Ed Yardeni

Source: Business Insider

🚨 BREAKING NEWS: US CPI for June just came in at -0.1% MoM below expectations of 0.1% MoM

US CPI for June just came in at +3% YoY below expectations of +3.4% YoY Core CPI inflation fell to 3.3%, below expectations of 3.4%. This marks the 39th consecutive month with inflation at or above 3%. It's also the 3rd straight month with declining CPI inflation. Looks like a September rate cut is coming. Source: Jesse Cohen

US CPI estimates by firm

TD Securities: 3.0% JP Morgan: 3.1% Wells Fargo: 3.1% Citadel: 3.1% Barclays: 3.1% CitiGroup: 3.1% Goldman Sachs: 3.2% Bank of America: 3.2% Morgan Stanley: 3.5% Previous: 3.3% Median: 3.1% Source: TrendSpider

Some wise words by Reagan

Source: Wall Street Silver

Investing with intelligence

Our latest research, commentary and market outlooks