Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

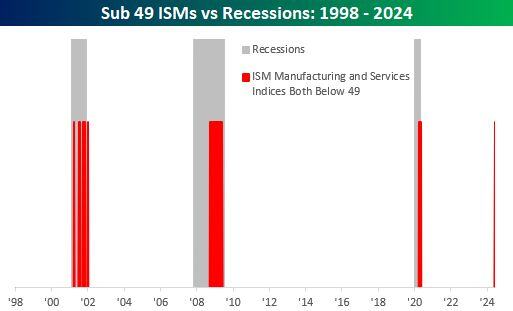

In June, both ISM Manufacturing and ISM Services fell below 49.

Here are all months where both PMI readings were below 49 Source: Bespoke

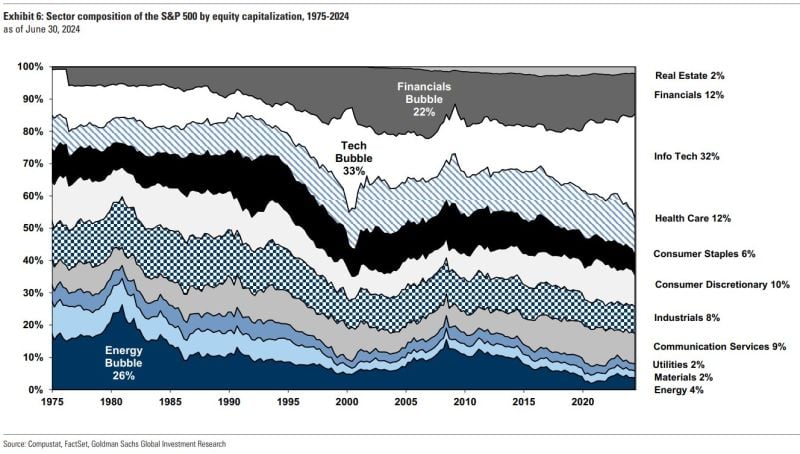

Sector composition of the S&P500 has shifted significantly over time.

energy used to be 26% of the index... Source: Goldman Sachs, Blake B. Millard

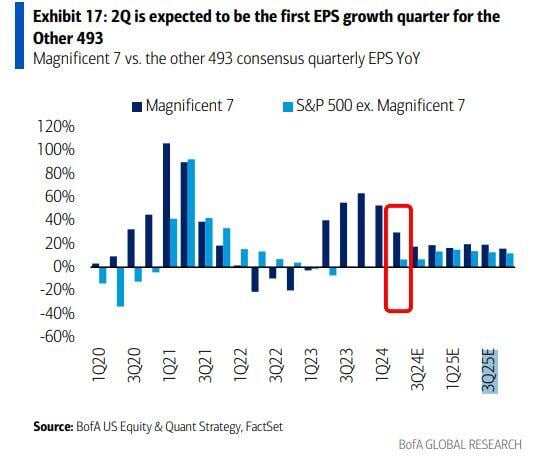

The S&P 493 earnings have been flat to down for the past five quarters.

2Q is expected to mark the first growth quarter for the Other 493. Could it lead to a more balanced market? Source: BofA

Oops... I missed this one... Russia's economy has defied sanctions in the two years since Moscow invaded Ukraine in February 2022

So much so that the World Bank is now classifying Russia as a "high-income country." On Monday 1st of July, the World Bank announced it has upgraded Russia from an upper-middle-income country to a high-income country, according to a report from the financial institution's economists. "Economic activity in Russia was influenced by a large increase in military-related activity in 2023," World Bank economists wrote in their report. Last year, Russians earned $14,250 per person on a gross national income basis. The World Bank's upgrade confirms reports from Russia that suggest the growth is primarily driven by wartime activities that generate demand for military goods and services, making some sectors winners in Russia's wartime economy. Russia's trade jumped by nearly 7% last year, while activities in the financial sector and construction grew by 6.6% and 3.6%, respectively. This boosted Russia's real GDP — which is economic growth adjusted for inflation — by 3.6%. The development has made some poor Russians better off financially, complicating any calculus over how to end the war.

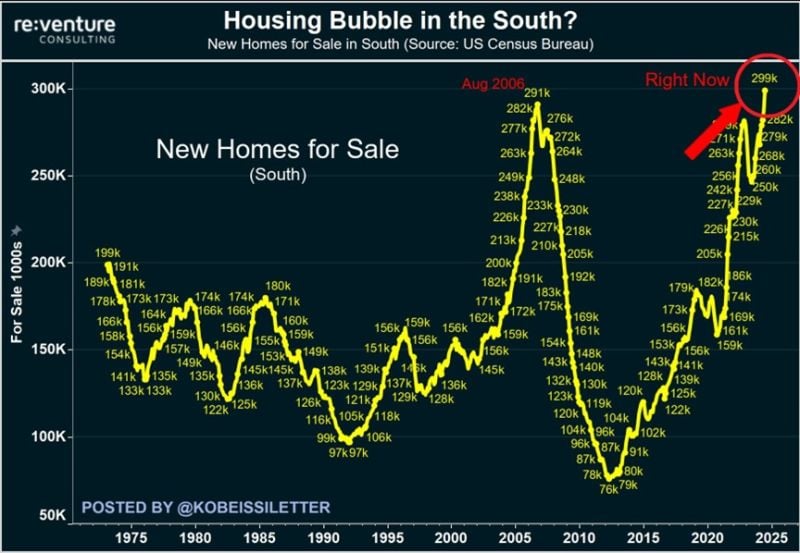

BREAKING: There are now a record 299,000 new homes for sale in the Southern US states, according to Reventure.

This is even higher than in 2006, a year before the housing market crash began. The number of new houses for sale in the South has nearly DOUBLED in just 4 years. Meanwhile, new home sales have officially dropped below pre-pandemic levels for the first time. It would take ~9 months current new inventory to sell if it sold at the current pace without new inventory coming to the market, 2nd longest duration since 2009. Source: The Kobeissi Letter, Reventure

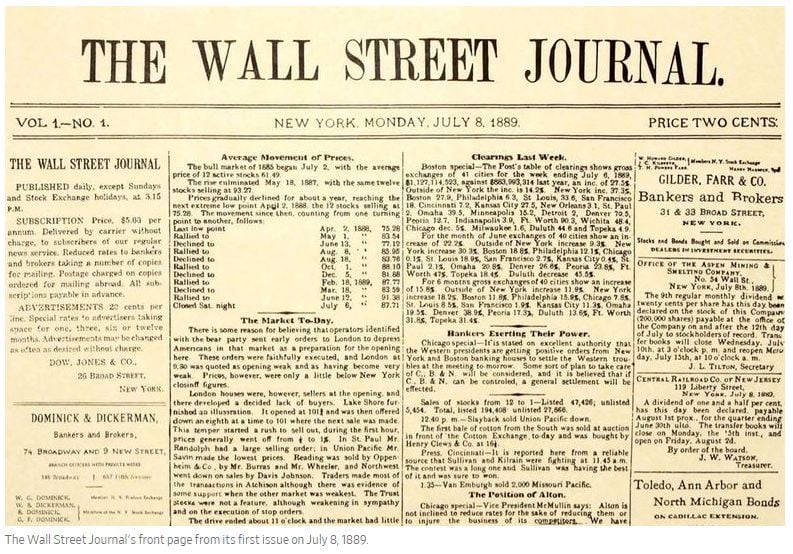

On this day 135 years ago, the The Wall Street Journal made its debut

Source: Barchart

Investing with intelligence

Our latest research, commentary and market outlooks